Have you ever stopped to consider the difference between science and art? How some things fall rather naturally into one or other of the categories, (like the 'science of engineering' or the 'art of film production'), yet many other things remain difficult to categorise. They may even belong to both.

Part of the distinction between the two is that if something is a 'science', then it will naturally follow formulae and rules and can typically be proved or practiced via logical methods. 'Art' on the other hand is a form of expression, and invariably involves some level of creativity or innovation. If you think of music as an example, it can be successfully argued that it is both a science and an art at the same time: if a musician follows the 'science of music', then they will practice classical methodology and you can expect that their performances will be clinically perfect yet potentially lacking in 'soul'. Followers of the 'art of music' by comparison might be more innovative, and typically can improvise and express a wider range of emotions and unique qualities in their playing.

I've always considered investing more 'Art' than 'Science'. If there was a formula for success the world's greatest investors would all be mathematicians. They're not. Successful investing requires more than just analysing numbers, it too requires creativity and innovation.

When it comes to Investing 'Artisans', Francois Rochon is one. Francois has a passion for both investing and art, he even named his fund Giverny Capital after the city where the famous Impressionist artist, Claude Monet lived. Over the last two-plus decades Giverny Capital has ranked in the top 1% of investors delivering returns c6.7%pa above its benchmark annually. Since 1993 the firm has clocked up a total return of 3,080% versus 686% for the benchmark.

Over the years I've always looked forward to reading the Giverny Capital annual letters. Not only is Francois an Investment Master he's also a master wordsmith.

Francois recently gave an enlightening presentation titled 'The Art of Investing - Analysing Numbers and Going Beyond' as part of the Talks at Google series.

While Francois trained as an engineer, he found the rigidity and precision of engineering to be a handicap to successful investing. Engineering and investing are almost diametrically opposed; there is no precision in investing. As an investor you can be considered successful even when wrong 40% of the time. As an engineer, if you're wrong 0.4% of the time, you're toast. Notwithstanding, at times engineering calls for more than just numbers - be it for a new design or solution to a problem. To emphasise this, Francois draws on a quote by one of the world's greatest engineers, Nikola Tesla:

"Instinct is something which transcends knowledge. We have, undoubtably, certain finer fibers that enable us to perceive truths when logical deduction, or any other willful effort of the brain, is futile."

The Investment Masters likewise see investing as more art than science.

Accordingly you need to master the 'Art of Investing'. Like mastering any art form, begin with an art form you love. You'll need to study the art's masters, and as a painter paints, you must invest. You'll develop your own unique style, an independent mind, and you'll need to always strive for improvements.

Like most great artists, it's likely you will be seen as a little eccentric, rash and unconventional. If your goal is to obtain better results than the average, you'll have to be able to stand on your own. You cannot achieve this by applying the same logical approaches as the herd.

Investors whose mindset and time horizon mirrors everyone else, those who own lots of companies and believe they are "smarter" and can predict the market, don't beat the market. It's the investors who think for themselves, own very few, carefully selected companies and develop the right behaviours (rationality, humility and patience) that become the Masters of Investment.

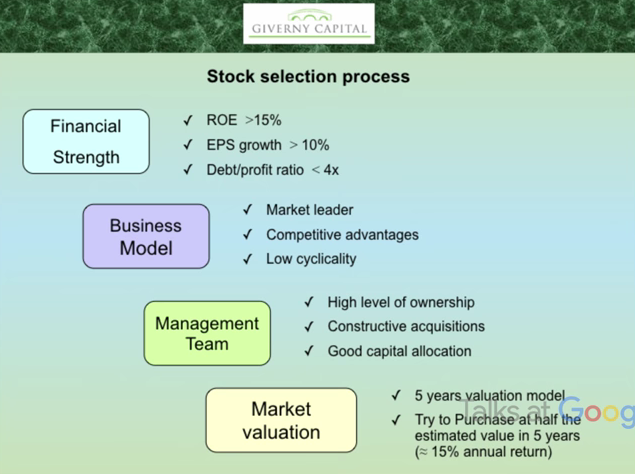

Francois outlines the stock selection process that has delivered Giverny Capital's outstanding returns. The firm focuses on the financial strength of a company searching for companies with an ROE greater than 15%, with EPS growth above 10% and a debt to profit ratio below four times. They search for good business models; those businesses which are market leaders, have competitive advantages and low cyclicality. They then ensure the management teams have skin in the game, capital allocation competency, and are long term thinkers. Finally, Giverny require an acquisition price which affords them the opportunity to double their money over a five year period. To estimate this they need an estimate of what the company can earn in five years time.

As in his art collecting, Francois is attracted to investment 'beauty' or 'corporate masterpieces'. Not surprisingly these are both unique and rare. By studying the investment masterpieces through history - National Cash Register, Ikea, Geico, Apple, McDonalds, Gillette, Google, Starbucks Coffee etc - Francois has discovered the qualities that made them so unique.

The defining character of the uniqueness in either the product, the service or the culture of corporate masterpieces is usually the equivalent of a moat that protects the economic castle from competitors. So in short, you have to find companies with moats.

"Moats always keep changing. There are always new companies with moats; some are expanding, some are shrinking. So we have to follow that closely. If I had to choose one criteria to help me decide what is the direction of the moat - it's the management. Moats aren't built by angels, they are built by human beings. What makes a moat grow is something in the culture of the company, it doesn't come from thin air. It comes from top management that build that culture, then it translates into a moat and high return on equity for shareholders."

Francois sets out his psychological edge in investing. The three behavioural competitive advantages he believes an investor can employ are patience, humility and rationality. In terms of humility, Francois recognises he can't predict macro-economic events so he doesn't try. Francois recognises his 'circle of competence', he strives to recognise mistakes, and is always looking for improvements.

"I would say the greatest quality of Warren Buffett is not necessarily intelligence, it's the humility. He is the greatest investor of all time, but he is still very humble. He is always looking to improve and learn. He's 87 years old and he's still striving for new learnings every day. If you have those qualities I think you'll succeed in almost anything you do."

Every year Francois dedicates a chapter of Giverny's annual letter to the year's best mistakes, awarding a bronze, silver and gold medal.

"We make many mistakes and we only choose three to give medals to: bronze, silver and gold. Most of the time the mistakes are omissions. Starbucks is an example, its a company that fits all our criteria. And we decided not to buy for simplistic reasons and you miss a 10,000% gain over 25 years. We try to give medals to the most costly mistakes."

When it comes to rationality, Francois advocates avoiding fads, even if it means others are making more money than you. And if you don't understand a company, stay away.

"You play an easier game when your'e very selective and you just go for companies you understand."

As hard as it may be, it's critical to be impervious to stock market quotations in the short run. By accepting you don't know the future, you can focus on what's controllable, which is finding companies you can understand and which have a competitive advantage. Then, should you own great companies and markets fall, over time you will still be okay.

"Owning great companies, and not trying to predict the stock market is the key to beating the index over the long run."

To overcome the psychological pressures on investors to do the wrong thing at the wrong time, Francois has developed the 'Rule of Three'. This set of rules states that; 1) one year out of three the stock market will decline by 10% or more; 2) one stock purchased out of three will not perform as expected, and; 3) one year out of three, you will under perform the index. If you set expectations from the start, when you have some bad years and bad investments, you'll be better prepared psychologically to deal with it.

In terms of patience, Francois points not to the 'ability to wait' but the 'ability to keep a good attitude while waiting'. A 'good attitude' is one where you focus on what is happening to the company, NOT the stock price. Provided the underlying company's earnings are growing, you'll find over time the stock price should reflect those improved earnings. Don't confuse patience however with stubbornness. When an investment doesn't work check to make sure the company's fundamentals aren't deteriorating. If they are, get out.

In his quest to buy investment 'masterpieces', Francois often faces a conundrum. Masterpieces can be expensive and tend to trade at higher price-earnings multiples than widely perceived value stocks. While most investors focus on the current price-earnings ratio, Francois suggests instead to look to the long term and estimate what the company's value might be then. If buying at today's price and selling at that future value can deliver a 15% pa return it's likely to be an attractive investment notwithstanding a higher multiple. This process is also useful in eliminating optically 'cheap' stocks which are actually value traps.

"We try to focus on the very long term, so we try to look five years in the future and come up with our best judgements of what the EPS should be in five years... Having this long term horizon help you to de-focus on the [higher] PE ratio today. It goes the other way; if you find a cheap stock but you look five years in the future and you don't see any growth prospects, there is no real reason to believe the stock will be higher in five years. It can be higher in three months just because the PE has gone from 10 to 12. But we don't try to invest for three months we try to invest for at least five years."

The wise investor must be able to balance the dualities in many human activities. While you want to love the art you must remain rational and not fall in love with stocks. You want as large a field of knowledge as possible while remaining within your circle of competence. You need to be open-minded yet maintain a balance of thought. You need to be able to value the business but be able to go beyond the numbers. You must have patience but not stubbornness. Finally, you need discipline but also the wisdom to break the rules.

In summary, the artistic or unconventional investor focuses on intrinsic value, maintains a long term horizon, is agnostic about many things including where the stock will be in the short term, focuses on what to own as opposed to when to buy and resists fads and popular beliefs.

While the majority of investors underperform, Giverny Capital's results have significantly bettered the stock market. Its clear that while they do things differently to most investors, many of their traits and practices are common to those whom we recognise as Investment Masters. They treat the bulk of their investing as an art form, and trade logic and formula for creative thinking.

So how do you approach your investing? As a science or an art form? Do you try to engineer your results, using a set formula or logic, or do you follow a more artistic approach, utilising innovation and creativity? The differences between the two are vast, and whilst scientific method might provide you with short term success, its only through the 'art of investing' that you can go beyond the numbers and create your own long-term performance masterpiece.

[note: click on any links above for further reading on that topic]