The Investing Goal? What Is It?

If you quiz most people regarding their investment ambitions, the answer is likely to be .. "grow my money", or thereabouts. Joe average isn’t striving to beat an index, and he’s certainly not trying to capture ‘attractive risk-adjusted returns’. Quite simply, most people want an adequate nest egg for retirement; which requires the protection and growth of their capital at an attractive rate considering the effects of inflation.

Inverting the question, ‘What is it you want to avoid?’. Common sense would suggest the answer: "not lose my money".

It raises some industry issues…

Relative Returns

The industry is fixated on relative returns. Nowadays, the majority of funds are trying [and mostly failing] to beat an index. The foundation of this strategy is: stock markets generally rise over time, if you make a little more in up periods and lose a little less in down periods [ie. better relative returns], you'll end up with a lot more money compared to investing in an index fund. Those few percentage points of annual outperformance mushroom into significant return differentials as the time horizon expands.

Unfortunately, markets don't always go up. Indices, even mainstream ones, can go for long periods with negative returns. Consider Japan's Nikkei index and America’s S&P500. Having peaked in 1989 at nearly 39,000, the Nikkei’s current level is just 16,700. The S&P500 has spent quite a few ten year periods, and more, without a positive return.

"Investors can lose sight of the fact that the market has gone through long periods when returns were minimal. During the 14 year period from the middle of 1968 to the middle of 1982 the S&P500 appreciated by less than 1% per year.” Lee Ainslie

"Say you were forty-eight years old in 1964 and put $100,000 into the Dow on the last day of 1964 with instructions that dividends be reinvested, confident that you would have a nice nest egg when you retired at age sixty-five. When the last day of 1981 rolled around, your money would be worth statistically less than your initial investment because of a moribund market and the depredations of inflation." Leon Levy

“There have been periods of longer than a decade for which investing in the stock market in expectation of a 7 percent real return turned out to be a devastating mistake. It took the market twenty-five years to regain its levels of 1929.” Andy Redleaf

An index fund or a relative return strategy might not be appropriate for an investor who can’t look ten years or beyond.

While index returns can remain stubbornly low or negative for long periods, most individual investors fail to capture the index return regardless of when they enter the market. Numerous studies highlight most individuals significantly under-perform the index. Downturns scare them out, only do they re-enter once momentum returns; sell low, buy high.

"In 2014, Dalbar released its 20th report QAIB (Quantitative Analysis of Investor Behaviour) and the results for the two decades are very instructive. From 1994 to 2013, the average return of investors in 14 equity funds was 5.02% compared to 9.22% for the S&P 500. Over 20 years, the total return to investors was 166% versus 484% for the S&P 500. This is an astronomical difference. And this shortfall is what might be called a "behavioral penalty." Francois Rochon

In contrast, an index has no emotion, it doesn't get scared out at the bottom. An index rides out the lows.

While relative returns are standard in markets, they may not be aligned to most customer demands. The majority of investors would probably rather a +15% return in a +20% market, than a -15% in a market -20%. Yet, a relative return manager would be deemed more skilful delivering the latter.

“We start with a deep truth, which is that if you were to ask the average portfolio manager, would you rather compound at 14 percent a year and have the market compound at 15 or would you rather compound at four and have the market compound at three? The vast majority might take the latter choice, because they would say, well, my firm will be enormous. We’re the opposite. We would use, A, all day.” Chris Davis

While relative outperformance in a market downturn maybe acceptable, many investors struggle with large losses. Large negative returns, even if they are good on a relative basis, are more likely to scare an investor out of a fund at the exact wrong time.

Asset Allocation

The investment industry derived the ‘Asset Allocation’ process to help individuals achieve their retirement goals. This process states younger investors should have higher exposure to equities, given their higher long term historic returns. As an investor ages, equities exposure should be reduced and replaced with less volatile bonds.

In principle, an increased equity exposure makes sense for younger investors provided funds are regularly added to the account. Remembering, whether you lose 10% in year 1, 10 or 20, if the capital doesn't change, you'll end up with the same amount regardless of when the loss occurred.

Most asset allocation models, while they might adjust for age, make no reference to the relative attractiveness of each asset class. The manager with say, 60% equities exposure, is usually mandated to be fully invested. While she's the resident expert on equities she can't go to cash if suitable investments aren’t available. Her best bet is to buy defensive stocks. Unfortunately in a bear market, even these may not be spared.

“The idea that you say, “I’ve got 60 percent in stocks and 40 percent in bonds,” and then have a big announcement, now we’re moving it to 65/35, as some strategists or whatever they call them in Wall Street do. I mean, that has to be pure nonsense. I mean, 60/40 or 65/30 — it just doesn’t make any sense.” Warren Buffett

The bond manager with a 40% slice of the money has a few options. She can move to shorter duration bonds to help protect the fund from rising rates. But if rates are very low, as they are now, it maybe difficult, or impossible to earn attractive [real &/or nominal] returns. Time has not always been kind to bond investors.

“An individual in a 50% bracket who put money into T-bills or government bonds after World War 2 and kept re-investing in these instruments to 1996, lost the major part of his or her capital” David Dreman

Over the last 30 odd years, the typical 40/60 portfolio has delivered. Bond yields trended lower and equities, though volatile, have trended higher. That’s the rear view mirror. Today’s bond yields are at or near record lows. Bond risk appears more asymmetric; bond yields have little room to fall. They could rise a lot. Low yields no longer provide an attractive income stream. It's return-free risk.

You shouldn’t expect a 40/60 portfolio to deliver returns over the next 10 years that mirror the last 30 years. It’s not likely to happen.

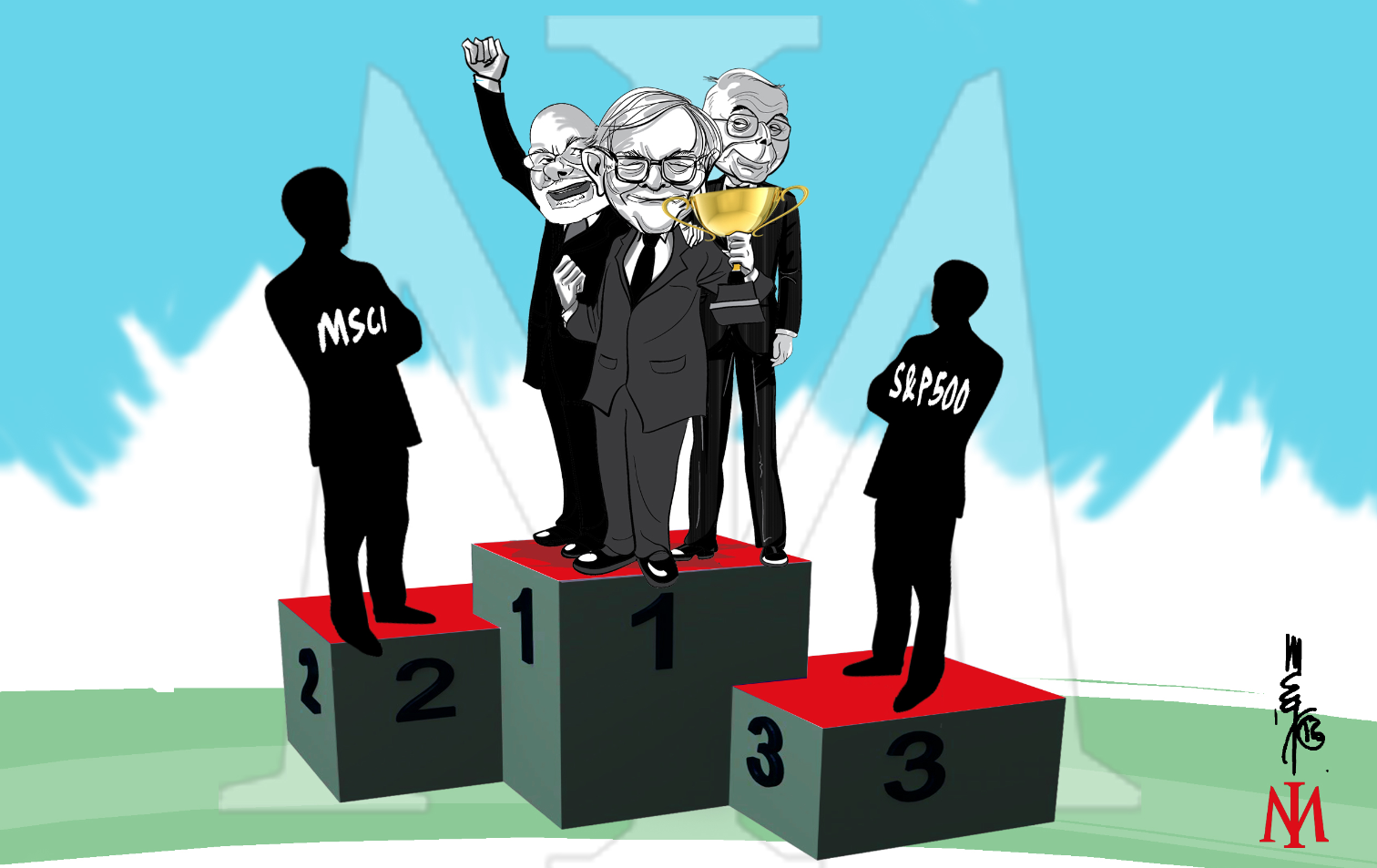

What do the Investment Masters do..

The Investment Masters, unlike most mutual funds, are FIRST trying to preserve capital. Making money comes next. The focus is on absolute, not relative returns; avoiding the permanent loss of capital is paramount.

Index agnosticism combined with an ability to hold cash when opportunities are scarce differentiate durable versus fragile portfolios.

While the Masters portfolios may appear unconventional, they’re often more conservative. Conventional investing doesn’t equate to conservatism. A portfolio's historic performance may provide some colour to it’s conservatism, it can’t fortell the future risk of permanent capital loss; the risk that matters.

The Investment Masters acknowledge the cost of outperforming in down markets will be accompanied by under-performance in bull markets. In the quest for higher long term returns this is a worthy price to pay.

"We have underperformed in ten of our 49 years, with all but one of our shortfalls occurring when the S&P gain exceeded 15%." Warren Buffett

Profits and Losses are Not Symmetrical

Consider the following two investment funds:

Fund A .. loses 50% in year 1, makes 50% in year 2 and then makes 10% in year 3

Fund B.. loses 50% in year 1, gets back to break-even in year 2 and makes 0% in year 3

Which would you prefer?

Fund B should be your preference. You get your money back. Fund A is still down 17.5% at the end of year 3. To get back to break-even, Fund A would have needed to deliver +81.8% in year 2 (not +50%) and then 10% in Year 3.

Is you fund focused on preserving capital? Is your fund focused on outperforming down markets while accepting of some level of under-performance in strong markets?