One of the fascinating things I have discovered in my studies of the Investment Masters is that almost to a man, the Masters all come from obscure and unique roots. Since those beginnings, most have fought their way to the top, learning from their mistakes and along the way picking up vast reams of knowledge. Success for each of them came from long years of hard work and bitter experiences; a veritable baptism by fire. They are the quiet achievers and through it all have earnt the right to be called an Investment Master.

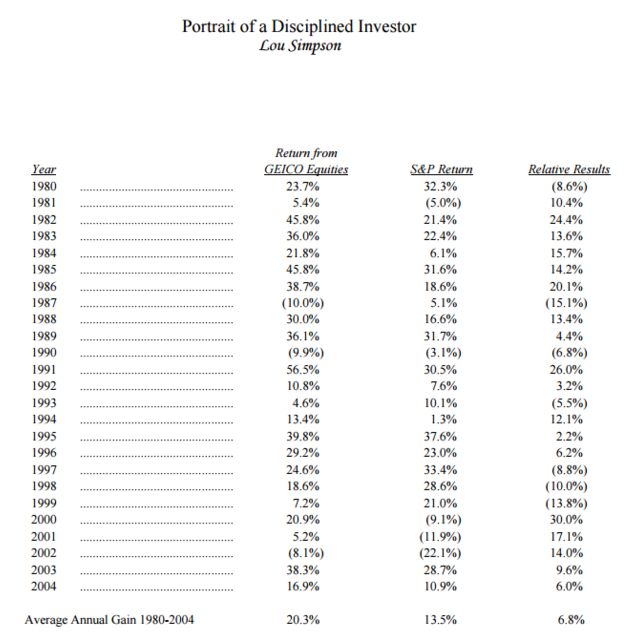

Among these, Lou Simpson is hardly a household name, even among investment professionals. In 1979 Jack Byrne, the CEO of Geico, was looking for a new chief investment officer to run Geico's investment portfolio. Jack had identified four candidates and had then sent them to Omaha to meet Warren Buffett who was a shareholder. ''I sent three of the four to meet Warren,'' Mr. Byrne recalled. ''And after a four-hour interview with Lou, he called me and said: "Stop the search. That's the fella." Lou stayed on for over 25 years racking up returns that bettered the S&P500 by an astonishing 6.8%pa.

In his 1995 letter Buffett noted "Lou takes the same conservative, concentrated approach to investments that we do at Berkshire, and it is an enormous plus for us to have him on board. One point that goes beyond Lou's GEICO work: His presence on the scene assures us that Berkshire would have an extraordinary professional immediately available to handle its

investments if something were to happen to Charlie and me." Eleven years later, in his 2006 letter, Buffett suggested Lou would “fill in magnificently for a short period.” if something happened to either himself or Charlie but given Simpson was just six years his junior, “a different answer” was needed for the long-term.

Charlie Munger had this to say about Lou Simpson ..

"It's not unheard to beat the averages for a couple of years, maybe even five or ten years. But imagine beating the S&P500 by an average annual gain of 6.8 percent over twenty-five years! This extraordinary track record speaks for itself - Lou has one of the greatest investment minds of our time. He is, as Warren says, "a shoo-in for the Investment Hall of Fame".

Lou left Geico in 2010 and started his own fund, SQ Advisers in 2011. SQ Advisers, which now manages more than $3 billion, has a management strategy [as per the 2016 brochure lodged with the SEC] developed and implemented using the following principles as guidelines:

Think independently

Invest in-high return businesses run for the shareholders

Pay only a reasonable price, even for excellent businesses

Invest for the long-term

Do not diversify excessively

Like Buffett, Lou is a value investor looking to buy quality businesses below intrinsic value; "Generally, SQ advisers believes that identifying a significant difference between the market value of a security and the intrinsic value of that security is what defines an investment opportunity."

As a Senior Fellow and Adjunct Professor of Finance at the Kellogg Institute [well worth adding their website to your bookmarks..], Lou recently sat down for a rare interview with Robert Korajczyk, a professor of finance. It shouldn't be a surprise that Lou's views on investing parallel those of the other Investment Masters. I've included links to relevant tutorials in Lou's quotes from the Kellogg Institute interview below.

"The essence [of my investment philosophy] is simplicity"

"What we do is run a long-time-horizon portfolio comprised of ten to fifteen stocks. Most of them are U.S.-based, and they all have similar characteristics. Basically, they’re good businesses. They have a high return on capital, consistently good returns, and they’re run by leaders who want to create long-term value for shareholders while also treating their stakeholders right."

"You can only know so many companies. If you're managing 50 or 100 positions, the chances that you can add value are much, much lower.

"... be very careful with each decision you make. The more decisions you make, the higher the chances are that you will make a poor decision."

"One thing a lot of investors do is they cut their flowers and water their weeds. They sell their winners and keep their losers, hoping the losers will come back even. Generally, it’s more effective to cut your weeds and water your flowers. Sell the things that didn't work out, and let the things that are working out run."

"If I’ve made one mistake in the course of managing investments it was selling really good companies too soon. Because generally, if you’ve made good investments, they will last for a long time."

"Of course, things can change. Amazon is changing the retail business quite dramatically."

"I think you need a combination of quantitative and qualitative skills. Most people now have the quantitative skills. The qualitative skills develop over time."

"Everyone talks about modelling—and it’s probably helpful to do modelling—but if you can be approximately right, you will do well."

"One thing you need to determine is: Are the company’s leaders honest? Do they have integrity? Do they have huge turnover? Do they treat their people poorly? Does the CEO believe in running the business for the long term, or is he or she focused on the next quarter’s consensus earnings?"

"There are a few factors that we look at. First, is this the business we thought it was? If you figure out that a business is not what you thought it was, that’s a bad sign."

The second factor is the management, which can also differ from what you thought. Unfortunately, a lot of managements are very short-term oriented, and that can be another reason to sell. This goes back to the basic integrity and the focus of people in charge.

The third factor is an overly high valuation, and this is often the most difficult, because you’re investing in something you wouldn’t buy at current prices, but you don’t want to sell because it’s a really good business and you think it’s ahead of itself on a price basis. It might be worth holding on to it for a while."

"The biggest difference between Warren and me is that Warren had a much harder job. He was managing 20 times the amount of money we were."

"If somebody’s going to invest using hot tips, or listening to CNBC, or investing with so-called wealth managers at brokerage firms, I think it’s a loser’s game for them."

Once again, a successful Investment Master espouses beliefs that mirror those of many others. Keep it Simple. You wont always be right - Learn from your Mistakes. The Value of Good Culture. Don't sell your position in Great Companies. Back yourself. Things Change. And be Humble. Because from humble beginnings, great things can grow...

Source: Image - 'Portrait of a Disciplined Investor - Berkshire 2004 Annual Report'

“One of the Investment Greats” Explains His Portfolio Strategy: A Q&A with renowned investor Lou Simpson - Kellogg Institute - Robert Korajczyk, 2017.

Further Reading:

Lou Simpson Investor Letters - Source: Turtle Bay