Of course, its nice to be able to view historical data on a market going back 200 years. The opportunity to review historical performance on that scale doesn't come about that often. But remember, history aside, investing involves outlaying money today in the expectation you will receive more back in the future. And whilst it's true that the stock market has delivered attractive returns in the past, as an investor your returns are determined by the future, not the past. If you think the future will be less prosperous than today, it follows that stock market returns are likely to be less favourable also. So in addition to studying the past, having a general view on what the future might look like is an important foundation for investment. The Investment Master, Li Lu, summed it up nicely...

"In order to understand stock performance in the past 200 years, and the next 20 years, we must be able to understand and explain the basic trajectory of human civilization. Otherwise, it will be hard for us to remain rational when a stock market crash occurs. We will think the world is coming to an end whenever we encounter a crisis similar to that of 2008 and 2009. Predicting the future lies at the heart of investing." Li Lu

The theme of the latest Time magazine, edited by Bill Gates, focuses on the fact the world is getting better. Much better. In the present day we are blessed by an unprecedented level of peaceful co-existence, prosperity and health.

"All families in my upper middle-class neighborhood regularly enjoy a living standard better than that achieved by John D. Rockefeller Sr. at the time of my birth. His unparalleled fortune couldn’t buy what we now take for granted, whether the field is – to name just a few – transportation, entertainment, communication or medical services. Rockefeller certainly had power and fame; he could not, however, live as well as my neighbors now do." Warren Buffett

Despite the growth and prosperity available to us today, many people remain pessimistic. But why? If ingenuity and innovation have delivered prosperity and longer life spans, why do we focus only on the negative? The answer lies in our environment, which is saturated with drama. We are constantly bombarded with bad news—from newspapers, TV shows, and conversations. Bill Gates has pointed out the media's tendency to emphasize the negative, perpetuating a cycle of pessimism.

"So why does it feel like the world is in decline? I think it is partly the nature of news coverage. Bad news arrives as drama, while good news is incremental—and not usually deemed newsworthy. A video of a building on fire generates lots of views, but not many people would click on the headline “Fewer buildings burned down this year.” It’s human nature to zero in on threats: evolution wired us to worry about the animals that want to eat us." Bill Gates

As Gates recognises, in the first instance humans have evolved to feel fear above any other emotion; it's all about survival.. 'noise in the bush, you better run or risk being eaten by a tiger.'

Humans have also evolved to think visually, not in numbers. We are wired to believe more in a story than we are in statistics. Stories carry much more impact, negative stories even more so. Steven Pinker, an American cognitive psychologist and linguist also points out...

“You can’t get an accurate picture of the world by looking at media headlines. The headlines are about things that happen, they’re not about things that don’t happen. As long as the rate of violence hasn’t fallen to zero, there are always going to be enough violent instances to fill the news. And we can lose sight of the vast amounts of the world that are at peace.”

The latest Time edition contains an article entitled, 'Warren Buffett Shares the Secrets to Wealth in America.' Buffett has long espoused the dangers of betting against America. He's not alone. Throughout time, many of the Investment Masters have recognized the same dangers.

"America is America and it’s always wrong to bet against her.” Barton Biggs

"You don't see any Fifth Avenue mansions built by bears." Bernard Baruch

"Who has ever benefited during the past 238 years by betting against America? If you compare our country’s present condition to that existing in 1776, you have to rub your eyes in wonder. In my lifetime alone, real per-capita U.S. output has sextupled. My parents could not have dreamed in 1930 of the world their son would see." Warren Buffett

"One of the things I think that's really important is we should never underestimate the resilience of the US economy. It's very powerful. And no matter how much the politicians try and screw it up, there's an underlying strength there. And I never want to bet against that." David Swenson

“The American spirit is a factor which no quantitative model can properly account for, yet it has been such an important factor throughout our history. My closing comments today are that in the midst of all our problems; do not underestimate the American people.” Chuck Akre 2009

“Yes, for better or for worse, we are faced with cyclical swings in our economy, periodic recessions, and even rare depressions. But American capitalism has demonstrated remarkable resilience, plugging along steadily even as times change, driving growth in earnings and paying dividends that have risen apace over time, in step with our growing economy.” John C Bogle

And despite the negativity that abounds today, over the last few hundred years America has experienced a growth rate unprecedented in the history of mankind.

“It is important to remember, the American system is a six-sigma event like the world has never seen. In the last 100 years America has enjoyed a 7-fold increase in productivity – unprecedented in modern history. What is new and cutting edge in one’s youth is outdated and obsolete by the time one reaches middle age, if not sooner – a development that was unheard of before the mid 1800’s." Allan Mecham

"When we examine the past 200 years, we see a continuous upward trajectory [in US GDP]. If we take a year as the unit of measurement, GDP grew almost every year. This is real, long-term, cumulative and compounding growth... The economic pattern of sustained, long-term compounding growth is a modern phenomenon, which had never previously occurred in the recorded human history of the past 16,000 years." Li Lu

In many ways, the characteristics that make a great country are the same characteristics that define successful companies and investors. After all, a large company is essentially a small society. In previous blogs we've recognised those parallels that exist between great businesses and great investors. And given this, it's worth spending some time understanding how America evolved from an agrarian society to a flourishing modern economy.

It started with free trade and specialization.

"The division of labor is responsible for the world's greatly increased standard of living, despite its huge population growth." Charles Koch

“So long as human exchange and specialisation are allowed to thrive somewhere, then culture evolves whether leaders help it or hinder it, and the result is that prosperity spreads, technology progresses, poverty declines, disease retreats, fecundity falls, happiness increases, violence atrophies, freedom grows, knowledge flourishes, the environment improves and wilderness expands.” Matt Ridley

“It is irrefutable that billions of people around the world, including most Americans, have benefitted from the massive increases in global trade over decades. An ever expanding upward spiral of innovation, entrepreneurship, production, exports, imports and exchange of goods and services has produced massive accretions of wealth, together with billions of new consumers, producers and increasingly skilled workers.” Paul Singer

“Adam Smith identified that when men and women specialize their skills, and also importantly “trade” with one another, the end result is a rise in productivity and standard of living for everyone. In 1817, David Ricardo expanded upon Smith’s work in developing the theory of comparative advantage. What Ricardo proved mathematically, is that if one country has simply a comparative advantage (not even an absolute one), it still is in everyone’s best interest to embrace specialization and free trade. In the end, everyone ends up in a better place. First and foremost, you need free and open trade. It is quite bizarre to see modern day politicians throw caution to the wind and ignore these fundamental tenants of economic science. Time and time again, the fact patterns show that when countries open borders and freely trade, the end result is increased economic prosperity.” Bill Gurley

In addition, America benefited from knowledge sharing.

"In the age of the modern civilisation, the value created by the division of labor and by exchange is further increased because human knowledge can be accumulated. Compared to goods and services, human knowledge is easier to accumulate. Exchanges of ideas often result in a 1+1>4 equation. When different ideas are exchanged, the parties not only retain their own ideas, they also obtain the ideas of others. Moreover, sparks can fly during exchanges, creating entirely new ideas. When ideas are having sex with each other, they become very productive." Li Lu

The US Declaration of Independence provided a constitutional and limited government, whose fundamental goal was to protect property rights and whose legitimacy came from empowerment by the people.

“This country is unique. Why is this country unique? For many different reasons. We have a Constitution put together in a four month period of time by 55 white males who came to Philadelphia. While the constitution has had 27 amendments or so, it has stood the test of time, and over 240 years has become a role model as a way of government to work as it has problems. It has been a stable government and been an incredible opportunity." David Rubenstein

The American Constitution led to political unification; it set the framework for a large unified population. Prior to this, it was medieval China that had led the world in technology, with a long list of major technological firsts including cast iron, the compass, gun powder, paper, and printing. But it lost that position. Jared Diamond, in 'Guns, Germs and Steel,’ posits that once China unified in 221 BC, “No other independent state ever had a chance of arising and persisting for long in China”. However China’s connectedness eventually became a disadvantage, because a major decision by one despot could, and repeatedly did, halt innovation.

This was in contrast to Europe which resisted unification by determined conquerors such as Charlemagne, Napoleon and Hitler. Jared Diamond notes, “even the Roman Empire at its peak never controlled more than half of Europe’s area.” While “Europe’s geographic balkanisation resulted in dozens or hundreds of independent, competing statelets and centres of innovation. If one state did not pursue some particular innovation, another did, forcing neighbouring states to do likewise or else be conquered or left economically behind. Europe’s barriers were sufficient to prevent political unification, but insufficient to halt the spread of technology and ideas.”

Abundent resources and geographic protection certainly provided an economic advantage.

“It might sound silly, but having a ton of land endowed with tons of natural resources buffered from long-time foes by the world’s biggest oceans on both coasts is responsible for more of our prosperity than we think. I don’t know how much. But if you know the history of countries who are just as capable as Americans but have been ravaged by battle every few generations you know how devastating the after-effects of war are, in both infrastructure and culture. Things could change, of course. But it is reasonable to assume America will indefinitely have an economic advantage over other nations because of its structural advantages in geography and natural resources?” Morgan Housel

“America is still the most prosperous nation the world has ever seen. We are blessed with the natural gifts of land; all the food, water and energy we need; the Atlantic and Pacific oceans as natural borders; and wonderful neighbors in Canada and Mexico. And we are blessed with the extraordinary gifts from our Founding Fathers, which are still unequaled: freedom of speech, freedom of religion, freedom of enterprise, the sanctity of the individual, and the promise of equality and opportunity for all. These gifts have led to a bold and dynamic economy – one that nurtures vibrant businesses large and small.” Jamie Dimon

The American Constitution's design was intended to expand and maintain order in the free market, provide freedom of speech, safeguard individual liberties and protects business interests.

“[Throughout history] a large, interconnected population meant faster cumulative invention – a surprising truth even to this day, as Hong Kong and Manhattan islands demonstrate.” Matt Ridley

“An open economy always delivers a more prosperous future. This has been one of America’s chief advantages for several centuries.” Michael Mandel

"Societies are most prosperous when knowledge is most plentiful, accessible, relevant, and inexpensive. These conditions are best bought about by freedom of speech and association, and trade based on mutual gain." Charles Koch

America also offered the prospect of wealth and a new beginning to immigrants. America was unencumbered by social classes, operated with a common language and had an incentive system based on meritocracy.

"America is the great equalizer. You can come from nothing, you can come with no pedigree, you can be the son or daughter of immigrants, and you have the opportunity to be successful. There's no other country that doesn't require some kind of birth heritage, or inheritance, or ingrown advantage. Here, everybody has a shot at being the lead dog." Sam Zell

"America's strengths include [the fact it is a] society that attracts talent from around the world and assimilates them comfortably as Americans; and a language that is the equivalent of an open system that is clearly the lingua franca of the leaders in science, technology, invention, business, education, diplomacy and those who rise to the top of their own societies around the world." Lee Kuan Yew

"Another thing that is unique is we had a melting pot; the country has welcomed people from all over the world and many people have bought different talents. There has also been a sense you can rise from the bottom. Now there is a problem today in income inequality and social mobility, maybe its getting worse. But there is no doubt the American dream is one I believed in. You can, in this country, make a difference. Your life outcome isn’t determined by who you were born to, but what you do on your own merits. No doubt you have a chance to rise up." David Rubenstein

America's open society drives an entrepreneurial culture of risk taking, is accepting of failure, leading to creativity and innovation. Characteristics necessary for companies to succeed also.

"America loves the entrepreneur who failed. I kid you not. Because they will back that person again in a heartbeat. And it’s one of the great things about America; you can fail in America time and time again; it’s a country that forgives. And each time you go through a failure, there’s a valuable life experience you will carry your entire life. I remember some of the early things I did at Citadel where abysmal failures.” Ken Griffin

“It is no exaggeration to say that much of the reason for America’s extraordinary economic greatness is that it has nurtured an environment in which a small entrepreneur can flourish.” Bruce Kovner

"America's asset is, simply risk taking and the use of optionality, this remarkable ability to engage in rational forms of trial and error, with no comparative shame in failing, starting again, and repeating failure. In modern Japan, by contrast, shame comes with failure, which causes people to hide risks under the rug, financial or nuclear, making small benefits while sitting on dynamite, an attitude that strangely contrasts with their traditional respect for fallen heroes and the so-called nobility of failure." Nicholas Nassim Taleb

"What has made the U.S. economy pre-eminent is its entrepreneurial culture. Entrepreneurs and investors alike see risk and failure as natural and necessary for success. When they fail, they pick themselves up and start afresh. The Europeans and the Japanese now have the task of adopting these practices to increase their efficiency and competitiveness. But many American practices go against the grain of the more comfortable and communitarian cultural systems of their own societies - the Japanese with life-long employment for their workers, the Germans with their unions having a say in management under co-determination, and the French with their government supporting the right of unions to pressure business from retrenching, by requiring large compensation to be paid to laid-off workers." Lee Kuan Yew

“It is the ever increasing exchange of ideas that causes the ever-increasing rate of innovation in the modern world.” Matt Ridley

"The wealth of this country over the last 240 years is due to the economic wealth created by entrepreneurs, businesses, skills and talents that have come together to create the envy of the world in various parts of our country - Silicon Valley and Wall Street.” David Rubenstein

And the future looks bright. The characteristics that contributed to the America's success remain it's competitive advantage.

"The US has endured all kinds of difficulties in the past and ultimately prospered – I believe the future will be similar." Allan Mecham

"Human potential is far from exhausted, and the American system for unleashing that potential – a system that has worked wonders for over two centuries despite frequent interruptions for recessions and even a Civil War – remains alive and effective." Warren Buffett

"The dynamism embedded in our market economy will continue to work its magic. Gains won’t come in a smooth or uninterrupted manner; they never have. And we will regularly grumble about our government. But, most assuredly, America’s best days lie ahead." Warren Buffett

“The same factors that have served the U.S. well in the past are the same that factors I believe will lead us to future prosperity, namely: 1) America is the home of the entrepreneur. 2) The U.S. is the most open/flexible society the world has ever seen. 3) The brightest minds from around the world dream of coming to the U.S. 4) English is the universal language. 5) Americanization remains a powerful and growing — albeit often resented — economic and social trend globally. (To quote my friend, the advertising/marketing giant WPP Group’s CEO, Sir Martin Sorrell, ‘‘Globalization’ is a misnomer. The better word is ‘Americanization.)’’ Shad Rowe

With the advent and broad-scale adoption of the internet, America and the world are on the cusp of a potential massive leap in productive potential. The world has never been so connected.

“Human cultural progress is a collective enterprise and it needs a dense collective brain.” Matt Ridley

“The secret of the modern world is its gigantic inter-connectedness.” Matt Ridley

“Every generation has perceived the limits of growth that finite resources and undesirable side effects would pose if no new recipes or ideas were discovered. And every generation has under-estimated the potential for finding new recipes and ideas. We consistently fail to grasp how many ideas remain to be discovered.” Paul Romer

“There is not even a theoretical possibility of exhausting the supply of ideas, discoveries and inventions. This is the biggest cause for all my optimism.” Matt Ridley

“It will be hard to snuff out the flame of innovation because it is such an evolutionary, bottom-up, phenomenon in such a networked world.” Matt Ridley

The potential of new technologies is far from exhausted..

"With the arrival of powerful new technologies, we stand on the verge of a productivity boom. Just as networking computers accelerated productivity and growth in the 1990s, innovations in mobility, sensors, analytics, and artificial intelligence promise to quicken the pace of growth and create myriad new opportunities for innovators, entrepreneurs, and consumers." Michael Mandel

While America's best days no doubt lie ahead, foreign governments need to adapt to promote creativity, innovation and productivity. It's little wonder the powerhouses of the last 20 years like Amazon, Facebook and Google have all developed in the US.

“When you have freedom of speech and freedom of expression and don’t get thrown in jail by criticizing a bad idea, it’s more likely bad ideas will get exposed, and it’s not a coincidence oppressive regimes are also oppressive in clamping down on free speech.” Steven Pinker

"Societies with beneficial incentives - those that reward creating the most value in society - have tended to enjoy the greatest and most widespread well-being. Societies with perverse incentives have suffered from waste and corruption, and the vast majority of their citizens have languished in poverty." Charles Koch

“When you have ideas being brought together and people debating them and arguing over them, bad ideas tend to get filtered out.” Steven Pinker

"China will inevitably catch up to the US in absolute GDP. But its creativity may never match America's, because its culture does not permit a free exchange and contest of ideas. How else to explain how a country with four times as many people as America and presumably four times as many talented people not come up with technological breakthroughs?" Lee Kuan Yew

“A nationalised industry stagnates: monopoly rewards caution and discourages experiment, the income is gradually captured by the interests of the producers at the expense of the interests of consumers and so on. The list of innovations achieved by the pharaohs is as thin as the list of innovations achieved by British Rail or the US Postal Service.” Matt Ridley

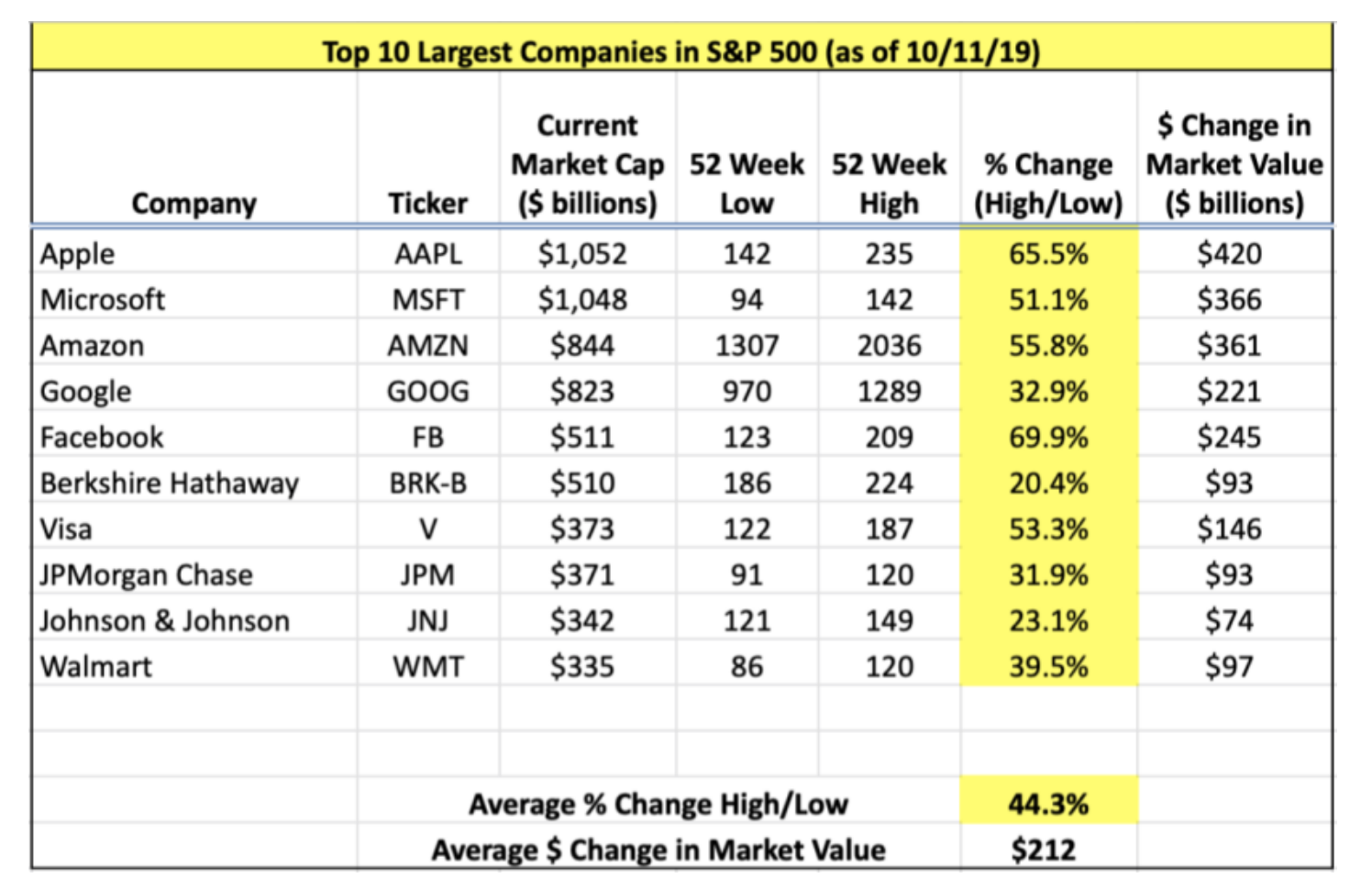

It's little wonder, most of the Investment Masters either don't short or they run long-biased portfolios. They also focus on stocks, not bonds [That's a post for another time!].

"We're always long. You guys should know one thing: the markets go up over time. If you try to play the short game at the wrong time, you'll lose money. You don't want to be short markets over a long period of time." Craig Effron

"The 9.5% long term upward bias of the stock market is one reason that shorting stocks generally is a bad business." Ed Wachenheim

"[We] maintain net long exposure typically between 30% and 60%.…. Shorting is more challenging for several reasons, one of which is that the market tends to appreciate over time." Lee Ainslee

“In practice, we have more long exposure than short exposure... the market tends to rise over time and we wish to participate. It is psychologically challenging to manage a portfolio that outperforms only a falling market, I have no desire to spend my life hoping for a market crash.” David Einhorn

"The economy overall has been really growing at a compounding rate for 200-300 years, ever since the modern science technology era. So, naturally, the economic trend favors long positions rather than short." Li Lu

“We are always long-biased, such that our long exposure is typically at least three times our short exposure." Zeke Ashton

So why is betting against America likely to prove a dumb trade?

Despite the numerous challenges that America has faced, it consistently demonstrates resilience. Much like the legendary Phoenix, it repeatedly emerges stronger from adversity. Beyond the apparent drama and negativity, one can discern the nation's enduring industriousness and innovative spirit, which define its success. With over 200 years of outstanding performance, and the best years yet to come, it is hard to even contemplate placing a long term bet against those odds.

Further Reading:

The Rational Optimist - How Prosperity Evolves - Matt Ridley

Guns, Germs & Steel - The Fates of Human Societies - Jared Diamond

A Discussion on Modernization - Li Lu

The Prospect of Value Investing in China - Li Lu

Media and The Market - Mastersinvest

The Coming Productivity Boom - Michael Mandel/Bret Swanson

Technology in 1776, The last 250 years of progress, as told to the Founding Fathers in 5 minutes - A16Z

![S&P500 [grey] vs General Electric [blue] Normalised - 2000 - 2021 [Source: Bloomberg]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1626240958557-MQY5UOVVQ98IF9CHHKM1/Screen+Shot+2021-07-14+at+3.33.36+pm.png)

![Dow Jones Industrial Average - 1987 Crash [Source; Bloomberg].](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1616478903417-5MBL252INY28HCUPDPYG/dow.PNG)