"Market-Based Management emphasises Principled Entrepreneurship over corporate welfare, virtue over talent, challenge over hierarchy, comparative advantage over job title, and rewards for long-term value creation over managing to budgets"

In an environment of rapid technological disruption, Koch Industries has been able to adapt and prosper, even as the business has grown into a large organisation with more than 100,000 employees. You'll notice most of the sub-titles in this post are both the same as the Nucor post and also titles of tutorials that form the basis of the Investment Masters Class. Great business sense and great investing go hand in hand.

Let's hear from Charles ..

As with the views of most of the Investment Masters we have reviewed, effective Culture is vital for success in business. Charles agrees and has identified the key elements that combine to create a culture that cultivates true business effectiveness.

"For us, culture is key."

"Every organisation has its own culture. If that culture is not created consciously and purposefully, it will degenerate into a cult or personality, or an "anything goes" environment. Whether good or bad, an organisation's culture is determined by the values, beliefs, and conduct of its members, as well as rules and incentives set by its leaders - and modeled by them behaviourally."

"It requires focus, discipline, and persistence to produce a culture dedicated to superior results."

Koch's culture promotes behaviours and individual conduct over functional competency. This shows out in their hiring policies.

"[MBM places a great focus] on culture and on hiring based not just on skills but on virtues, with the goal of ensuring our businesses and leaders foster integrity, courage, compliance and respect."

"Many companies have principles somewhat similar to Koch's Guiding Principles, but rarely are they the basis for a company's culture. As Koch we strive to hire and retain only those who embrace our principles."

Innovation, accountability and leadership are all integral to a successful culture...

"To build a culture of discovery, we must encourage, not discourage, the passionate pursuit of hunches (no matter their origin)."

"A culture that lacks accountability lacks integrity and cannot survive, let alone thrive."

"Leaders must solicit the best knowledge internally and externally and create a culture in which the best knowledge is used regardless of the source."

"It is particularly important for everyone to embrace a challenge culture, both by soliciting different perspectives and expertise, and by having the courage to constructively speak up when we disagree."

"Because leaders set the standard - both by how they lead and by what they do - they are the guardians of, and must be held accountable for, the culture."

Vision

Companies that lack a Vision, lack purpose. They are missing a goal to strive for and a path to growth and greater returns.

"The lack of an effective vision, or, a conflict of vision, is a root cause of the failure of many great businesses."

"Each [businesses vision] needs to be aspirational in order to expand the thinking of leaders and employees throughout the organisation."

"Our vision is to create long-term value by economic means for customers, society, and the company. Customers come first in this list because without them there is no business."

"In deciding which businesses to pursue, Koch looks at how we can make good profit in the long term. This is fundamental to our vision because unless a business creates value for others, it will cease to exist (unless coercion is involved)."

Clearly the idea of customer value is important for Koch. If the customer attains a benefit from its transaction with the business, then that is ideal, because without customers, there is no business.

"We prefer to look at business through a win-win mindset."

"I had a clear understanding that the purpose of business was to create value for customers."

"Our goal was - and still is - to be the best counter-party of choice to our customers, vendors, communities, and employees."

"For a business to survive and prosper in the long term it must develop and use its capabilities to create real, sustainable, superior value for its customers, for society, and for itself. Only by doing so can it continue to inspire and attract customers, suppliers and partners."

Identify a differentiator - what can Koch do differently that gives them an edge in the market?

"We are constantly improving our capabilities, building new ones, and finding new opportunities for which they can create value. This is a departure from the conventional wisdom of most companies, which stick to industries they know well."

"Koch's emphasis on compounding is another difference between the vision of our company and that of many others."

"Koch's vision is different from most because it's focused on value creation and people."

"Other companies typically have a much different business philosophy and management approach."

The value of retaining long-term thinking...

"We remain private so we can focus on the long term."

"Short term profit created by liquidating assets and avoiding expenditures necessary for long-term success, can be illusory."

"When employees are rewarded only for short-term accounting profits without factoring in what long-term profits were missed, they will tend to make sub-optimal decisions."

"Short term profits, while necessary, are not sufficient for long-term business success. We have always shared the same vision for Koch; to innovate, grow, and reinvest in order to maximise long-term value by applying our core capabilities. If we try to smooth our earnings (as some public companies feel compelled to do to defend their stock price) our future would not be as bright."

"Based on its vision, Koch (and each of its businesses) develops and implements strategies that will maximise long term value."

"When setting priorities, one of the most difficult choice is between short-term optimisation strategies and long-term growth and innovation strategies. The natural tendency is for a business to under-invest in long term strategies. To offset this tendency it needs to commit dedicated resources to growth and innovation. Since long-term strategies won't result in profits for some time, incentives must be designed to reward progress in the interim."

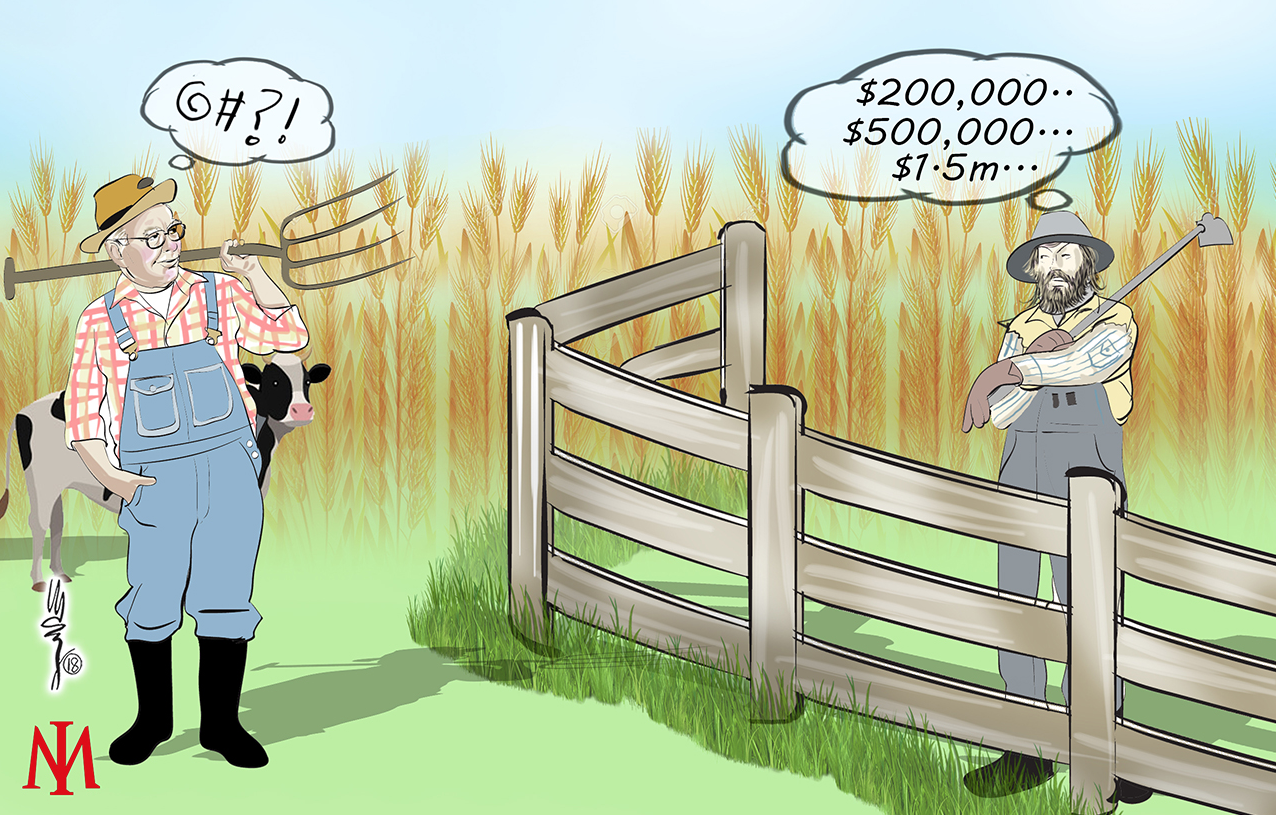

"Another type of perverse incentive is endemic at publicly traded companies: the quarterly earnings report. Management at a public company is under a great deal of pressure to meet quarterly earnings forecasts, because falling slightly short can cause a significant drop in the stock price. Consequently, management is motivated to make decisions that optimise short-term earnings at the expense of maximising real long-term value. Such decisions may include under-investing in attractive cyclical or long-term opportunities, ignoring needed write-downs, or even manipulating the books. Perverse incentives like these make managing a public company extremely difficult."

Like many other successful business leaders, Koch place an emphasis on people fitting with their values and culture rather than just having functional competency. Its a lot easier to train someone to fill a functional need than it is to change them to fit the culture...

"We focus first on values."

"The best coaches place as much emphasis on virtue as on talent."

"Having skills and intelligence is important, but we can hire all the brightest MBA's in the world, and if they don't have the right values, we will fail. Therefore, we hire based on values first - then talent."

"We increased our efforts to hire first on values, and only then on talent and experience. It is our goal to fill every position with individuals who are equally virtuous and talented, but if forced to choose between one or the other, Koch will choose virtue every time. Why? Because we understand that talented people with bad values can do far more damage to a company than virtuous people with inferior talents."

Information, Knowledge & Sharing

This one speaks for itself.

"There is no stronger form of communication than face-to-face sharing."

"Having a better point of view than our competitors has been a key driver of our success."

"Seek and use the best knowledge and proactively share your knowledge while welcoming challenges."

"In refining, as in all our businesses, developing a superior understanding of our markets has been critical to our approach and to our success."

"We study not only the history of a business or industry, but also existing and potential technologies, competitors, customers, applicable laws, and industry structures, and how all these factors are changing - both for industries we participate and for those we are considering. We then analyse their value chains and cost structures, future demand for their products, competitive positions of participants, and other meaningful factors and trends. We seek to understand the future drivers and level of profitability for the various segments of relevant industries. Even so, we recognise that uncertainty guarantees that any point of view can, at best, only be directionally correct"

"Whether the goal is to cure cancer, build a smaller and faster smartphone, or develop a more efficient and environmentally friendly way of making nylon, disruptive innovation requires creating, acquiring, sharing, and applying knowledge."

"For a culture to create spontaneous order that contributes to discovery, it must constantly seek, nurture, and implement new knowledge."

"Knowledge sharing isn't just important for innovation. Seeking, sharing, discussing, or challenging ideas and plans plays a crucial role in every aspect of an organisation's success."

"Replicating the way the scientific community organises itself, wherein knowledge is shared freely with a commitment to disproving even the most cherished hypothesis, leads to innovation."

Koch place value on measuring the things that matter rather than just producing reports for the sake of reporting.

"To guide activity correctly we must measure what leads to results, rather than what is easy to measure."

"A business must develop measures that help it understand the drivers of profitability."

"It is usually wasteful to develop detailed information beyond what is necessary to make good decisions. When evaluating an investment, unnecessary detail just distracts from the key drivers. Since it is impossible to predict outcomes precisely, trying to do so - as in making financial projections to several decimal places is wasteful. Even worse, such attempts create a false sense of confidence."

"A successful organisation should measure - and do its best to understand - the profitability (and profitability drivers) of its assets, products, strategies, customers, agreements, and employees, and anything else for which it is practical to do so."

"We need to ensure we are not wasting time providing information that is nice to have, but doesn't improve results."

And change is eternal, and that Koch have to keep abreast of those changes.

"Consumer needs and desires are constantly evolving."

"Change is ever present in society, the economy, and politics. Companies, products, methods, and individual skills are constantly being replaced by superior alternatives."

"Base on our changing point of view, we modify our thinking about the best opportunities and how to capture them."

Limited Hierarchy and Bureaucracy

Once again leadership and the erosion of bureaucratic empires is vital for growth, innovation and success.

"Command-and-control companies are less innovative and less competitive over time."

"There's a tendency for many successful companies to rest on their laurels, and become complacent, self-protective, and less innovative. In such bureaucratic cultures, employees can survive only by running with the herd. Decline sets in."

"Verbal exchanges lead to the discovery of new and better ways to create value. When such exchanges are hampered by overbearing taboos, bureaucracy, systems, procedures, tenure, knowledge hoarding, egos, or hierarchy, knowledge sharing is stifled."

"At Koch, truth is what gets results. It is what stands the tests of evidence and criticisms - not what someone in the hierarchy declares is true."

"Like many companies, Georgia Pacific [when acquired by Koch] had a command-and-control structure in which challenge of leaders was discouraged. We broke down this strict hierarchy in which leadership seemed above and apart from other employees."

Humility as always is a fundamental trait of a successful culture and leadership.

"My father, Fred Koch, exemplified much of what is at the core of our culture: the value of hard work, integrity, humility, and a lifelong dedication to learning."

"Guard against self-assuredness. None of us at Koch can ever declare victory and lose focus on what matters."

"Arrogance is one of the most destructive traits of an organisation."

"We all need to exemplify humility and intellectual honesty as vital attributes of our culture."

"I don't consider any work I do "good enough" - because complacency and eventual decline are embedded in that mental model."

"Complacency and defence of the status quo are surefire prescriptions for business failure, because creative destruction is always with us."

Seeking knowledge from others and their experiences...

"I sought to read everything I could on the subject [of societal well-being] from every relevant discipline, including history, economics, philosophy, science, psychology, sociology, and anthropology."

"I am a bona-fide book person. My home contains more books than I'll ever have time to count."

"MBM draws from the wisdom of philosophers, economists and psychologists willing to face reality and use logic."

"Everyone, in every business, and in every position within a company, can be constantly learning and strengthening the values that drive good profit."

"No matter what business we are in, we can all learn a great deal from the best company (internal), the best industry (competitive), and the best in any industry anywhere in the world (world-class)."

The use of mental models appears time and time again within the doctrine of the Investment Masters.

"Mental models are intellectual structures that enable us to simplify and organise the myriad inputs we get from the world around us. They shape and support our thinking, decision making, opinions and beliefs."

"The quality of our mental models determines how well we function in the physical world. The same is true for the economic world, which is why Koch industries invests tremendous time and effort to ensure that our MBM mental models fit reality. Any business with behaviour based on faulty mental models will eventually fail."

"The most reliable signal that a business is using reality-grounded mental models and providing service that customers truly value is a profit made over time under beneficial rules of conduct."

"Theoretical grounding is necessary, but by itself it is not sufficient to obtain results. Success in applying new mental models - and thus acquiring personal knowledge - comes only after correct, frequent, and prolonged practice."

Ideas

Ideas and innovation are actively encouraged within the organisation...

"Ideas are encouraged and challenged, not destructively criticised."

"Free speech within a company allows the exchange of information and ideas that generate innovation and progress."

"When a workplace culture of respect and trust is promoted, employees share their ideas and seek out the best knowledge to anticipate and solve problems."

"Businesses with good ideas but poor execution ultimately fail."

And rather than just accept those ideas at face value, they need to be vigorously and constructively agitated to ensure their value.

"The kind of communication that fosters value creation requires constant disagreement."

"One of our top priorities is impressing on new employees that not only is it permissible to challenge their bosses respectfully if they think they have a better answer, but they have an obligation to do so. And supervisors have the obligation to create a culture that invites challenges."

"We are able to create superior value for customers because we attempt to replicate a free community of scientists - constantly sharing knowledge and ideas, testing hypotheses, experimenting and adjusting to what honestly works - rather than succumbing to establishment pressure."

"Continual questioning and brainstorming to find a better way is what we call challenging. It must be seen as an opportunity to learn and improve, not as a chance to kill another person's idea. Leaders should encourage challenges by asking open-ended questions such as "What are we missing here?" or "Is there a better way to do this?"

"The quality of a challenge depends on having the courage and willingness to respectfully question anyones' - up to and including the CEO's - beliefs, ideas, proposals, and actions."

"We need to strive - seeking help when needed - to clearly articulate our hypothesis, which, when made concrete and specific, can be challenged, tested and improved to the point that we believe them to be valid."

"To be most effective, [a] challenge process must include people with different perspectives, kinds of knowledge, and expertise. This is the kind of diversity that is important for innovation and reaching the best decision."

"To drive the process of creative destruction internally, nothing and no-one can be immune to challenge. Each of us, from the front-line supervisors to the CEO, must help foster an open environment that invites challenge and embraces change."

Failure and its acceptance are integral to growth and learning as well as success.

"Confusing as it might seem, failure and getting results are not mutually exclusive. When driving experimental discovery within a company, failure is not desirable, but should be expected. Sometimes today's positive results can only be derived from lesson's of yesterday's failed experiments. As Einstein observed "Failure is success in progress."

"By not unduly penalising well-planned experiments that fail, we fuel an engine of small and frequent bets that can generate powerful discovery and learning. This is vital to innovation, growth, and long-term profitability."

"Koch's model for growth today is still a trial and error process."

"Perfection is the enemy of progress: Progress - whether in business, an economy, or science - comes through experimentation and failure. Those who favour a 'grand plan' over experimentation fail to understand the role that failed experiments play in creating progress in society."

"Experimental discovery is needed because we cannot know the final destination when our journey begins. Innovation usually involves numerous changes in direction that lead to the discovery of new paths."

"A key factor in our success has been the willingness to admit to mistakes and mitigate our losses in a timely manner. Rather than squandering our scarcest resource (talent) trying to save a marginal business, we've learned to focus that resource on opportunities with real potential."

"Our practice of exiting businesses with limited potential for us and focusing on ones with greater potential has been a key element in our success."

"I can never undo all the damage that has been done [by management failures], but I can commit myself to improving as a result of these management failures and helping others avoid the same mistakes."

Trust, Value and Empower your People

Koch understand that people are their greatest asset, and that being a manager doesn't mean that that person is always right.

"The old cliche is true: Good people are a company's most valuable resource. They are also essential for good profit. I join Jack Clark in feeling grateful for everything and entitled to nothing. I am especially grateful for all our good people."

"Organisations should treat people as individuals, according to their virtue, talents and contributions. Teamwork requires honesty, dignity, respect and sensitivity. Making people feel appreciated leads to better long term results."

"Just like owners usually take better care of their property than renters do, when an employee "owns" well-defined areas at work, she takes greater pride and responsibility for outcomes. This greatly improves results."

"At Koch we have found that each employee can help experiment and improve our ability to get results through MBM. In fact, employee innovations and contributions constitute most of the examples in this book."

"[We follow] a vision that focuses on what our employees can do to seize opportunities to create value for our customers."

"Leaving the particulars to those doing the work encourages discovery and enhances their ability to adapt to changing conditions."

"Freeing people to explore new approaches, within Koch's Guiding Principles, leads to innovation."

"[The concept that] the person with the comparative advantage to make that decision well (not necessarily the highest ranking person) should be the decision maker - leads to greater value creation."

"Granting well defined decision rights flies in the face of hierarchical norms."

"In an environment with clear decision rights, the owners of good decisions reap rewards, just as entrepreneurs in a free society do when they use their private property to create value for their customer and society."

"Decisions should not be made by those in closest proximity, but rather by those with the comparative advantage to make sound decisions, including the best knowledge."

"Too many businesses insist that decisions ought to be made by the highest-ranking person in the company hierarchy. But this should only be the case when that person is the one with the comparative advantage to make that decision. Tenure, credentials, or titles are not reliable predictors of good decision-making ability."

"No matter your role in the company, you should actively seek knowledge and alternative points of view."

"If the goal is to develop a culture that will be competitive in the long term, it's crucial for a company to give its people the right amount of responsibility to seek a better state."

The Right Incentives

Reward should encourage innovation and long term value.

"At Koch, base pay is recognised as an advance payment for the value an employee is expected to create for the company."

"With our approach, when individual employees create more value than their leaders, they are compensated more than their leaders, no matter what title. This is the same philosophy used by sports teams in which the top performers are paid more than the coach."

"Every company should strive to leverage incentives to motivate all employees to fully develop and apply their capabilities to maximise long-term value for the company in a principled way."

"At Koch, we do not reward roles or positions. We reward individuals for specific contributions and results, not for some generalised or averaged result. At Koch, anyone can earn more than his boss if he creates more value. Our goal is to motivate all employees to maximise their contribution, regardless of the role."

"All incentives, whether financial or not, should motivate each employee to fully develop her aptitude to create value, to innovate and drive creative destruction."

"At Koch we use incentives to attempt to align the interests of each employee with the interests of the company, our customers and society. Our philosophy is to pay employees a portion of the value they create for the company."

"If we don't hold employees (especially leaders) accountable for results and instead continue to compensate them the same regardless of their performance, we undermine the whole system."

"We recognise our incentive system is more demanding to administer than budget-, formula-, or hierarchy-base systems. However, in our experience, the effort Koch expends connecting employees to how they can create more value- and rewarding them for it - causes them to greatly increase their contribution."

"We have found that aligning incentives with performance almost always improves outcomes."

Innovation

And of course, Innovation...

"Now, more than ever, if you don't have a culture of innovation, your days are numbered."

"At Koch, we stress the importance of incessantly embracing innovation and replacing old products, services, and methods with newer and better ones."

"Koch has grown through innovation and by painstakingly identifying and acquiring businesses that are beneficial to our customers and Koch as a whole."

"Anyone who wants to maximise creativity should work as part of multi-disciplinary teams, share ideas - not in isolated silos - and their leaders must provide them sufficient resources and time to do so."

"Koch strives to drive what Schumpeter called creative destruction, creating "the new commodity, the new technology, the new source of supply, the new type of organisation."

"Companies must realise they are not competing just on price and output of existing products. They have to relentlessly strive to come up with new and better products and produce them more efficiently than the alternatives."

"We must continually drive constructive change in every aspect of our company or we will fail."

"We constantly pursue disruptive innovations and opportunities through internal and external development as well as acquisition."

"Koch's reality-grounded MBM mental models, customer focus, and innovation have made us one of the world's largest and most successful private companies, generating exceptional long term performance."

"Even successful companies struggle to keep up because, given human nature, we all tend to become complacent, self protective, and less innovative as we succeed."

Conclusion

Koch's returns are an example of doing the right things rather than just doing things right. Innovation is encouraged, staff can earn more than their boss, titles mean nothing and customers are all. Many businesses fall short of what they could achieve or fail altogether because they fear to allow change within their walls, and prefer structure and hierarchy and regulations to provide them with security and comfort. Koch is another strong example of ideals and values that espouse great investing. If Koch can do it, and the Investment Masters all do it, shouldn't the businesses you own do it also?