"Did you ever hear a broker say "I don't know" when you asked him a question? No, he's always got an answer." Adam Smith, Money Game

"Large permanent losses can dampen the confidence of an investor - and I sternly believe that a good investor needs to be highly confident about his ability to make decisions, because investment decisions seldom are clear and usually are muddled with uncertainties and unknowns" Ed Wachenheim

"Forget Wall Street. It's a promotion machine. Forget almost all books on investing. They won't help you. But this book will. Chris Browne makes sense. ' Jean-Marie Eveillard

“Disney is an amazing example of autocatalysis .. They had all those movies in the can. They owned the copyright. And just as Coke could prosper when refrigeration came, when the video cassette was invented, Disney didn’t have to invent anything except take the thing out of the can and stick it on the cassette. And every parent and grandparent wanted his descendants to sit around and watch that stuff at home on video cassette. So Disney got this enormous tail wind from life. And it was billions of dollars worth of tail wind” Charlie Munger

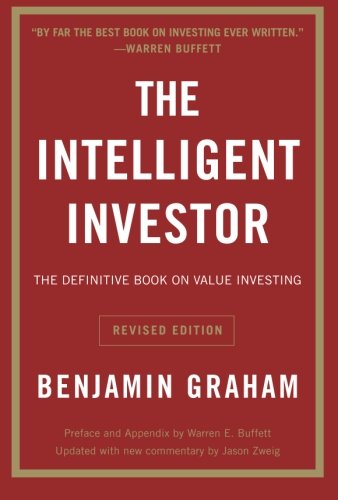

“The second book I read as a young investor was Gerald Loeb’s Battle for Investment Survival, first published in 1934, the same year Ben Graham’s seminal Security Analysis hit the bookstores, which was my first. Both backward looking, they poignantly explained to the reader what one should not do in heady times; that is, they were of no value for those who had been wiped out by the time the books were originally published. When treasure troves of wisdom and experience are most needed, perhaps even today, they are least sought after. Graham’s 1934 edition is ranked No. 81,165 on Amazon’s bestseller

list. We consider that information a powerful and easily obtained competitive advantage. If everyone is thinking alike (i.e., they are not studying Graham), then somebody isn’t thinking. No dust is gathering on our treasured copies of Graham’s ’34 edition.” Frank Martin

"I really liked The Rational Optimist,

by Matt Ridley. The general theme of the

book is that while it may not feel like it all

the time, things are getting better in the

global economy and will continue to do

so." Thomas Gayner

“Matt Ridley’s book The Rational Optimist is a great chronicle of the evolution of development of different societies, the industrial revolution and now the technology and communications revolution” Frank Martin

House of Money, Ed Wachenheim, Loeb Battle of rinvestment survival, graham memoirs

"Fooled by randomness - I consider it one of the most important books an investor can read" Howard Marks

“The most important thing in investing is to know what you’re invested in, and if your confident in the outcome it’s important to stay true to your position” John Paulson

“The reality is that stocks are not pieces of paper, offering returns correlated to arbitrary variables, but rather part claims on the future cash flows of businesses, whose returns are driven by changes – and anticipated changes – in these cash flows, as returns on capital respond to developing business environments, most importantly (from our perspective) those resulting from changes in the level of competition as capital enters and exits an industry” Marathon Asset Management

“If you don’t know the odds, putting a number on something makes no sense” Colm O’Shea

“People are very poorly attuned to making decisions where there is uncertainty” Colm O’Shea

"Great things are done by a series of small things brought together."

Vincent van Gogh

To the extent price deviates markedly from value, opportunity presents itself, whether as a buyer or as a seller. Understanding the difference between price and value is perhaps the most critical aspect of investing.” Semper Augustus

One of the key traits of successful investing is knowing what you don’t know. Semper Augustus

“I had very few actual mentors in this business because I didn’t really know anyone. I bought Seth Klarman’s book Margin of Safety which was published my first year of business school.” Bill Ackman

“Margin of Safety, published in 1991 – some concepts are timeless” Frank Martin

“Some twenty years ago, Margin of Safety was published which spelled out why financial markets weren’t, and never would be, efficiently priced and what we intended to do about it. I endeavoured to make the book timeless – more about how to think about investing than about what one should buy or sell at any given moment. Some of the categories of opportunity I wrote about hardly exist today (eg thrift conversions), while others that have emerged in recent years couldn’t have been specifically contemplated two decades earlier (eg distressed structured products). But while the categories and the specific opportunities may have changed, the fundamental lessons remain”” Seth Klarman

“When I was 17, I was backpacking across Europe. I was in Rome and had run out of books to reads. I went to a local open market where there was a book vendor, and literally, the only book they had in English was Reminiscences of a Stock Operator. It was an old tattered copoy. I still have it. It’s the only possession in the world I care about. The book is amazing. It brought everything in my life together” Colm O’Shea

“In areas like basic materials and other commodity businesses, there usually justisn’t enough of a moat, which makes it hard for us to get interested on a fundamental basis” Adam Weiss

“It comes down to doing business with people you trust. We pay careful attention to all management communications. Does the CEO write the shareholder letter himself or herself? Do they tell you where they’ve been right and where they’ve been wrong? Do they talk about what’s difficult about the business? Do they articulate how they allocate free cash flow, and do so in an owner mentality? Are the key benchmarks consistent? We worry about companies that one year focus you on adjusted net operating EPS, then the next year on EBITDA margin and the next year on something else” Adam Weiss

“Because we have our entire financial net worth in the fund, we care more about avoiding large permanent losses, and less about managing small swings in performance” James Crichton

“Both James [Crichton] and I recently read Groupthink, Irving Janis’ classic study of how small, cohesive groups of very smart people can make really bad decisions, such as getting deeper into Korea, the Bay of Pigs, and Vietnam. The main point is to make sure you have a culture that questions everything and vets out all the alternatives before zeroing in on one of them” Adam Weiss

“One of my favourite books, Groupthink by Irving Janis, breaks down how small, cohesive groups of very smart people can make very bad decisions.” Adam Weiss

“I have been deeply influenced by the existentialist and eminent psychiatrist Viktor Frankl, who wrote the perennial best seller Man’s Search for Meaning (one of the most influential books I’ve ever read and reread) after being imprisoned in Auschwitz and other concentration camps for three years during World War II” Frank Martin

“I think I have read almost everything Warren Buffett has written and I agree with more than 95% of his thinking” Lee Ainslee

“Nassim Taleb, author of the new book Antifragile, praises volatility and criticises those who would artificially damp it at great unseen cost. He is concerned about the rigidities inherent in our system…. Accepting that we cannot predict the future – ie that there will always be unexpected and highly consequential events – is the first step in becoming less fragile and more adaptable. People should be highly sceptical of anyone’s, including their own, ability to predict the future, and instead pursue strategies that can survive whatever may occur. Taleb advises us to be ‘anti-fragile’ ie to embrace those elements that benefit from volatility, variability, stress and disorder. This is exactly what we strive to do at Baupost, and Taleb has coined a name for it” Seth Klarman

“Daniel Kahneman, a psychologist who won the Nobel Prize in Economic Sciences for his work that challenged a rational model of judgement and decision-making, recently published a remarkable account of his intellectual journey; Thinking Fast and Slow” Seth Klarman

“I just read Daniel Kahneman’s Thinking, Fast and Slow, and I think that he and the late Amos Tversky are some of the great behavioural scientists. Since nobody in our industry thinks about this very much, I think about it a lot” Frank Martin

“We opened our investment partnerships for business in early 1983, a fledging firm with an investment philosophy adopted straight from Graham and Dodd. We have refined that approach a bit over the years, pursuing some new asset classes and covering some new geographies, but we have stuck to the bedrock principles of value investing and are far better off for it” Seth Klarman

“I think some of the best things that any investor today can read are his [Warren Buffett’s] early partnership letters. The world is totally different, but there’s wisdom in them for the ages” Seth Klarman

“You should read the Berkshire Hathaway ‘Letters to Shareholders’ which are on the Berkshire website so they are free. That will be a great start” Mohnish Pabrai

“The Crowd, written in 1895by Gustave Le Bon, is probably the most instrumental book in framing my ability to go against the grain of conventional thought and not feel insecure” Frank Martin

“A book like the Outsiders is a good example of what I like to read. It uses eight case studies to illustrate how unconventional managers can make a huge difference in creating per share value for shareholders’ Wally Weitz

“My favourite book to recommend is The True Believers: Thoughts on the Nature of Mass Movements by Eric Hoffer. There is no discussion about investing, but in my opinion it is extremely helpful in understanding markerts. It conveys the nature of human mass behaviour – how people act as a group” Joe Rosenberg, Loews Corporation

“Some years ago a friend gave me a copy of Extraordinary Popular Delusions. In a vage way I had been familiar with the stark facts of these events, as who is not? But I did not know .. the astonishing circumstances of each of the greater delusions of earlier eras” Bernard Baruch

There are a few books - really not that many which I believe are indispensable reading for every serious investor in whatever facet of investment practice they may favour:

Extraordinary Popular Delusions and the Madness of Crowds by Charles Mackay (only the first two chapters the title is worth the price of admission!)

The Crowd: A Study of the Popular Mind by Gustave Le Bon

Buffett: The Making of an American Capitalist by Roger Lowenstein

The Money Masters by John Train

The Intelligent Investor: A Book of Practical Counsel by Benjamin Graham

The Templeton Touch by William Proctor

The Alchemy of Finance by George Soros

By PETER CUNDILL

“Subscribe to Outstanding Investor Digest and Value Investor Insight. Both carry detailed interviews and write-ups with some of the best money managers in the United States. These are likely to deliver anothjjer idea or two for you to add to your funnel” Mohnish Pabrai

“And then I read The Alchemy of Finance because I’d heard about this guy Soros. And when I read The Alchemy of Finance, I understood very quickly that he was already employing an advanced version of the philosophy I was developing in my fund” Stanley Druckenmiller

“The availability of a quotation for your business interest (stock) should always be an asset to be utilised if desired. If it gets silly enough in either direction, you take advantage of it. Its availability should never be turned into a liobility whereby its periodic abberations in turn formulate your judgements. A marvellous articulation of this idea is contained in chapter two {The Investor and Stock Market Fluctuations) of Benjamin Graham’s “The Intelligent Investor”. In my opinion, this chapter has more investment importance, than anything else that has been written.” Warren Buffett 1966 Partnership Letter

“More recently, Poor Charlie’s Almanac, which got released at this year’s Berkshire meeting is fantastic. I rate that as the best book I’ve ever read. If your looking for one book, Poor Charlie’s Almanack is loaded with a lot of wisdom. If you spend some time on that book, it’s pretty much all the wisdom picked up in 82 years of living, so there’s a lot of it digested and condensed in that book” Mohnish Pabrai 2005

“The boom is drawn out and accelerates gradually; the bust is sudden and often catastrophic.” George Soros, Alchemy of Finance

My successor will need one other particular strength: the ability to fight off the ABCs of business decay, which are arrogance, bureaucracy and complacency. When these corporate cancers metastasize, even the strongest of companies can falter. Warren Buffett

Roll-Ups .. “In the late 1960s, I attended a meeting at which an acquisitive CEO bragged of his “bold, imaginative accounting.” Most of the analysts listening responded with approving nods, seeing themselves as having found a manager whose forecasts were certain to be met, whatever the business results might be.

Eventually, however, the clock struck twelve, and everything turned to pumpkins and mice. Once again, it became evident that business models based on the serial issuances of overpriced shares – just like chain-letter models – most assuredly redistribute wealth, but in no way create it. Both phenomena, nevertheless, periodically blossom in our country – they are every promoter’s dream – though often they appear in a carefully-crafted disguise. The ending is always the same: Money flows from the gullible to the fraudster. And with stocks, unlike chain letters, the sums hijacked can be staggering.

At both BPL and Berkshire, we have never invested in companies that are hell-bent on issuing shares. That behavior is one of the surest indicators of a promotion-minded management, weak accounting, a stock that is overpriced and – all too often – outright dishonesty.” Warren Buffett

“Silos are a double-edged sword. A narrow focus leads to potentially superior knowledge. But concentration of effort within rigid boundaries leaves a strong possibility of mispricings outside those borders. Also, if others’ silos are similar to your own, competitive forces will likely drive down returns in spite of superior knowledge within such silos.” –Seth Klarman

“My good friend, Guy Spier, observed that both of us have a pre-investment checklist, but no in-flight checklist. The pre-investment checklist has proven invaluable. However, it is not enough to just keep up with ongoings in existing investments in an ad hoc manner. It is important to periodically run and re-run the in-flight checklist.” Mohnish Pabrai

Outperformance

John Bogle suggests that in most cases, you’re better off just buying an index fund. Typically, only about 15% of managers beat the index long term, but if you look at the number of managers that beat the index by more than 3 percentage points a year, that number drops to around 1 in 200. It becomes a really small number” Mohnish Pabrai

“You know one of the things about investments and investment management is it’s very hard to beat the index in general. One of the reasons it’s tough to beat the index is because the index is really smart. It doesn’t sell things as random times or distressed times or whatever. And it just chugs along. And it’s rule based in the sense that if you look at the Dow, how frequently do the elements of the Dow change? They don’t change very often” Mohnish Pabrai

“In the great majority of cases the lack of performance or even matching an unmanaged index in no way reflects lack of ewither intellectual capacity or integrity. I think it is much more the product of (1) group decisions – my perhaps jaundiced view is that it is close to impossible for outstanding investment management to come from a group of any size with all parties really pareticipating in decisions (2) a desire to conform to the policies and (to an extent) the portfolios of other large well regarded organizations; (3) an institutional framework whereby average is “safe” and the personal rewards for independent action are in no way commensurate with the risk attached to such action; (4) an adherence to certain diversification practices which are irrational; and finally and importantly (5) inertia” Warren Buffett, Partnership Letters 1964

“It is obvious that the performance of a stock last year or last month is no reason, per se, to either own it or to not own it. It is obvious that an inability to “get even” in a security that has declined is of no importance. It is obvious that the inner warm glow that results from having held a winner last year is of no importance in making a decision as to whether it belongs in an optimal portfolio this year” Warren Buffett, Partnership letter

“For a magnificent account of the current financial scene, you should hurry out and get a copy of “The Money Game” by Adam Smith. It is loaded with insights and supreme wit” Warren Buffett, Partnership Letter 1968

“The persistant belief that superior returns can be generated through dancing in and out of stocks as the tune of the music changes defies logic or empirical analysis but at least provides useful material for students of behavioural finance” Marathon Asset Management

“It is a tenet of my investment style that, on the subject of common stock investment, maximizing the upside means first and foremost minimizing the downside. The deleterious effect of permanent capital loss on portfolio returns cannot be overstated” Michael Burry

“Venturing cash-first into unfamiliar territory nearly always results in either losses appropriate for the bonehead move or success borne of dumb luck” Michael Burry

“I buy common stocks for the portfolio as if I were buying pieces of businesses” Michael Burry