Step right up, step right up! Welcome to the Stock Market Circus, an unruly bazaar that is absolutely chock full of brazen salespeople, fortune tellers, sham wealth remedies, high-frequency pirates, fallen angels, pigs with lipstick and much, much more. This is a place where crazy things can happen; stocks can take exponential leaps only to then crash and burn, companies that are here today can be gone by tomorrow, and perceived good news that usually brings higher prices might actually trigger shock selling. Its not a place for the faint-hearted; this Circus abounds with metaphors like death spirals, squeezes, collapses and crashes, none of which engenders feelings of security. And if you want to leave, the exits aren’t always big enough. For the uninitiated, this can be a truly scary place.

If you take a step back however, there is beauty to be found in this madness. You just need the right perspective. A few home truths, a grasp of history and an ability to filter out the noise can go a long way to help investors in this respect. Let’s dive in…

Silly Prices

"The beauty of stocks is that they do sell at silly prices from time to time. That's how Charlie and I have gotten rich." Warren Buffett

Buffett likes to remind us that on occasion you will get silly prices in the stock market. That’s the beauty of it. Silly prices are often the result of emotionally charged behaviour rather than anything fundamental. The market’s ease of access and low cost of transacting encourages quick action, hence turning the psychological short cuts that saved our ancestors on the savannah into an impediment to investment success.

When we’re fearful, we look to other people for guidance. Yet, the truth of the matter is they’re just as likely to be acting on their own fears; reacting emotionally rather than rationally.

When you throw in the dominant quantitative and passive funds of today, who’ve no idea what they own and are triggered by price movements, you’ve got a recipe for significant mis-pricing - stock prices become untethered from business value. For those who are able to keep their cool during these situations, opportunity abounds.

"The stock market will offer you opportunities for profit, percentage-wise, that you’ll never see, in terms of negotiated purchase of business." Warren Buffett

“Research has shown that over the last century, U.S. stock prices have been three times more volatile than fundamentals.” Frank Martin

“We believe that shares spend relatively little time at ‘fair value’. Rather, lengthy periods of overvaluation are followed by lengthy periods of undervaluation… Extreme valuation spreads in the equity market aren’t necessarily rare or short-lived.” Marathon AM

Nick Sleep of Nomad Partners recognised that over time, all businesses can be meaningfully mis-priced.

“We can all observe that stock prices, set in an auction market, are more volatile than business values. Several studies and casual observation reveal that individual prices oscillate widely around a central price year in year out, and for no apparent reason. Certainly, business values don’t do this. Over time, this offers the prospect that any business, indeed all businesses, will be meaningfully mis-priced.” Nick Sleep

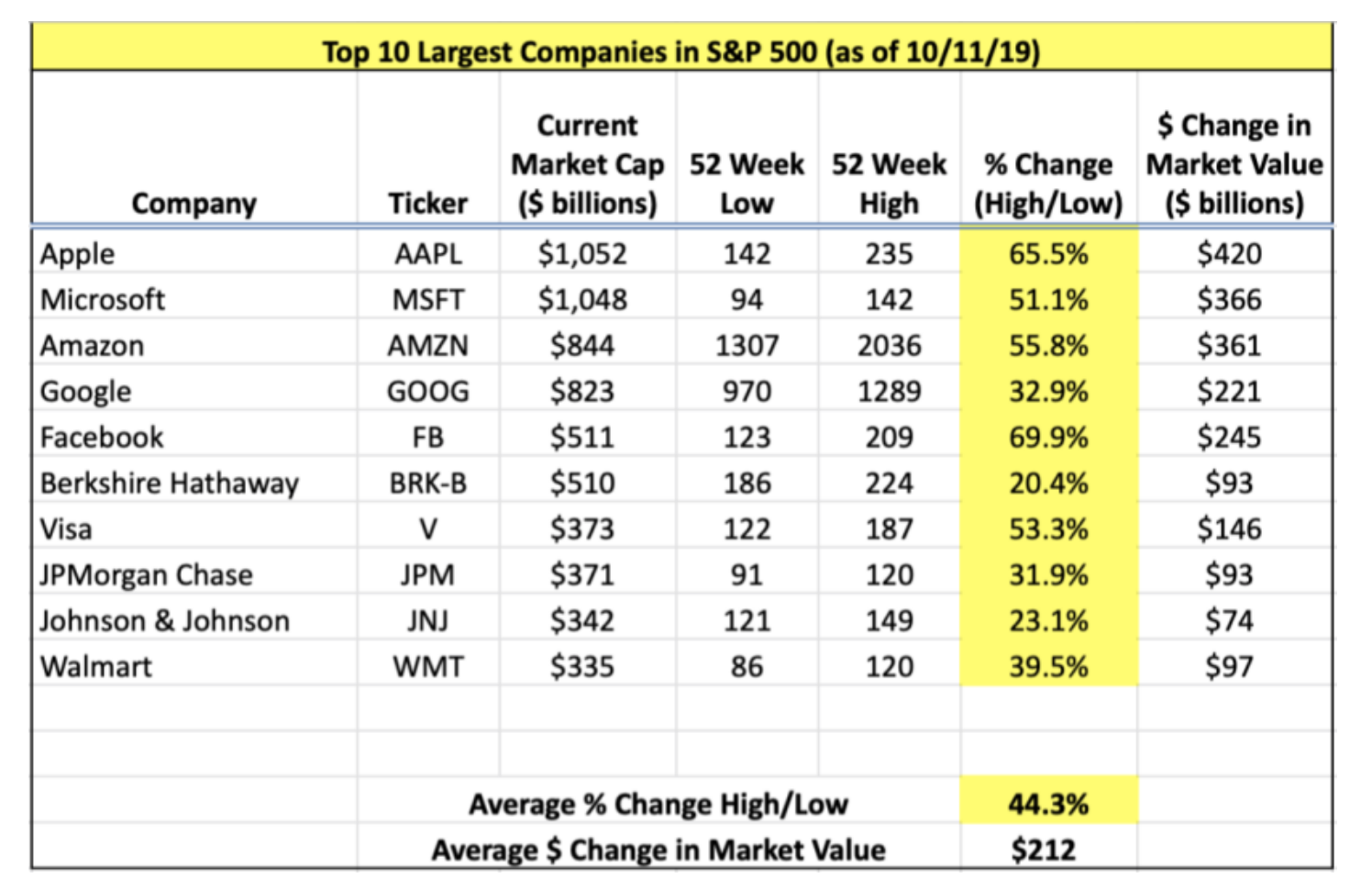

An analysis by John Huber at Saber Capital highlights this point. Mr Huber shows the average intra-year difference between the high and low of the ten largest stocks in the S&P500 in 2019 was a staggering 44%! [and people talk of an efficient market?]

“Stock prices move much more than true values do even in the largest stocks, which by definition causes mis-pricing at times. This isn’t due to a lack of information, it’s simply good old-fashioned human nature, and unlike the price of semiconductors or the value of information, human behaviour is not going to change. The biggest edge is in understanding this simple concept, and then being prepared to capitalise on it when it’s appropriate.” John Huber

Source: Saber Capital Letter Q3 2019.

The opportunity conferred by extreme price volatility isn’t lost on the Investment Masters. In many ways, the great investors are arbitrageurs of human nature.

Stock Markets Compound

The long-term history of the US stock market is one of rising prices. A key contributing factor to a rising stock market has been the earnings retained by corporates that are re-invested for the benefit of shareholders.

“Equities can compound in value in a way that investments in other asset classes, such as bonds and real estate, cannot. The reason for this is quite simple: companies retain a portion of the profits they generate to re-invest in the business.” Terry Smith

“To report what Edgar Lawrence Smith discovered, I will quote a legendary thinker - John Maynard Keynes, who in 1925 reviewed the book, ‘Common Stocks for Long-Term Investment’, thereby putting it on the map. In his review, Keynes described ‘perhaps Mr. Smith's most important point ... and certainly his most novel point. Well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits. In good years, if not in all years, they retain a part of their profits and put them back in the business. Thus there is an element of compound interest operating in favour of a sound industrial investment.’ It was that simple. It wasn't even news. People certainly knew that companies were not paying out 100% of their earnings. But investors hadn't thought through the implications of the point. Here, though, was this guy Smith saying, ‘Why do stocks typically outperform bonds? A major reason is that businesses retain earnings, with these going on to generate still more earnings--and dividends, too.’" Warren Buffett

“In the 1920’s, a brilliant and important book by Edgar Smith, ‘Common Stocks for Long-Term Investment’, became a prime market influence. It was still popular in the fall of 1929, but most people read it too late. Mr. Smith advocated the benefit to corporate growth of the application of retained earnings and depreciation. Thus capital appreciates. The book may have been influential in changing accepted multiples of 10 x earnings to higher multiples of 20 to 30 x earnings.” Roy Neuberger

“Retained earnings have propelled American business throughout our country’s history. What worked for Carnegie and Rockefeller has, over the years, worked its magic for millions of shareholders as well.” Warren Buffett

While markets can be volatile, the returns achieved by corporate America have remained remarkably consistent. Free trade, an entrepreneurial spirit and continuous innovation have been the hallmarks of America’s success.

“Historically, US companies increase their profits by about 6-7% per year and pay a dividend of around 2%. This generates an annual return of 8-9% from simply owning a solid group of companies.” Francois Rochon

“Anyone who examines the aggregate returns that have been earned by companies during the postwar years will discover something extraordinary: the returns on equity have in fact not varied much at all.” Warren Buffett

“The S&P 500 produces 12% or 13% returns on capital and it retains and reinvests about half of its earnings, and so that should generate 6% or 7% earnings growth over the long run. Then the rest of the earnings can be returned to you as dividends and share repurchases. If you can get 6% earnings growth in the long run, plus a couple percent from dividends and buybacks, then you're going to achieve a high single digit rate of return by owning that asset class in the long run. Obviously, it's going to be very lumpy, but if you have a long term, 10-year plus time horizon, that is the rate of internal compounding that I think American business will continue to achieve over time.” John Huber

Attractive Long Term Returns

Over the long haul the stock market has delivered attractive returns. While the Saber Capital table above makes clear the potential for short-term volatility, the potential for loss diminishes with time. Certainly that’s been the case in history.

The chart below highlights that over the last c150 years, investors who’ve taken a twenty year view have earned positive returns 100% of the time.

“The historical odds of making money in U.S. markets are c50/50 over one-day periods, 68% in one-year periods, 88% in 10-year periods, and (so far) 100% in 20 year periods.” Morgan Housel

Source: Collaborativefund.com - Morgan Housel.

Not only have investors been blessed with positive returns a good majority of the time, those returns have ordinarily been pretty solid. For context, in the last one hundred years the worst 25-year return in the market was four times capital. More generally, it’s been twelve times or more.

“You want to remind people that the worst 25-year period in the past 100 years was a 4-times return on their capital. Typically, a 25-year investor gets 12 times return or more. So, to me, being able to share that message with our younger analysts, with our shareholders and potential shareholders helps me keep it together when stocks are behaving differently than we anticipate they would.” Bill Nygren

Even stock market crashes fade over time. The worst percentage fall in stock market history, the 1987 crash, is a blip on the long term chart [see below]. What a wonderful friend compounding has been for the long term investor.

Dow Jones Industrial Average - 1987 Crash [Source; Bloomberg].

Asymmetric

It’s been found that humans find symmetrical patterns more attractive than asymmetrical ones. When it comes to the stock market however, it’s the asymmetry that beautiful. When you invest, the most you can lose is 100% of your capital yet the opportunity exists to make multiples of your investment.

“The asymmetric payoff structure (you can make far more if you’re right about a stock than you can lose if you’re wrong) is the fundamental attraction of investing in equity markets.” James Anderson

“One of the interesting dynamics of buying stock in a company is that our downside is known. In the worst case, we can lose 100% of our investment. In the best case, we can make many multiples of our original investment.” Scott Miller

Long Term Gains

To harness the market’s beauty you need to be invested. Sitting on the sidelines won’t earn returns. While short term market moves can be volatile, history has shown investing in high quality businesses has been a winning strategy over the long term.

“I think that this time would be as good as any other time or as bad as any other time. I have been at this business for 40 years now, so I have been through all kinds of times. That’s a long time to be at one trade, and I have done it every day. I couldn’t tell you that I knew any particular day, whether it was today or 10, 15, 20 or 40 years ago that actually would have been the right day for someone to invest. The right thing to do is to enter the investment scene, whether you are just an individual investor, someone who might be approaching it on a career basis, or a professional investor already working to hone your skill set.” David Polen

“All I can tell you as an increasingly experienced investor, is that I have never known a time when people weren’t worried about the sort of issues that you adduce and those people that spent too much time worrying about those issues, didn’t get invested and missed out on a opportunity to protect their wealth against inflation and indeed, to growth their wealth in real terms. So the rational way to deal with these sports of concerns, it may not be the correct thing, but the rational thing is to ignore them and be invested in fine businesses.” Nick Train

“The stock market goes up over time. Developed markets should increase by around 6% p.a. over long periods of time, implying a double every 12 years, a quadruple every 24 years, and so on. If you have a 40 year plus time horizon and an investment opportunity that will go up 8-fold, how much is there to think about? The smart money is invested, not on the side-lines fretting about what to do.” Robert Vinall

Get Rich Slowly

Compounding’s power reveals itself over time. While short term gains may look small, with time they mushroom. You don’t need to hit the ball out the park every year to build long term wealth. In fact, doing so, may increase the risk of losing capital. And losing capital is what impedes compounding. While everyone wants it all today, the world’s best recognise the beauty in getting rich slowly.

“At the beginning of the AGM of the Berkshire Hathaway Company they show this little video and each year Buffett is asked what’s the main difference between himself and the average investor, and he answers patience. And there is so little of it these days. Has anyone heard of getting rich slowly?” Nick Sleep

“The biggest thing about making money is time. You don’t have to be particularly smart you just have to be patient.” Warren Buffett

"The desire to get rich fast is pretty dangerous.” Charlie Munger

“People would rather be promised a (presumably) winning lottery ticket next week than an opportunity to get rich slowly.” Warren Buffett

“Ninety-nine percent of investors shouldn’t try to get rich too quickly; it’s too risky. Try to get rich slowly.” Sir John Templeton

“Small investors who get into trouble, I think, are those who try to get rich quick. They are in and out of the market in a flash and don’t take the time to learn. That’s a dangerous game.” Roy Neuberger

"In investing, time is your friend. The people who make a lot of money in investing are those that buy great businesses, in our case with expanding moats, and they give them time to work for them over 5, 10 and 15 year pulls. All the people that have created a lot of wealth for themselves didn't do it in a week, or 3 months or 6 months. They did it over a generation." Paul Black

“A good summary of investing history is that stocks pay a fortune in the long run but seek punitive damages when you try to be paid sooner. Virtually all investing mistakes are rooted in people looking at long-term market returns and saying, “That’s nice, but can I have it all faster?” Morgan Housel

Summary

On any given day it’s pretty much a coin toss what markets will do, and because of it you must be able to brace yourself for volatility. It’s a function of human nature and that’s not going to change anytime soon. Discard the received dogma that volatility is risk. While most business schools trumpet this notion, the great investors have recognised the beauty in volatile prices - they can present attractive entry points which ordinarily don’t surface in most markets. Little wonder these Investment Masters consider volatility as the friend of the long-term investor.

While there’s little sense to be made in the daily sound bites and market gyrations, as time expands, the markets longer term beauty reveals itself. Companies values compound and together cause markets to rise. You just have to lengthen your perspective to see it.

Whilst we’ve covered some of the attractive features of the stock market, I’m sure you can think of plenty of others; accessing the world’s best management teams, the ability to work from remote locations, not having a boss - there’s plenty more. Successful investing requires the right attitude, perspective and planning; manage your emotions, recognise and respect the power of compounding and exercise patience.

The market has a history of attractive long term returns; all you need to do is step back to see it’s beauty.

Follow us on Twitter : @mastersinvest

TERMS OF USE: DISCLAIMER

![Dow Jones Industrial Average - 1987 Crash [Source; Bloomberg].](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1616478903417-5MBL252INY28HCUPDPYG/dow.PNG)