What makes a Master Investor? We have covered many of them over the last couple of years, and you would have to agree that every single Master we have reviewed has their own special qualities. Whether its Buffett, Dalio, Rochon, or Akre, et al; all are impressive in their own right and I have learnt from every single one.

Now whilst I have learnt from them all, one of the questions I have often asked myself is: “Which of them would I like my kids to learn from?” Which of these inspiring investors’ footsteps would I wish my children to follow in? And whilst the answer could be indeed them all, there is one that I have always felt would be able to teach my kids more than any other.

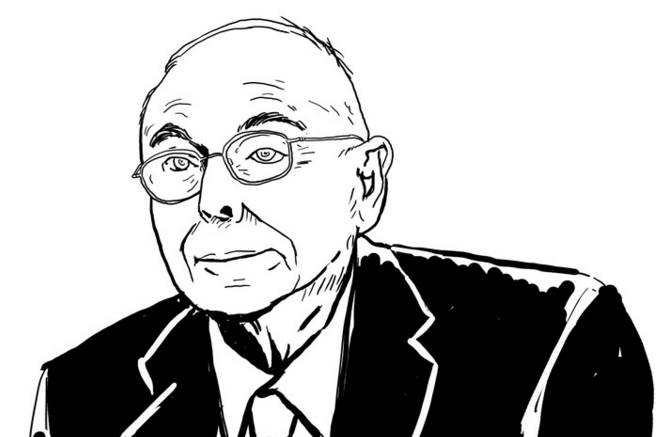

Charlie Munger.

At this year’s Daily Journal AGM, Charlie Munger once again shares his wisdom and some of the secrets to Berkshire’s success with the audience. The man is a veritable master when it comes to understanding both business and investing, and he’s a genius in articulating the psychological aspects that makes an investor successful. He’s also built a framework for living a successful and content life. And its this stuff I want my kids to heed. What he talks about, more than anything, I believe is absolutely fundamental to anyone’s success not only in the investment world, but in life in general.

I’ve included some of my favourite quotes below.

Try to Do Less

“At a place like Berkshire Hathaway, or even the Daily Journal, we’ve done better than average and now there’s a question why has that happened? The answer is pretty simple. We tried to do less. We never had the illusion we could just hire a bunch of bright young people and they would know more than anybody about canned soup and aerospace and utilities and so on and so on. We never thought we could get really useful information on all subjects like Jim Cramer pretends to have. We always realised that if we worked very hard, we could find a few things where we were right and the few things were enough and that that was a reasonable expectation. That is a very different way to approach the process [of mutual funds]. And if you would have asked Warren Buffett the same thing that this investment counselling did, give me your best idea this year. And you just followed Warren’s best idea you would find it worked beautifully. But he wouldn’t try to know a whole heap, he would give you one or two stocks, he had more limited ambitions.”

Traits That Help

“I think personal discipline, personal morality, good colleagues, good ideas - all the simple stuff. I’d say if you want to carry one message from Charlie Munger it’s this: if it’s trite it’s right. All those old virtues work.”

Know Something Better

“The whole trick of the game is to have a few times when you know that something is better than average and invest only where you have that extra knowledge. And then if you get a few opportunities that’s enough. What the hell do you care that you own three securities and J.P. Morgan Chase owns 100. What’s wrong with owning a few securities. Warren always says in a growing town if you owned stock in three of the best enterprises in the town that’s diversified enough. The answer is of course it is.”

Diversification vs. Excellence

“The whole idea of [wide] diversification when you’re looking for excellence is totally ridiculous. It doesn’t work. It gives you an impossible task. What fun is it to do an impossible task over and over again?”

Fees Are a Big Toll

“People don’t realise, because they’re so mathematically illiterate, is that if you make five per cent and pay two of it to your advisers, you’re not losing 40 percent of your future. You’re losing 90 percent because over a long period of time that little difference becomes a 90 percent disadvantage to you. So it’s hugely important for somebody who is a long term holder not to be paying a big annual toll out of performance.”

Get Rich Quick Books

“If you take the modern world where people are trying to teach you how to come in and trade actively and stocks - well I regard that as roughly equivalent to trying to induce young people to start off on heroin. It is really stupid. And when you’re already rich do you make your money by encouraging people to get rich by trading? Then there are people on the TV and they say I have this book that will teach you how to make 300 percent a year and all you have to do is pay for shipping and I will mail it to you. How likely is it a person who suddenly found a way to make 300 percent a year will be trying to sell books on the internet to you? It’s ridiculous.”

You Don’t Need Many Great Decisions

“If you actually figured out how many decisions were made in the history of the Daily Journal Corporation or the history of Berkshire Hathaway it wasn’t very many per year. They were meaningful. It’s a game of being there all the time and recognising the rare opportunity when it comes and recognising that a normal human life does not have very many. Now there is a very confident bunch of people who sell securities who act as though they’ve got an endless supply of wonderful opportunities. Those people are the equivalent of the racetrack tout. They’re not even respectable. It’s not a good way to live your life to pretend to know a lot of stuff you don’t know, and pretend to furnish opportunities you’re not furnishing. My advice to you is avoid those people, but not if you’re running a stock brokerage firm. You need them. But it’s not the right way to make money.”

Find Costco’s, Not Stocks to Sell

“I’m no good at exits. I don’t like even looking for exits. I’m looking for holds. Think of the pleasure I’ve got from watching Costco march ahead. Such an utter meritocracy and it does so well, why would I trade that experience for a series of transactions? I’d be less rich not more after taxes. The second place is a much less satisfactory life than rooting for people I like and admire. So I say find Costco’s, not good exits.”

Under Spend Your Income

“This business is of controlling the costs and living simply. That was the secret. Warren and I had tiny little bits of money. We always underspent our incomes and we invested it. You live long enough, you end up rich; it’s not very complicated.”

Scramble Out of Mistakes & Change Your Ways

“There is a part of life which is, how do you scramble out of your mistakes without them costing too much? We’ve done some of that. If you look at Berkshire Hathaway, think of its founding businesses: a doomed department store, a doomed New England textile company and a doomed trading stamp company. Out of that came Berkshire Hathaway. We handled those losing hands pretty well and we bought into them very cheaply. But of course the success came from changing our ways and getting into better businesses.”

Avoid Difficult Things

“It isn’t that we were so good at doing things that were difficult. We were good at avoiding things that were difficult, and finding things that were easy.”

Only Do Things If They Are Better

“If we’ve got one thing we can do more of, we’re not interested in anything that’s not better than that. That simplifies life a great deal. It’s amazing how intelligent it is to spend some time just sitting. A lot of people are just way to active.”

Don’t Expect too Much from Human Nature

“I like those old Stoics. Part of the secret of a long life that’s worked as well as mine is not to expect too much of human nature. There’s almost bound to be a lot of defects and problems and to have your life full of seething resentments and hatreds; it’s counterproductive. You’re punishing yourself and not fixing the world. Can you think of anything much more stupid?”

Recognise Good Ideas Can be Overdone

“A problem thoroughly understood is half solved the minute you point out there’s a big tension between good ideas yet over done so much they’re dangerous, and good ideas that still have a lot of runway ahead. Once you have that construct in your head start classifying opportunities into one category or the other. You’ve got the problem half solved. You’ve already figured it out. You’ve got to be aware of both potentialities and the tensions.”

Less Bureaucracy is Better

“One of the reasons that Berkshire has been so successful is there is practically nobody at headquarters. We have almost no corporate bureaucracy. Having no bureaucracy is a huge advantage. The people who are running it are sensible people.”

“Bureaucracy and successful bureaucracy breeds failure and stupidity. How could it be otherwise? That’s the big tension of modern life and some of these places that go into a stupid bureaucracy and fire a third of the people in place works better.”

Reduce Your Return Expectations

“My advice for a seeker of compound interest that works ideally is to reduce your expectations, because I think it’s going to be tougher for a while and it helps to have realistic expectations - it makes you less crazy.”

Opportunities in China

“Some very smart people are wading in [to China] and in due course I think more will wade in. The great companies in China are cheaper than the great companies in the United States.”

Have a Too-Hard Pile

“Part of our secret is that we don’t attempt to know a lot of things. I have a pile on my desk that solves most of my problems - it’s called the ‘too-hard pile’ and I just keep shifting things to the too hard pile. Every once in a while an easy decision comes along and I make it. That’s my system.”

Look at Qualitative Aspects

“We pay attention to the qualitative metrics and we also pay attention to other factors. Generally we like to pay attention to whatever is important in a particular situation and that varies from situation to situation. We’re just trying to have that uncommon sense. And part of our common sense is to refer a lot of the stuff in the too-hard pile.”

Companies Tend To Buy Back Stock at the Wrong Time

“When it was a very good idea for companies to buy back their stock they didn’t do very much. And when the stocks got so high - that is frequently a bad idea they’re doing a lot. Welcome into adult life. This is the way it is. It is questionable at the present levels whether it’s smart.”

The Trouble with Economics

“A great philosopher said: 'A man never steps into the same river twice, the man is different, and so is the river when he goes in the second time.' That's the trouble with economics. It's not like physics. The same damn recipe done a different time gets a different result.”

Humour

“Humour is my way of coping.”

Why Buffett is Richer Than Munger

“He [Warren] got an earlier start. He probably was a little smarter, he worked harder. There are not a lot of reasons. Why was Albert Einstein poorer than I was?”

Investment Products

“I tend to be suspicious of all investment products created by professionals, and I tend to go where nothing is being hawked aggressively or merchandised oppressively or sold aggressively.”

Bank Worry

“All intelligent investors worry about banks because banks present temptations to their managers who do dumb things. There are so many things you can easily do in a bank that looks like a way of reporting more earnings soon where it’s a mistake to do it, long term considerations being properly considered. As Warren puts it, the trouble with banking is there are more banks than there are good bankers.”

How to Sleep Better

“Now I actually deliberately blank out my mind and go to sleep rather easily and I recommend it to all of you. It really works. I don’t know why I didn’t get to it before 93.”

Indexing

“I do think that index investing, if everybody does it, won’t work, but for another considerable period index investing is going to work better than active stock picking where you try and know a lot.”

Summary

Munger is a genius. Even at 95, the man is still so intellectually active and has so much to teach. You can see he’s made his life as simple as possible, which has to be an invaluable lesson to us all. You don’t get to his age without gaining some knowledge along the way, and given his track record of success, I for one, and my kids, too, I hope, will gladly listen to what he’s got to offer.

Follow us on Twitter: @mastersinvest

TERMS OF USE: DISCLAIMER

Further Reading:

2019 Daily Journal Annual Meeting [Video]

2019 Daily Journal Annual Meeting [Full Transcript] - ValueWalk

Poor Charlie’s Almanack - Peter Kaufman

CNBC Becky Quick Munger Interview at Daily Journal Meeting 2019