Known as "The Lone Wolf of Wall Street", Bernard Baruch was one of the the world's most famous speculators of the 20th Century. By the age of 30, Mr Baruch had amassed a fortune. He went on to advise US presidents and congressional leaders from 1918 to 1948.

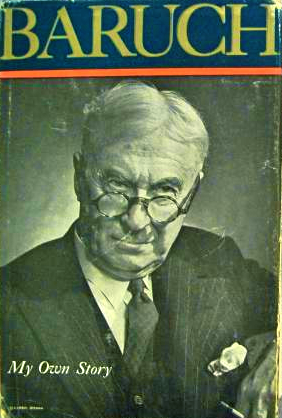

His memoirs, "My Own Story", written in 1957, provides a fascinating account of Baruch's life, his insight into human psychology and the history of speculation. His first hand account of market panics, bull markets and short squeezes and the associated emotional reaction of the markets provide timeless wisdom.

Mr Baruch lays down 10 guidelines from his lifetime of experience in the markets which he notes 'may be worth listing for those who are able to muster the necessary self discipline'. Like all of the Investment Masters there are many common threads that form the foundation of his success. With the exception of Mr Baruch's commentary on taxes, all of the 10 guidelines are tutorial topics in the Investment Masters Class.

1. Don't speculate unless you can make it a full-time job

2. Beware of barbers, beauticians, waiters - of anyone - bringing gifts of "inside" information or "tips."

3. Before you buy a security, find out everything you can about the company, its management and competitors, its earnings and possibilities for growth.

4. Don't try to buy at the bottom and sell at the top. This can't be done except by liars.

5. Learn how to take your losses quickly and cleanly. Don't expect to be right all the time. If you have made a mistake, cut your losses as quickly as possible

6. Don't buy too many different securities. Better have only a few investments which can be watched.

7. Make a periodic reappraisal of all your investments to see whether changing developments have altered their prospects.

8. Study your tax position to know when you can sell to greatest advantage.

9. Always keep a good part of your capital in a cash reserve. Never invest all your funds.

10. Don't try to be a jack of all investments. Stick to the field you know best.

[Source: "Baruch - My Own Story" Published by Henry Holt & Co., 1958.]