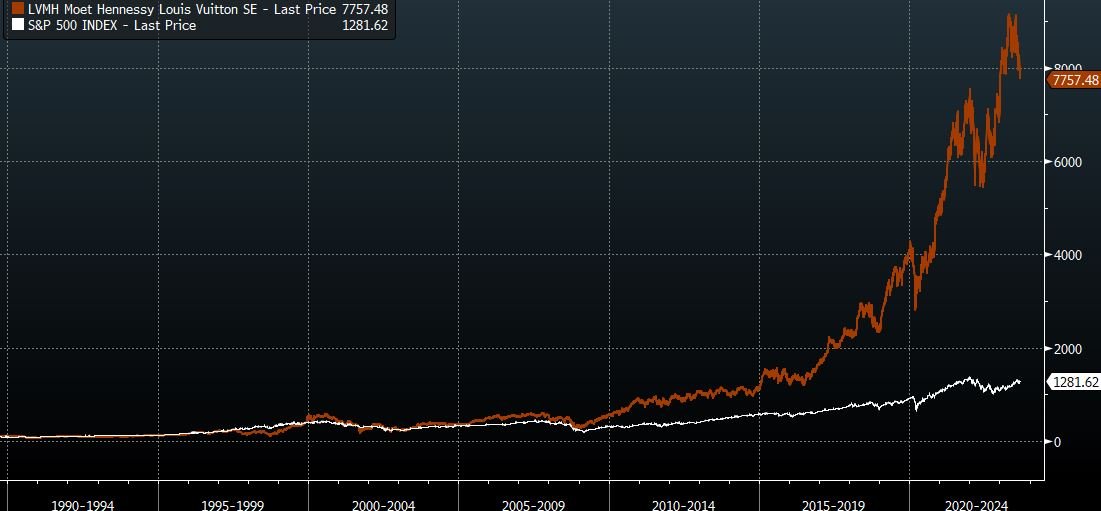

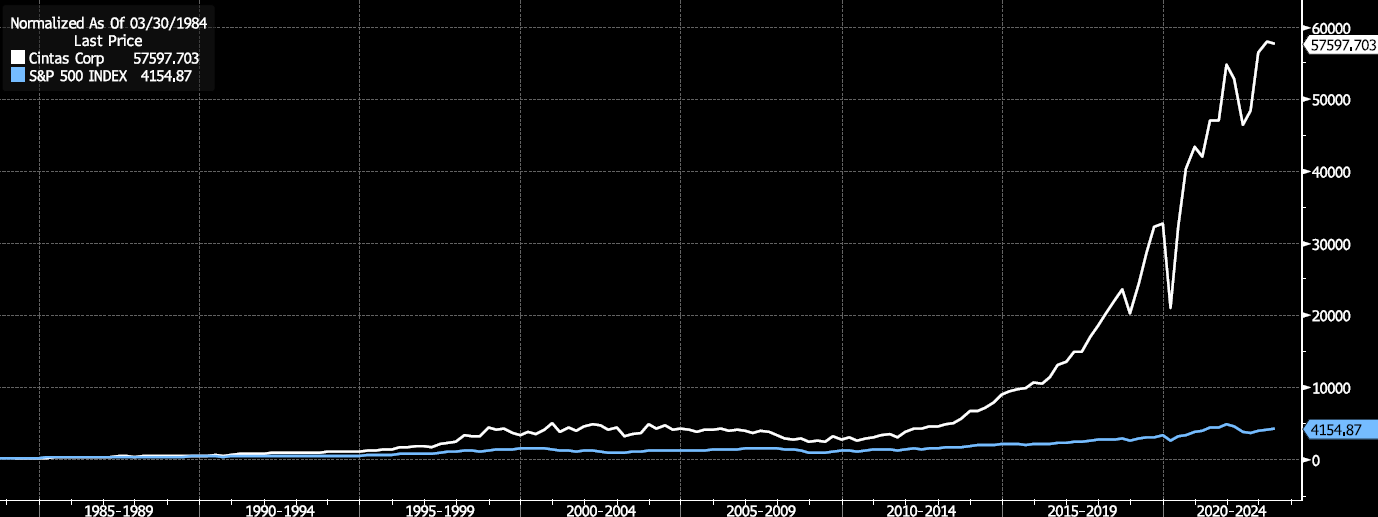

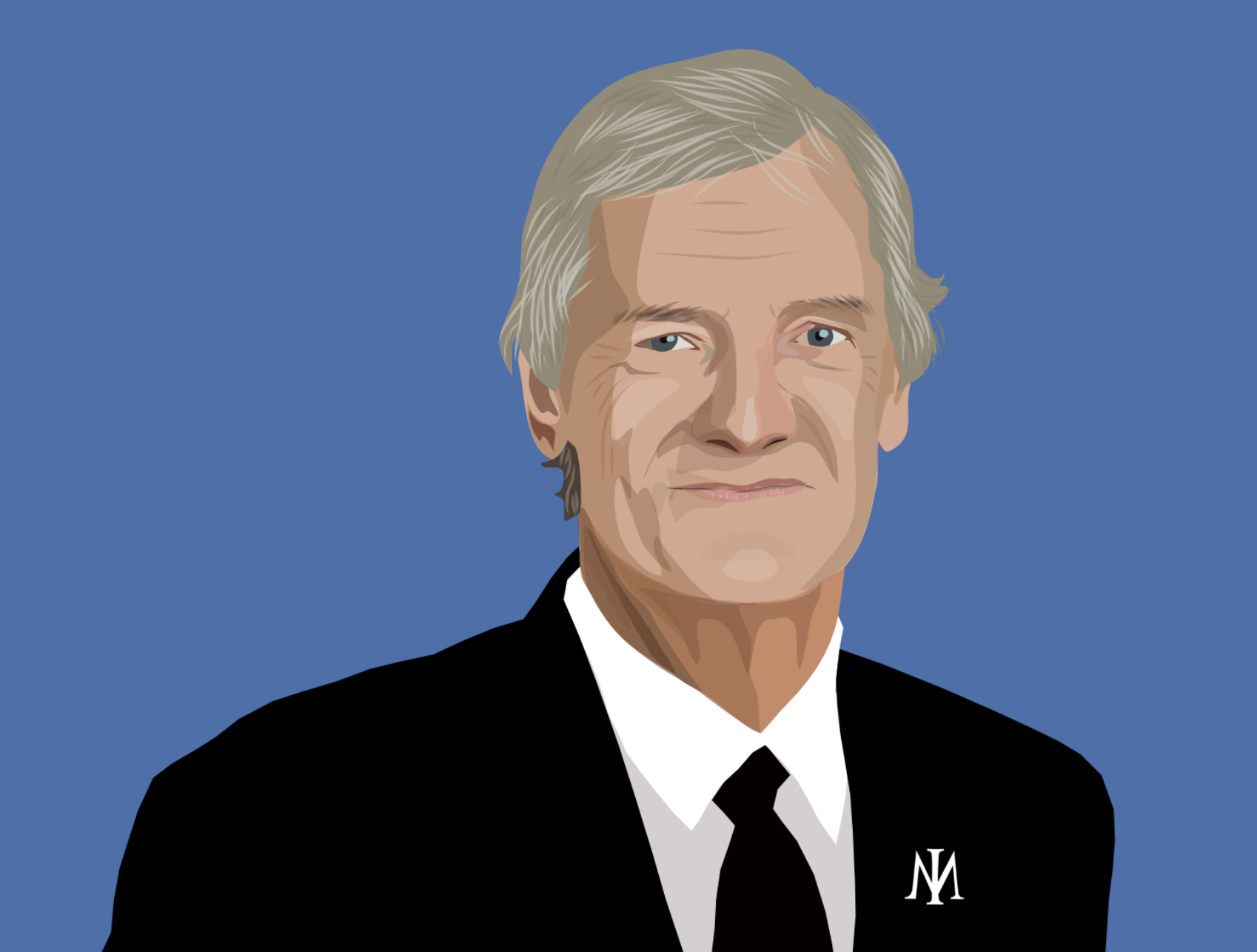

Bernard Arnault, the visionary architect behind LVMH, has not only shaped a global luxury empire but has also graciously shared profound business insights. His unwavering dedication to the long-term stewardship of luxury brands has been instrumental in his extraordinary success. Since 1989, LVMH has delivered an impressive 16.4% annualized return compared to the S&P 500's 7.4% annual return, underscoring the enduring impact of visionary leadership.

Arnault's steadfast belief in acquiring and nurturing ‘star brands’ like Dior, Louis Vuitton, Moët & Chandon, Hublot, Givenchy, Dom Pérignon, Tiffany’s, Bulgari and others is a hallmark of his strategy. These brands, spanning the realms of luxury wine and spirits, leather goods, fashion, cosmetics, watches, and jewelry across continents, not only offer geographic diversification but also serve as economic stabilizers during turbulent times. The substantial cash flows generated by these established brands provide LVMH with the stability and resources to foster emerging brands for the future.

Central to LVMH's accomplishments are principles shared with other successful businesses: decentralized decision-making, employee empowerment, and an unwavering commitment to uncompromising quality. Arnault's leadership embodies the conviction that profitability is an organic result of excellence in all aspects of business.

LVMH vs S&P500 1989-2023 [Source: Bloomberg]

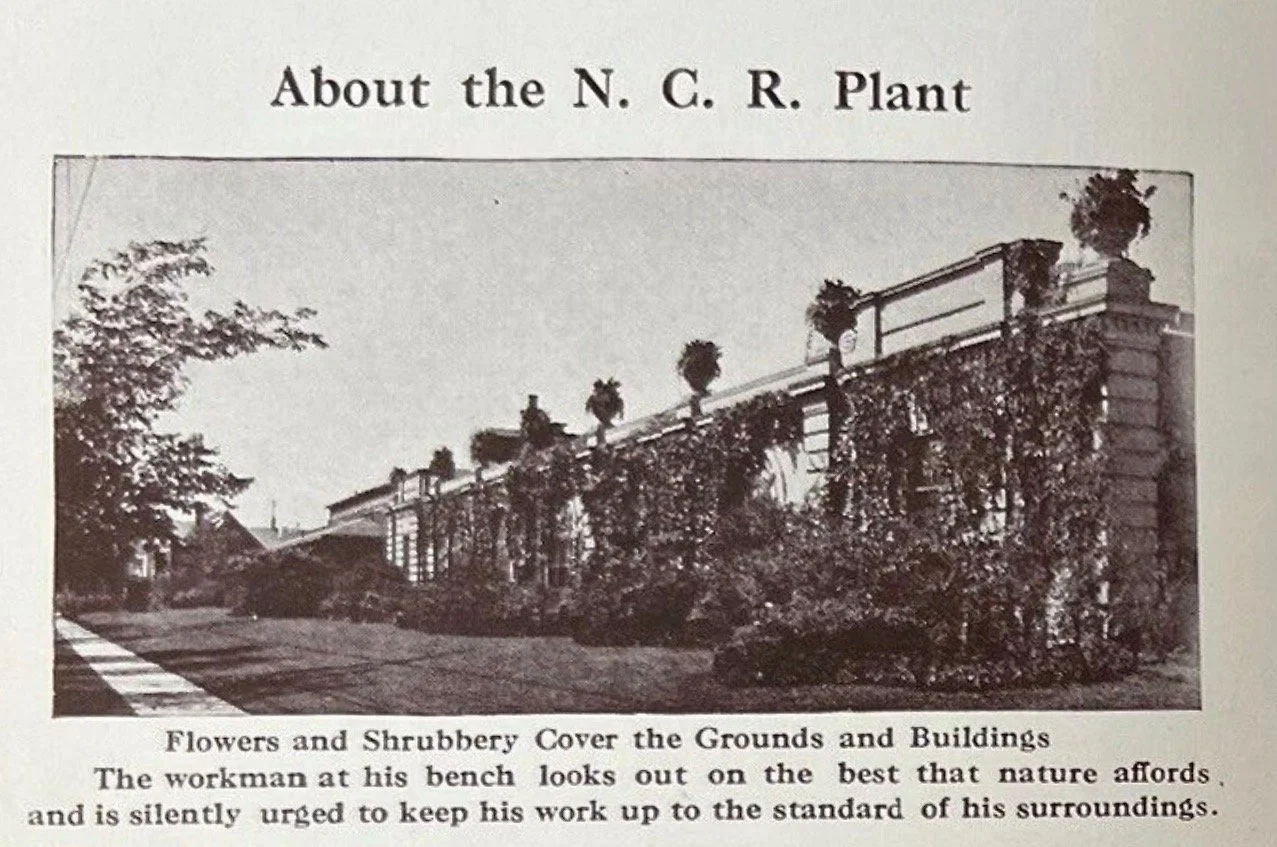

Arnault's emphasis on the long-term perspective, facilitated by his significant ownership stake, has empowered LVMH to adopt a patient and forward-thinking approach.

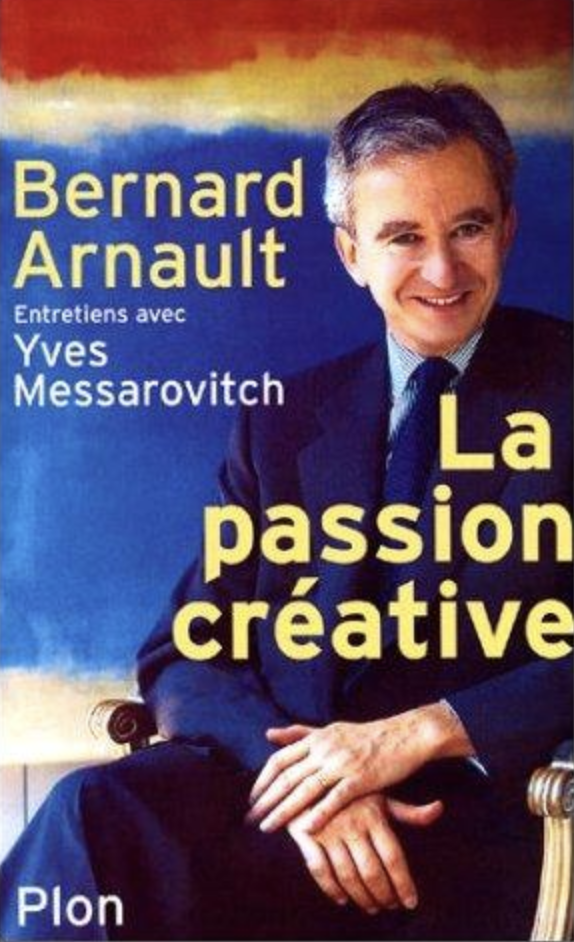

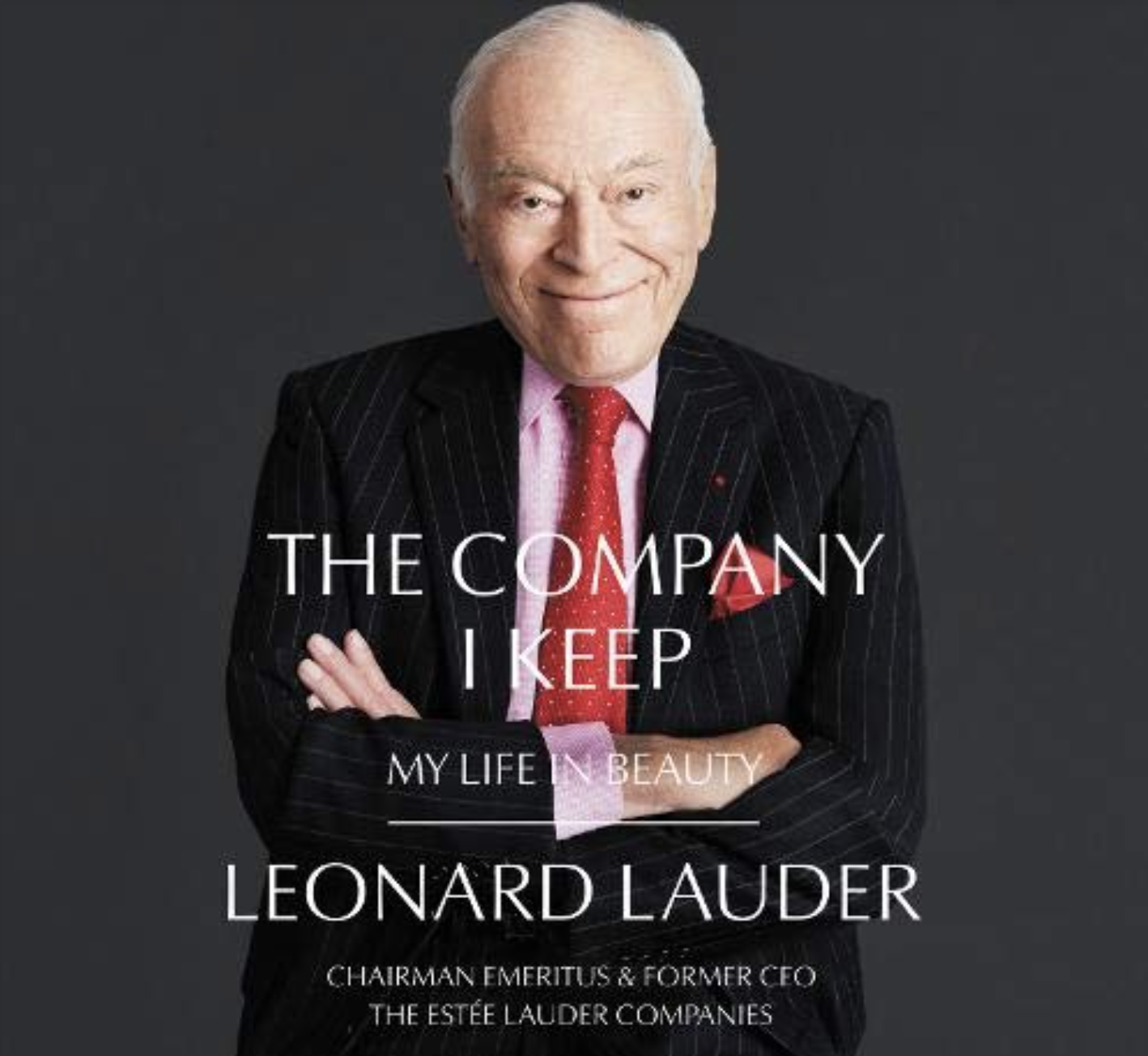

Over the decades, LVMH has curated an unparalleled collection of luxury brands which are poised to transcend generations. I recently enjoyed reading the book of interviews with Bernard Arnault titled 'La Passion créative,' where he shares his wisdom and vision for the world of luxury. Below, you'll find a compilation of my favorite extracts, peppered with Arnault's candid take on the stock market, along with a selection of quotes from separate interviews and LVMH Chairman’s letters.

Ordinary People doing Extraordinary Things

“To succeed in economic life, it is not enough to be intelligent. What is necessary is to combine intellectual abilities with solid common sense, a taste for the concrete, and above all a sense of leadership, the ability to lead high-level teams. As one of my professors told me, to make a company sublime, you have to be able to have ordinary people do extraordinary things.”

Obliquity

“Success, for an entrepreneur, is leading a company that develops, that gains market share, that manages to bring together a team. This is what has always stimulated me, more than the strictly material aspect.”

“Money has never been, in my eyes, an objective or even an indicator of any significance.. Investing in a company has a meaning for me that completely transcends the material, it means investing in a team & doing everything so that this team comes out on top.”

Bernard Arnault - 2022 LVMH Annual Report

“Profit is a consequence of what we do well; it should never become a goal.”

“Money is just a consequence. I always say to my team, don’t worry too much about profitability. If you do your job well, the profitability will come.”

Aligned Interests

“I am in favor of employee shareholdings. We are in a period of truly exceptional economic growth. Involve employees in growth by allowing them to purchase seems to me essential for social consensus and the motivation of company personnel.”

Competitive Advantages

“The brands created in the US are, for some, very strong. Their success took twenty years, that is to say a generation. Certainly, some of them are fantastic brands. But they do not have the mythical dimension that Dior or Louis Vuitton have - these have a history the Americans don't have.”

‘La Passion créative,’ Plon 2000.

“The formation of (our) group makes it possible to rely on classic operational synergies which offer significant economies of scale (legal services, accounting services, logistics problems, etc.) to manage the whole in an economical and rational manner in order to lower costs… Synergies also work upstream on purchases of certain products, as well as on advertising. Our group has become the world's leading buyer of advertising in the luxury sector, which allows us to obtain preferential rates.”

“We saw straight away LVMH was unique in the world with “absolute star" brands from which we could build the first luxury group on the planet, capable of going through all [financial and economic] conditions. Create high-quality items, sell them worldwide through a constantly evolving network of stores.”

“Indeed, building a luxury group, in my opinion, can only be done around companies that are “real economic luxury stars.” For a brand to have this status, it needs three characteristics: timelessness, exceptional cash flow, solid growth over a very long period. The number of global brands fulfilling these characteristics can be counted on the fingers of one hand; Cartier, Louis Vuitton, Dom Pérignon, are among them. They alone can justify the creation of a real group around them.”

“The group's star brands, the strongest and which have substantial and recurring cash flow, make it possible to finance those which are growing. It is this notion of shared benefits that provides the key to our success.”

“I can assure you that we will be drinking Dom Pérignon in a century; I will not say the same of certain brands of fashion, even if they are in vogue today. This stability allows our group to get through periods of crisis better than others.”

“The inherent synergies as well as the economically and geographically balanced cyclicality of our activities are irreplaceable competitive strengths.”

“Mastering the paradox of star brands is very difficult and rare, fortunately.”

“Our products have unbelievably high quality; they have to. But their production is organized in such a way that we also have unbelievably high productivity. The atelier is a place of amazing discipline and rigor. Every single motion, every step of every process, is carefully planned with the most modern and complete engineering technology. It’s not unlike how cars are made in the most modern factories. We analyze how to make each part of the product, where to buy each component, where to find the best leather at the best price, what treatment it should receive. A single purse can have up to 1,000 manufacturing tasks, and we plan each and every one. In that way, the LVMH production process is the exact opposite of its creative process, which is so freewheeling and chaotic.”

Owner Shareholder & Family Culture

“LVMH is a group with a family spirit.”

“Risk-taking is, for an entrepreneur, like breathing, necessary to life and sometimes to survival. It is, moreover, the opportunity for adventures to be shared in the four corners of the world with teams, which vibrate all the more as the stakes and the risks increase. In addition, when you are a manager-owner, you are really associated with all the shareholders who buy your shares on the stock market; your vision is strongly influenced by this association; there are transactions, mergers, costly acquisitions, which a pure manager will do, convinced, of course, that it is in the interest of his company, but which you will consider from another angle as as majority shareholder. Will I make this move the same way a pure manager does by playing with my own money? Probably not always. I think it must be reassuring for the shareholders of a group like LVMH to have an owner at the helm.”

Continuous Improvement

“All executives, all leaders of the group have and must have this constant concern in order to progress. Somewhere, we are permanently dissatisfied with what we do. I believe there is nothing worse than complacency. As soon as we believe we have arrived, that we are the best, it is the beginning of the end.”

“There is nothing worse than taking a situation for granted. It is from constant questioning that progress is born. Which sometimes leads to difficult discussions. The temptation to be complacent always exists, especially when you are a world leader. But you have to improve every day.”

LVMH Annual Report 2022

“I think, in a business which is successful, as [is each] business, I always say to my team, you should be thinking that the worst is coming. And you should never be satisfied. And you should always be frightened. In a way, state of mind is to be positive paranoid.”

Integrity

“The first principle is never to lie, which is very important in business where transparency is essential, even decisive.”

Confederation of Companies

“There is no limit to (our) size. The problem is not there. Our businesses are run like family businesses, independently, and that's why they succeed. Some groups are formed here or there and try to manage in a much more central way in terms of organization or creation. I think they will have many difficulties. For what ? Because success comes, in this type of business, from the size which must remain relatively modest, thus making it possible to have direct, permanent, personal contact with the products, the teams and the craftsmen. This can only work in an organization totally decentralized.”

“Today, we have a total of forty-one companies, each independent. If we have forty-five or fifty tomorrow, it will make no difference in our system since each company lives independently of the others. Our control method does not risk saturation.”

“Our company is both a large group and a federation of medium-sized companies.”

“At LVMH, we have a philosophy. A certain number of fundamental axes which govern the general strategy of all of our houses and which I can summarize. There are five: product quality, creativity, image, entrepreneurial spirit and, finally, the desire to constantly challenge oneself and be the best. This is what underlies the general philosophy of the group.”

Spirit of Entrepreneurship

“We want to federate a team of entrepreneurs, which includes all managers. With a permanent concern for dynamism, efficiency, motivation and complete attachment to a brand as if these companies were individual and not part of a larger group. This is part of the group's philosophy and this is how we manage to recruit talents who are real entrepreneurs. This also applies to creators. John Galliano has stock options indexed to the performance of Dior.”

“The entrepreneurial spirit, as opposed to the bureaucratic spirit that reigns in certain groups, is really present. It is a group of entrepreneurs.”

Decentralisation

“What seems perfectly useless to me, is what certain large industrial groups have done for years - strategic plans, developed at central level which are imposed on the subsidiaries. That's not how we operate at all. This centralizing approach destroys the entrepreneurial spirit.”

“Our decentralized organization fosters a spirit of enterprise and also, therefore, reactivity - an essential quality in periods of uncertainty.”

“The responsiveness afforded by our decentralized structure is one of our key strengths. This is what enables us to remain close to the markets and stay abreast of new developments as they occur. This is what gives us the flexibility to make good decisions fast and then seize every opportunity to increase our market share by meticulously implementing those decisions on the ground.”

“[Our company is so] decentralized. Each brand very much runs itself, headed by its own artistic director.”

People Constraint

“Precisely, the fact that we are not centralized but rather a federation of SMEs does not set a limit to our size. The real problem is talent. It is vital to recruit men & women of great talent. Finding them, motivating them, retaining them, working for a long time with men and women of great talent: this is where the key to success lies. This is not a size issue per se.”

Empowerment

“We are pleased to have welcomed over 145,000 visitors to our workshops, allowing them to discover some of the treasures of our heritage and the virtuosity of our artisans, to attend fascinating talks and demonstrations given by creative team members, even acquiring hands-on experience in some of the techniques used in our professions.”

Quality

“Let's start with the quality. A company like ours, listed, transparent and large, gives us all the means necessary to ensure the very high quality of our products. It is a constant priority, no matter what. The fact that a family business one day joins the LVMH group does not change anything, quite the contrary, in the demand for quality.”

“A lot of companies talk about quality, but if you want your brand to be timeless, you have to be a fanatic about it. Before we launch a Louis Vuitton suitcase, for example, we put it in a torture machine, where it is opened and closed five times per minute for three weeks. And that is not all—it is thrown, and shaken, and crushed. You would laugh if you saw what we do, but that is how you build something that becomes an heirloom.”

Tenure

“Quality also comes from hiring very dedicated people and then keeping them for a long time. We try to keep the people at the brands, especially the artisans—the seam-stresses and other people who make the products—because they have the brand in their bones—its history, its meaning. At the stores, too, many of the salespeople have the brand in their bones. Most companies clean house when they acquire a new brand. We don’t do that because we have found it hurts quality terribly. When you clean house, you usher out the people who respect the brand the most and who contribute to its longevity—its timelessness, its authenticity.”

Luxury Brands

“The problem posed today by external growth with well-known brands is the amount of investment: the business world recognizes the value of luxury brands and values them much more than it about ten years ago. We saw it again recently in a case of watches sold by the Mannesmann group, the prices have become very exaggerated, astronomical. This is where the limit to external growth lies. Also, the strategy that we must prioritize consists in allocating significant resources to young brands, even very young ones, that we have created or taken over, to develop them over time instead of overpaying for acquisitions. This is all the more consistent as we have the most formidable portfolio of brands in the world. We must therefore build the future on the second or third horizon rather than on the first. For example, we bought very young cosmetics brands in the United States (Bliss, Hard Candy, Benefit, Urban Decay, Fresh). They are very connected, and they offer strong growth rates of around 50% to 80% per year, or even more. If some of them confirm this dizzying journey over the next ten years, then we will have made a fantastic investment. Ten years ago it was completely different. The brands were much cheaper, and it was therefore easier to invest. We must now proceed differently.”

Source: LVMH Annual Report 2022

“We cannot be satisfied with simple style exercises! This is where the main difficulty lay, for a time. Lacroix sometimes said: “It’s wonderful, I work for a patron.” But LVMH does not aim to be just a patron! To ensure sustainability, economic results must be there. I think that Christian Lacroix has now made this reflection his own… Christian Lacroix was also, for years, not sufficiently interested in the sale of his products. Since then it has evolved. He now knows that true success is necessarily commercial and that success with fashion critics is good, but it's not enough. To meet the support of customers, the company must be able to count on the total commitment of its creator.”

“The creativity of Galliano, who expresses himself for Dior, is sometimes shocking, it's true. But if it did not shock, it would be because this creativity would be sanitized. It is not the goal. On the contrary, it is about pushing ideas to the extreme, revealing them, and then deriving commercial results from them.”

“Our whole business is based on giving our artists and designers complete freedom to invent without limits.”

“We have correspondents who keep abreast of the trends emerging in the various markets. We are watching this carefully to stay connected. We watch what our competitors are doing around the world. We monitor new creators who are in contact of young people's lives, which allows us to anticipate. Even if, sometimes, we discover phenomena that we had not anticipated.”

“Some brands out there will make it to stardom. But their managers cannot be in a hurry. It takes time. But once you get the elements of a star brand aligned, they last for a long time. They stay and stay, and they deserve to.”

Keep it Simple

“I don't like spending more time than necessary on one subject. Just as I don't like receiving stringy thirty-page notes. A good note is one or two pages long. Beyond that, everything becomes confused and it is useless. Especially when you receive about fifty a day.”

Retail Insights

“Retail sales represent a large part of our activity, in Vuitton, Dior or Sephora stores, among others. And the word of this American entrepreneur is right, who said “retail is detail”. This is very true in trade and even more so in luxury products. Every element, no matter how small, has an impact on customers. The sale, the design of the stores, their aesthetics have always interested me. So when I go into the stores, I think I see right away what's right and what's wrong. When I think it's good I say it, and when I think it's wrong, I say it too.”

“Our group likes to sell its products without intermediaries.”

“If you control your factories, you control your quality; if you control your distribution you control your image.”

“I'm not sure that, in this profession, we are really competitors. We are when it comes to buying some business, but not in terms of customers. When a Louis Vuitton store sets up next to a Prada store or a Gucci store, both benefit. It is therefore no coincidence that all these luxury boutiques are generally located in the same places. In fact, the more prestigious brands are concentrated on the same site, the better they work. The notion of competition in luxury is very specific.”

Walk the Floors

“Don’t go to the offices too much. Stay on the ground with the customer or with the designers as they work. I visit stores every week. I always look for the store managers. I want to see them on the ground, not in their offices doing paper work.”

Scarcity and Social Proof

“[Long lines outside our stores] is not such a bad thing sometimes, because those lines have a way of increasing demand even further.”

Short vs Long Term

“What matters most to me is keeping a firm focus on the long term.”

“We have consistently adhered to a strategy of value and long-term vision which is the life blood of LVMH.”

“In business, I think the most important thing is to position yourself for the long-term and not be too impatient, which I am by nature, and I have to control myself.”

“American companies have other flaws. The main thing, when they are listed on the stock exchange, is to be too tied to quarterly results. However, it is difficult, for a business like ours, to be permanently focused on the current quarter while we are building a brand for the next twenty years. In the United States, this sometimes leads to short-sighted decisions taken to the detriment of the long-term interest of the company.”

“Our corporate values, our global project, “creativity and quality”, will remain the basis of our action and our success. The “creative passion” will be intact in twenty years.”

“Taking a long view – that’s what the LVMH Group is all about.”

“What I have in mind every morning is that the desirability of a brand should be as strong in ten years. It’s really the key to our success.”

Leadership

“To lead, you have to motivate. When you issue a criticism, there must also be somewhere a compliment. Or else you should not keep the person you are talking to. Generally, when you give criticism, you do it to people you enjoy working with and who you find valuable. You know, everyone can be criticized. The boss of a company. It must be done without breaking the motivation, making sure that the criticism stimulates rather than discourages.”

Mistakes

“High level executives have the right to make mistakes, they don't have the right to fail. Mistakes are inevitable, everyone makes them. You have to accept them. These are often very formative experiences. What is not acceptable are repeated mistakes that turn into failure.”

Palchinsky Principle

“The element of uncertainty always exists in a large-scale undertaking like (buying Dior’s parent company). But we had studied, as we always do, the “worst case scenario”. We had invested a very important sum for us, 100 million, but if we had lost it, we would still have survived. This was the maximum risk we could expose ourselves to at the time.”

“Well, we don’t like failures. We try to avoid them. That is why, with many of our new products, we make a limited number. We do not put the entire company at risk by introducing all new products all the time. In any given year, in fact, only 15% of our business comes from the new; the rest comes from traditional, proven products—the classics.”

Marketing

“We must not lose sight of the fact that, in order to sell a product, we must make people dream.”

“Advertising only allows you to sell more of a good product. And to possibly make an exceptional success from a product which, in any case, is exceptional. This is what happened with Dior's latest perfume, “J'adore”. It's an extraordinary global success, and it happens to be a fantastic product. Everything is successful in this perfume: the name, the juice, the bottle, the advertising, the packaging... We invested a lot and the result is there. But the same advertising effort carried out for another less promising product would not have given the same results. Fortunately, anyway. It would be too easy. If it were enough to spend on advertising to make a product work, it would be known.”

“If you associate a product, whose strong personality you want to praise, and a well-known actress who does not appear sufficiently in tune with this product, then you risk being disappointed. It will work less well than with a more anonymous model.”

“All modes of communication between the brand and its customers are important, whether advertising, the press or the presentation of products. The boutique plays a key role in this, as does the way in which the sales assistants are in contact with the customers. All this maintains the image and we take care of it like the apple of our eye.”

“Most companies think it is enough to use advertising to present a picture of the product. That’s not enough. You need to project the image of the brand itself.”

“The last thing you should do is assign advertising to your marketing department. If you do that, you lose the proximity between the designers and the message to the marketplace. At LVMH, we keep the advertising right inside the design team.”

Innovation

“Innovation is at the heart of our strategy.”

“In each of its businesses, LVMH embodies innovation. In cosmetics, for example, 20% of turnover is achieved thanks to products that did not exist the previous year. It is therefore necessary to create, but also to register the novelty in line with a given brand. Louis Vuitton is very modern, but at the same time it's Vuitton; even when we see the new products, we think of traveling by ocean liner!”

Small Headquarters

“Central headquarters in Paris is very small, especially for a company with 54,000 employees and 1,300 stores around the world. There are only 250 of us.”

Execution

“When something has to be done, do it! In France we are full of good ideas, but we rarely put them into practice.”

“You need ideas but the idea is just 20%. Execution is 80%”

Training

“If you walk into a Vuitton factory, you will see very few machines. Almost every piece is made by hand. Usually, piecework is the most inefficient operating system in the world, but for us it is different because we give our craftsmen and women fantastic training. They are trained for months before they touch the products, and then, every task they do has been studied and refined for many years, so we know precisely how to arrange the atelier. No moment or motion is wasted in there. And that allows us to offer a very high quality product at a cost that makes our business very profitable.”

Stock Market Advice

“I find the short-term recommendations of analysts or banks extremely presumptuous and often very inaccurate.”

“I fundamentally believe that, to succeed in stock market investments, you have to have a long-term vision, be interested in companies and not in business sectors, invest in a company because you believe in its management and because the courses seem interesting. Then, for two or three years, you no longer have to look at the stock market. Otherwise you are speculating and above all you get angry, because it is very rare for the company's share price to rise after your investment. In the medium term, you should normally win, whatever the general development, if you bet on the right company. Even when the stock market trend is not good, you find companies that are making progress. It seems to me that this is the best way to invest. If, on the other hand, you follow the technique of the managers who buy Danone in September, sell it in November to buy Nestlé, you will see that in the end all this tends to bring commissions to the broker rather than to enrich you.”

Capitalism

“Capitalism remains the best system for sharing progress in daily reality. Private companies are best placed by their growth, their vitality, their speed of adaptation in the face of novelty, to translate concretely what progress brings to humanity, technical progress in particular. It is freedom to undertake, economic freedom which are the vehicles of progress today.”

Summary

LVMH's extraordinary success is undeniably indebted to the exceptional abilities of one man—Bernard Arnault. His strategic prowess in acquisitions, profound business acumen, and unyielding devotion to the business have been instrumental. Arnault has impeccably honed the delicate art of balancing commerciality with the artistic independence of designers and the ever-evolving desires of luxury consumers.

Learning from Bernard Arnault transcends the confines of luxury, offering invaluable business wisdom. With over three decades at the helm of LVMH, Arnault's unwavering commitment to a long-term vision, his relentless pursuit of quality, and his dedication to empowering employees illuminate the path for entrepreneurs and business leaders. Diligent control over the production and distribution of luxury goods preserves the highest standards, while harnessing the momentum of global affluence has fortified LVMH's revenue streams. The diverse portfolio of brands and businesses spanning various luxury segments and geographic regions positions the company to adeptly navigate economic fluctuations and invest in a prosperous future.

Yet, even a visionary like Arnault cannot single-handedly steer a company to greatness. Arnault heeded his professor's sagacious counsel: a genuinely sublime company arises when ordinary individuals are empowered to achieve extraordinary feats—an ethos that brilliantly radiates throughout LVMH.

Sources:

‘La Passion créative,’ Bernard Arnault interviews with Yves Messarovitch. Plon 2000.

[Translated from French]

‘The Perfect Paradox of Star Brands: An Interview with Bernard Arnault of LVMH,’ Suzy Wetlaufer, HBR. 2001.

‘The $100 Billion Man: How Bernard Arnault Stitched Together The World’s Third Biggest Fortune,’ Susan Adams, Forbes. 2019.

Further Reading:

‘How Bernard Arnault became the world’s richest person. The lord of luxury is a model European capitalist—but with American characteristics,’ The Economist. December 2022.

Follow us on Twitter : @mastersinvest

* Visit the Blog Archive *

TERMS OF USE: DISCLAIMER

![S Truett Cathy [Source: Chick-fil-A]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1625470889696-3YKLQ7FZUYR7FHDT7U7X/truett-web.jpg)

![Estée Lauder vs SP500 1995-2021 [Source: Bloomberg]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1622953763962-A339S3D8A10QJA6BVXPE/Screen+Shot+2021-06-06+at+2.28.10+pm.png)

![Disney Corporation vs S&P500 - March 2005 to 2021 [Source: Bloomberg]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1613102921408-U4VQK7OGPQ515OR2Y2LI/dischart.JPG)

![COPART Share Price vs S&P500 Normalised [Source: Bloomberg]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1590377897583-CI4565VVKZN2GM15HXZ2/Screen+Shot+2020-05-25+at+1.37.52+pm.png)