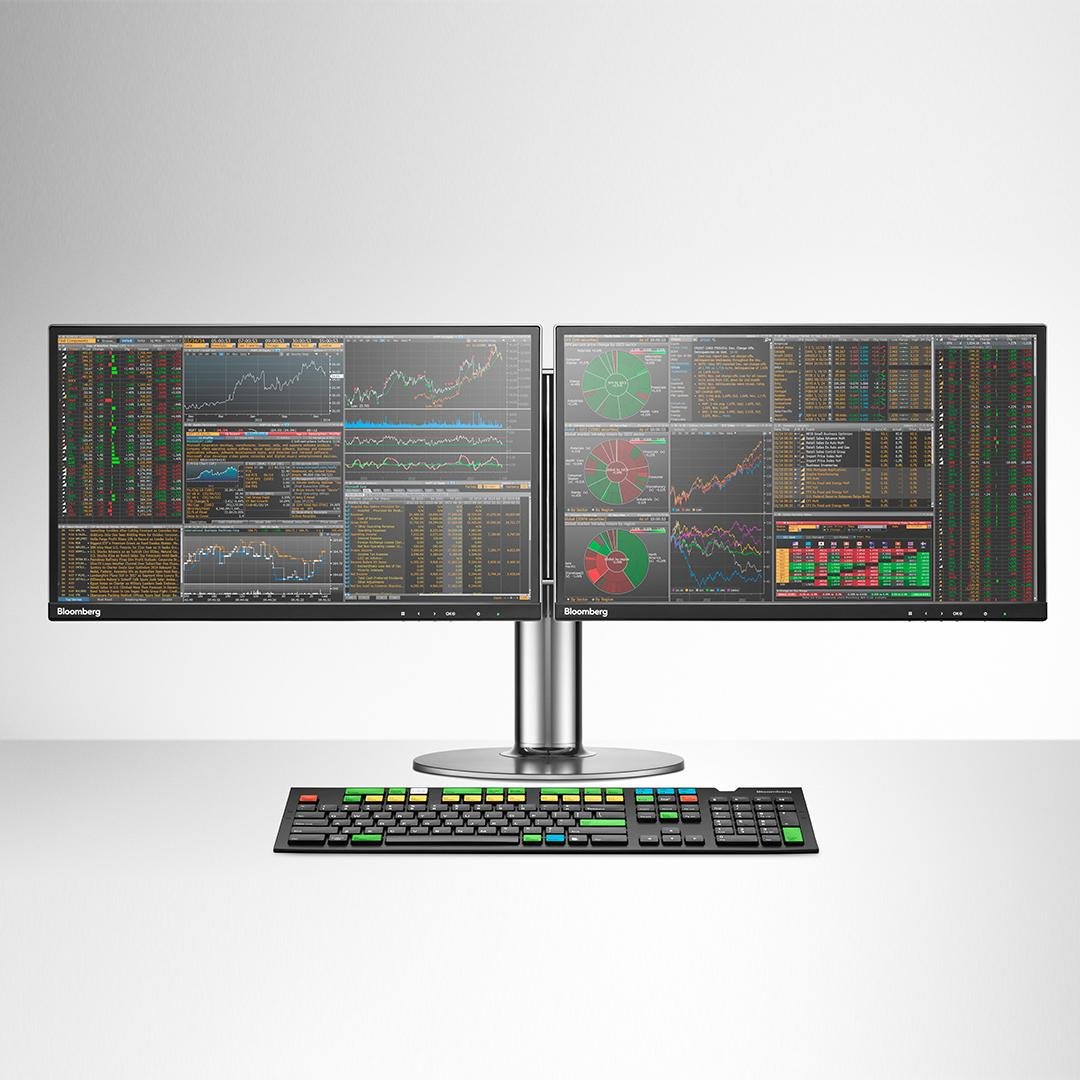

Every day, thousands of traders, portfolio managers, and analysts rely on one system without which they cannot perform their daily tasks: Bloomberg.

At the age of 39, Michael Bloomberg found himself at a crossroads after being let go from Salomon Brothers, where he had devoted the last fifteen years of his career. Armed with a $10 million payout, Bloomberg decided it was time to launch a financial services firm that would leverage technology to equip traders and market participants with the knowledge and tools needed to outperform the competition. In a mere fifteen years, a modest initial investment of $300,000 would transform into a billion-dollar enterprise.

In a 2006 lecture at Columbia Business School, Li Lu, a famed investor and Charlie Munger protegé, posed a question to his students: 'What truly sets one business apart from the others? What gives them an edge? Why do some businesses thrive while others falter?' Li Lu offered a crucial insight, stating, 'The best way to understand this is by studying those businesses that have already established themselves.'

Li Lu contended that virtually all businesses undergo a transformative process triggered by industry shifts that predictably shape their future. He pointed to Bloomberg as a remarkable case study, illustrating how a company emerged seemingly from nowhere to challenge well-established industry players, gradually solidifying its status as a virtual monopoly. When a product or service is difficult to replace, indispensable for daily tasks, and crucial for collaboration, the stage is set for a winner-takes-all scenario. Li Lu concluded that such insights are worth a 'sh*tload of money.'

With a steadfast two-decade commitment to Bloomberg, I've gained firsthand insight into their systems, distinguished by formidable analytics, innovative functionality, and proactive customer support. Over time the company’s moat has been widened as the business has become increasingly entrenched into the global finance ecosystem. A good example is the introduction of the chat function, an indispensable tool with profound network effects, seamlessly fostering collaboration among industry professionals, and ensuring Bloomberg remains an integral part of our daily operations.

Michael Bloomberg's story of his eponymous firm is vividly recounted in 'Bloomberg by Bloomberg,' a classic David and Goliath tale that reveals how he stealthily navigated past competitors to emerge as the dominant global markets information system today. The traits defining many of the remarkable businesses we've explored are evident here as well: a creative zealot, empowered and incentivized employees, valued and engaged customers, unique competitive advantages, and an unwavering dedication to continuous improvement. Here are some of my favorite passages:

Culture and People

“Our success continues to be derived mostly from one thing: our own people. They will always be our most important asset.”

“Our most important asset [is] our people. They are the company. You can replace our technology, data, reputation, and clients, but you cannot duplicate the group we've put together and the culture they've developed.”

Customer Focus & Good Profits

“If there is anything that defines our company, it is an awareness that nothing is more important than customer service.”

“Bloomberg has always treated its existing customers at least as well as its new ones. Not everyone else does the same. Why some companies give a better deal to their worst customers, I've never understood. What's the incentive to be a good client?”

“When we reduce our prices for new customers, we simultaneously do the same for existing ones. Treat your customers well and they'll stay with you forever.”

“Bloomberg is in the business of giving its customers the information they need - no matter what that information is - where and when they need it, in whatever form is most appropriate. We don't shoehorn programs into less-than-optimal presentation formats, or deliver them at inappropriate times and places. With all methods at our disposal, we do better. We give our customers what they need, not just what we have. When there's a difference between the two, we create or adopt a new medium - we don't ask our customers to accept less.”

Value and Empowering Employees

“The only way to have the best customer service is treat our people the best.”

“Another tenet of Bloomberg philosophy is that our main asset is not our technology, our databases, our proprietary communications network, or even our clients. It is our employees. Improving the rest is far less important than the care and feeding of ourselves - the maintenance of our culture, protecting it from the outside world. Physical plant, compensation politics, personnel policies, promotion, training, and so on-all of these at Bloomberg are designed with our culture in mind.”

“We always have our offices in the best and most expensive parts of town while our competitors look for bargain space in the low rent districts. It gets back to who you think is more important: your people or outsiders. I believe our people matter. The best for us. This is true not only at ‘headquarters,’ but everyplace.”

“The leverage we gain from employing creative people and letting them do their own thing is incredible. Our open physical plant encourages innovation, and our flat management structure guarantees a well-functioning meritocracy. Fortunately, for us, others do it differently. Typical company politics elsewhere stifle most free-thinking employees and discourage risk taking.”

“The primary function of those at the top is the care and feeding of the company's most valuable asset, its employees, including designing and administering a compensation system that encourages cooperation, rewards risk taking, and gives inducements to work hard. Job One for the CEO.”

Fanaticism & Hard Work

“The rewards almost always go to those who outwork the others. You've got to come in early, stay late, lunch at your desk, take projects home nights and weekends. The time you put in is the single most important controllable variable determining your future.”

“I learned hard work, intellectual curiosity, and the ambition to strive relentlessly for the goals I set - all of which would serve me in good stead at school, during my capitalist education at Salomon, and in creating my own company later on.”

“It's the ‘doers,’ the lean and hungry ones, those with ambition in their eyes and fire in their bellies and no notions of social caste, who go the furthest and achieve the most.”

“Work was, is, and always will be a very big part of my life. I love it. Even today, after toiling for thirty years, I wake up looking forward to practicing my profession, creating something, competing against the best, having comradeship, receiving the psychic compensation that money can't buy.”

Resilience

“Most fortunes are built by entrepreneurs who started with nothing and generally got fired once or twice in their careers. And thoughout history, the vast majority of great writers, artists, musicians, dancers, jurists and athletes have come from less financially secure families.”

Mission Statement

“Well-run organizations, whether commercial, political, educational, military, or philanthropic, have conceptual goals stated long in advance. New possibilities are always tested for fit against these predefined objectives. This insistence on a prior specific mission statement against which all proposed actions must be judged tempers the emotions to follow the ‘fad of the day.’”

Competitive Advantage - Empowering Customers

“Our product would be the first in the investment business where normal people without specialized training could sit down, hit a key, and get an answer to financial questions, some of which they didn't even know they should ask. To this day, we still don't have a competitor. Although investors can get some of our data and analysis elsewhere, most features of our system are unique.”

“From the beginning, we tried to be different. We built a unique product: We combined text and analytics with computer-driven tours that let readers automatically see the calculations and graphs of what we wrote about. We gave an illustration to complement what we told in words, then followed up with words to expand what the illustration showed.”

“Understanding and reinventing how news should be produced and delivered, as opposed to doing it ‘the way it's done,’ lets us beat the competition.”

‘1994: PC-style keyboard’ [Source: Bloomberg]

“If you're not providing something unique, you have no ability to impose charges.”

“It was obvious the economy was changing and services were taking a bigger share of the gross domestic product. .. I would start a company that would help financial organizations. There were better traders and salespeople. There were better managers and computer experts. But nobody had more knowledge of the securities and investment industries and of how technology could help them. All I had to do was find a value-added service not currently available. I conceived a business built around a collection of securities data, giving people the ability to select what each individually thought the most useful parts, and then providing computer software that would let non-mathematicians do analysis on that information. This kind of capability was sorely lacking in the marketplace. A few large underwriting firms had internal systems that tried to fill this need but each required a PhD to use and weren't available off the shelf to the little guy.”

“When it came to knowing the relative value of one security versus another, most of Wall Street in 1981 had pretty much remained where it was when I began as a clerk back in the mid-1960s: a bunch of guys using No. 2 pencils, chronicling the seat-of-the-pants guesses of too many bored traders. Something that could show instantly whether government bonds were appreciating at a faster rate than corporate bonds would make smart investors out of mediocre ones, and would create an enormous competitive advantage over anyone lacking these capabilities.”

Under the Radar and Truth Tellers

“Why did Bloomberg News rival Dow Jones and the British wire service Reuters so quickly? No big company thinks a little start-up company will ever become a major competitor. Invariably, by the time the big guy catches on, it's too late. The customers have grown used to having a choice. And playing catch-up isn't easy. In this case, major company complacency was furthered because Reuters and Dow Jones were growing at the time Bloomberg came on the scene; at first we were barely a distraction to either behemoth. Moreover, both of those established companies possessed a large status quo infrastructure with a vested interest in convincing management it was doing a good job, doing everything right, covering all the bases. So what management heard internally were reassuring feelings, not facts. I have always worried when our people tell me that we're doing great, that all is fine. As the ‘emperor’ of Bloomberg, I need someone to tell me when I've left my clothes at home.”

Competitive Landscape & Counter-Positioning

“We would have had a much tougher time had we entered an industry that had lots of small, scrappy competitors. But we went against giants, and giants are usually easy to beat. Remember the Germans and then the Japanese versus Detroit's ‘Big Three’ automakers? If you have to compete based on capital, the giant always wins. If you can compete based on smarts, flexibility, and willingness to give more for less, then small companies like Bloomberg clearly have an advantage.”

Recognition

“The more successful you are, the more likely it is that ‘you’ is a group. To win big, you must have an ability to leverage your work by identifying, including, convincing, and inspiring others to follow your vision. Then share the praise, or they won't be there for very long to help, and soon there'll be little for you to talk about.”

Family Culture

“I preach again and again at work that everyone in our company is family, that we must take care of one another. We really are related in both an emotional and a fiscal sense. Anyone who goes through life successfully receives the help of others. And no organization succeeds without most of its members contributing.”

Share the Profits

“As a private company, we don't have a stock price to worry about. But we do have to give employees the incentive to go in the same direction as the owners. I have a firmwide, long-term interest in the company's success; everyone else must be rewarded in a similar manner. All our staff get a salary commensurate with what the local market pays for their specialty and experience. Additionally though, they all share in the worldwide overall revenues of the company.”

“Everyone participates in our firmwide (as opposed to branch or product or department) success. For senior people, this revenue sharing can be 50 to 75 percent of their total yearly compensation. If we have a bad year, the most junior employees get hurt, and those who are running the company do too. In good times, both groups have smiles on their faces.”

“Our company shares its financial success: High salaries, significant revenue sharing, and generous expense reimbursement are part of everyone's package.”

CEO Pay

“My salary is equal to the lowest-paid full-time employee we have (currently, $19,000 per year). Everything else I get is from my share of the firm's earnings (and income tax regulations encourage me to reinvest most of that in research and development). I have the incentive the other stockholders and employees want me to have: to maximize the company's long-term value.”

Competition

“Competition's great-obviously for the consumer, but even for the providers. Every morning when we get up, we relish the day's upcoming battles. They keep us alive, and they keep Bloomberg's corporate family thriving. We can't wait for tomorrow. Who says we can't do that? What do you mean they'll beat us? Have them put on their boxing gloves, and send them into the ring. We're ready!”

Scuttlebutt

“When I look at a company, I pay little attention to its accounting statements. A good accountant with a creative mind can make numbers paint any desired picture. No one understates revenues and profits when they're trying to show off. Presumably, the financial situation is always equal to or worse than stated. A better way to evaluate a company is to talk to the experts. No, I don't mean journalists or analysts. I mean those who really know what's going on and what the potential is. First, I call those most knowledgeable, the customers. "Do you plan to buy more or less of this company's product?" I ask. "Are there competitors coming along with better offerings?" Then, I call the other insiders, the headhunters. "Do people want to go to work at this company, or are they trying to leave in droves?" Management, accountants, and other outsiders can say anything they want. Clients and employees never lie.”

Tone at the Top and The Golden Rule

“It's the top person's policies, personal and professional deportment, and working hours that the organization tries to emulate. While the only difference between stubbornness and having the courage of one's convictions may be the results, it's a natural reaction to attribute superior strength, knowledge, and consistency to those we follow. (But the slightest sign of vacillation can kill that image forever.) Say something as CEO and the organization responds. It may only be by analyzing, criticizing, ridiculing, or specifically deciding to ignore the pronouncement, but notice it they will.”

“Work hard. Share. Be lucky. Then couple that with absolute honesty. And never forget the biblical admonition, ‘Do unto others as ….’”

Personal Identity

“If we were going to build our business, we, too, needed a personality. The obvious choice? Me. Our competitors' founders, Messrs. Dow, Jones, Reuter, Knight, and Ridder, were all dead. I, on the other hand, was alive and out making speeches and sales calls every day in city after city around the world, turning my name and work into a great weapon that others in the financial news and market data businesses couldn't match…. I would become the Colonel Sanders of financial information services.”

Source: FT Magazine

Innovation and Permission to Fail

“Deep pockets and a strong stomach help when trying new things. Few innovations are accepted right away. You must bring changes along slowly, improving them over time, building an audience with persistence and repetition. But with just as much resolve, when you find something not working, after giving it a reasonable time, you've got to take a deep breath, bite the bullet, and stop the carnage. The embarrassment of failure can't be allowed to kill the company.”

“Companies need people with imagination and energy, particularly with regard to technology. Unbridled enthusiasm and belief that anything's possible may not be the real world, but trying things with low probabilities of success and big payoffs is a lot better than the alternatives.”

“We didn't want people to feel their jobs were in danger, or that they would be penalized for conceiving of or working on a ‘failure.’ At Bloomberg, all we ask is that they come up with as many new ideas as they can think of (no matter how "crazy"), and do their best on the projects we assign. If a concept is flawed, the blame and pain rest with me. The credit for whatever's right goes to them.”

Bureaucracy

“Our greatest challenge today? Fighting the stultifying effects of success, the paralyzing results of growth, the debilitating cancer of entrenchment.”

Private Company and Long Term View

“As a private company, we report to only a few who understand and have a long-term perspective.”

Balance Sheet

“Our financing is all long-term borrowings that mature in small, gradual tranches, something that should be manageable in virtually any financial scenario.”

Growth and The Palchinsky Principle

“Growth by acquisition is a bet-the-store, high risk gamble. It's true that a few (very few) work. But it's the kind of ‘all in up front’ risk that leaves me uncomfortable. Maybe I'm just not that smart. When I'm looking to expand, I prefer starting with a little capital that we can afford to lose, and a few people we can always reassign to other projects. This way, we never feel we're committed to stay with our mistakes, nor are we so overextended we can't handle other additional experimental ventures simultaneously. (Out of deference to our professional service providers, I won't mention the savings in accounting bills, legal charges, and investment banking fees we also get with this build-versus-buy strategy.)”

“Whether by building or buying, there are dangers in growth you ignore at great peril. We insist on management depth at every position. Lack of it would leave us vulnerable when someone quits or gets hit by a truck.”

“Growth by building gives us the chance to reward our best employees with newly created management jobs. Growth by buying would just force us to fire a bunch of people I've never met who haven't done anything bad to me.”

Acquisitions

“We're frequently presented with opportunities to grow or diversify by acquisition. I almost never let a seller's representative send us offering memoranda. If we're not seriously interested in making a bid, it's disingenuous to look; and I really don't care anyway. If the company being shopped was good enough for us to consider buying, it wouldn't be for sale.”

“At Bloomberg, we're builders, not buyers. I'd make a terrible venture capitalist; every company I look at seems overpriced. I always think we can create it more cheaply ourselves.”

“The real problem with acquisitions is that neither corporate cultures nor technologies mix. The momentary advantage to the buyer adding an existing operation often gets dissipated quickly, and then one's stuck with the reasons it was for sale in the first place. More times than not, when two good companies combine, they stay as separate functional organizations, having contact only through common ownership. When poorly run companies get together, they tend to do it at the operating level, where the worst of both can do the most damage to each other. It's probably inscribed someplace (or should be): Two negatives always produce something worse!”

Loyalty

“Loyalty is everything. Our people expect me to have it to them, and vice versa. Be honest, work hard, treat each other fairly and openly. Add a dash of competency, and we'll be together for a long time.”

Continuous Improvement and Growth

“To survive, we must grow and improve. Any supplier who offers today what it sold yesterday will be out of business tomorrow.”

“In business, growth is a necessity: You grow or you get out. No company can stay anchored to the status quo, no matter how successful it is. Customers come and go; their needs change with time, and the services that help them do their jobs are always in flux. Woe to the supplier without the best offering.”

Source: FT Magazine

“In every way, we've got to improve just to stay even. Each of us at Bloomberg has to enhance his or her skills. Every element of all our products must be improved. All our expenses need reexamination. Our suppliers must be pressed a little harder for a better deal. Our marketing should be refocused and our customer service enhanced. The basic assumptions behind our business must constantly be reassessed, "off-line" and out of sight.”

Lollapalooza Effects

“To succeed, you must string together many small incremental advances - rather than count on hitting the lottery jackpot once… I have always believed in playing as many hands as possible, as intelligently as I can, and taking the best of what comes my way. Every significant advance I or my company has ever made has been evolutionary rather than revolutionary: small earned steps - not big lucky hits.”

Training

“Our company builds employees: Constant training, retraining, coaching, and instruction from on-staff, full-time experts increase everyone's worth.”

Promotion from Within

“Almost all our management is ‘homegrown.’"

“Our company creates opportunities: Management that's promoted from within, transfers to other offices around the world, and chances to move to new areas make us different.”

Low Turnover

“We have phenomenally low turnover for a company employing many young programmers, salespeople, and reporters, and we attract a pretty diverse labor force.”

Remove Hierarchy

“We have no reserved parking spaces for senior executives. If you want to leave your car right by the door, just come in earlier. Creating class distinctions isn't constructive. That's why I don't believe in executive dining rooms either. The issue isn't fairness. If we constantly remind those people at the bottom that they are not at the top, do you really expect them to be "gung ho" about the company?”

“I've always thought titles are disruptive at best. They separate, create class distinctions, and inhibit communications.”

Diversity

“Having a diverse workforce is required by law in the United States. Having a diverse workforce is also required by capitalism in the marketplace. It increases the likelihood that the next great idea will be born here, not at some other company.”

Cross-Collaboration

“Our reporters aren't alone, our data collectors aren't alone, our programmers aren't alone. In our company, everybody's in one room and works together. The environment we've created at Bloomberg means we don't do anything independently of one another. We have been more successful in news because of that. Our reporters periodically go before our salesforce and justify their journalistic coverage to the people getting feedback from the news story readers. Are the reporters writing stories that customers need or want? Does the depth of a story's coverage matter as much as the speed with which it is disseminated?”

Community

Loyal Customer : Bloomberg User Since 2003

“We should support local causes in every city where we have a branch. It's good for business because it's good for people.”

“We want to be known as a company that not only takes care of our employees, but is also generous to our community. It all helps the bottom line. Companies that don't understand that don't do as well as they could. Give something back and you'll wind up with more!”

Philanthropy

“Don't spoil your family. After you've worked for a lifetime, your legacy shouldn't be strife, anguish, and heartbreak, particularly for those you love. Leave them enough to have a crutch in hard times, a boost in good ones, and fond remembrances for the rest of their lives… Give most of your wealth to charity!”

“How much should you carve out first for your loved ones? Do you really want to eliminate the need for them to work as hard as you did? Do you really want your children to be like those who thought themselves your betters while you struggled? Letting them have too much money is really a lot worse than letting them have too little. I've watched family after family destroyed by excessive distributions to descendants, and by family patriarchs' and matriarchs' attempts to be able to control others' behavior from the grave. With wealth comes power. With power comes the ability to damage. Gifts and inheritances influence those you love most. Inheriting too much money at one time destroys initiative, distorts reality, and breeds arrogance. When the money runs out-as it always does-those left bereft of cash can't cope. And having money with ‘strings attached’ often creates unintended and perverse distortions in behavior.”

“If we make the gifts (or at least the commitments) when we're still around, we can get the greatest satisfaction available for cash today, watching the process of helping others unfold.”

Summary

Bloomberg's remarkable success story is a compelling case study. Michael Bloomberg's ability to transform a modest $300,000 investment into a multi-billion-dollar empire, all while keeping the company privately owned, stands as a testament to his exceptional business acumen, philosophy and scalable business model. This story holds invaluable lessons for entrepreneurs, investors, and managers alike.

As highlighted by Li Lu, the importance of studying such successful enterprises cannot be understated, serving as a playbook for identifying outstanding investments. Bloomberg consistently ranks among the top private corporations acknowledged by Investment Masters as deserving of in-depth analysis. Although financial information services may seem worlds apart from the rental car businesses, fast-food chains, or uniform cleaning services we’ve studied, it's striking how the underlying business philosophies of these industry leaders often mirror one another.

If you’re wondering what most of the great investors and traders have in common, even Berkshire, it’s a Bloomberg terminal. I expect to remain a loyal customer in the years to come.

Sources:

‘Bloomberg by Bloomberg,’ Michael Bloomberg, Wiley, 2001.

‘Bloomberg is contemplating life without its founder,’ FT Magazine, Robin Wigglesworth, April 2023.

‘Li Lu Lecture - Columbia Business School,’ 2006. [Bloomberg comments - see from 1 hr 25 mins.]

Follow us on Twitter : @mastersinvest

* Visit the Blog Archive *

TERMS OF USE: DISCLAIMER