If you’ve ever founded your own business, you’ll know how important they become to you. For many business owners, their companies become like one of their own children; they nurture and guide them and then watch them grow, and feel every triumph and failure far more keenly than others who are not as emotionally invested within the business might. Some few decide to sell their businesses after a while, yet many others choose to stay with them, remaining with their ‘child’ over time to see it grow to maturity.

I’m sure you’ve heard the saying, ‘no one works as hard as the owner’, and this is largely true. No one does. Where other managers and employees might come and go over time, it’s the founder who is there, quite often seven days a week, plugging away at their enterprise, steering and guiding and leading it towards success. And its this commitment to the cause that often leads to remarkable levels of performance.

We’ve covered a lot of different successful businesses in the Investment Masters Class over the last few years: Aldi, Home Depot, Walmart, Copart, Charles Schwab and McDonald’s to name but a few. And interestingly, one of the most striking features of these businesses has been the fact that ninety percent of them have been run by Founders.

You may have also noticed yourself that many of the investors considered ‘Masters’ have quite literally filled their portfolios with companies run by either founders, families or major shareholders who act like such; Berkshire, Nomad, Giverny, Baillie Gifford, Marathon and Gardner Russo are some that come to mind.

“Nomad’s investments may be in publicly listed firms but these firms are also overwhelmingly run by proprietors who think and behave as if they ran private firms.” Nick Sleep

“Sixty-plus percent of my investments at the moment and most of the past decades have been invested in family-controlled companies, which is quite unusual, and it has given us a slightly interesting benefit that to most investors, family-controlled companies suggest more risk, not less risk.” Thomas Russo

“Almost ninety percent of the portfolio is invested in firms run by founders or the largest shareholder, and their average investment in the firms is just over twenty percent of shares outstanding.” Nick Sleep

“The attractions of [founding] shareholder structures explain why companies that enjoy them form nearly 60 per cent of the International Alpha portfolio.” Baillie Gifford

And the reason for this is quite simple. Over time, businesses with aligned management have tended to produce some of the best stock market returns. There’s a myriad of explanations for this. Let’s delve a little deeper.

Outperformance

Numerous studies have shown that companies with a long term founder at the helm have outperformed. A 2012 study by the Harvard Business Review titled, ‘What You Can Learn from Family Business’ highlighted, ‘when we looked across business cycles from 1997 to 2009, we found that the average long-term financial performance was higher for family businesses than for non-family businesses in every country we examined.’

“Studies such as the one from the Harvard Business Review conclude that founder-led businesses often outperform professionally managed firms. I would suggest that they do so because the founder's commitment runs far deeper and is often longer-term in nature than that of the professional manager. And commitment and focus is what drives performance." Ron Shaich, Founder, Panera Bread

“Statistically, CEOs matter a lot. I can identify that some of these CEOs are founders and then I could ask: do founders do better on average? And the answer is yes, founders do better on average!” Hendrik Bessembinder

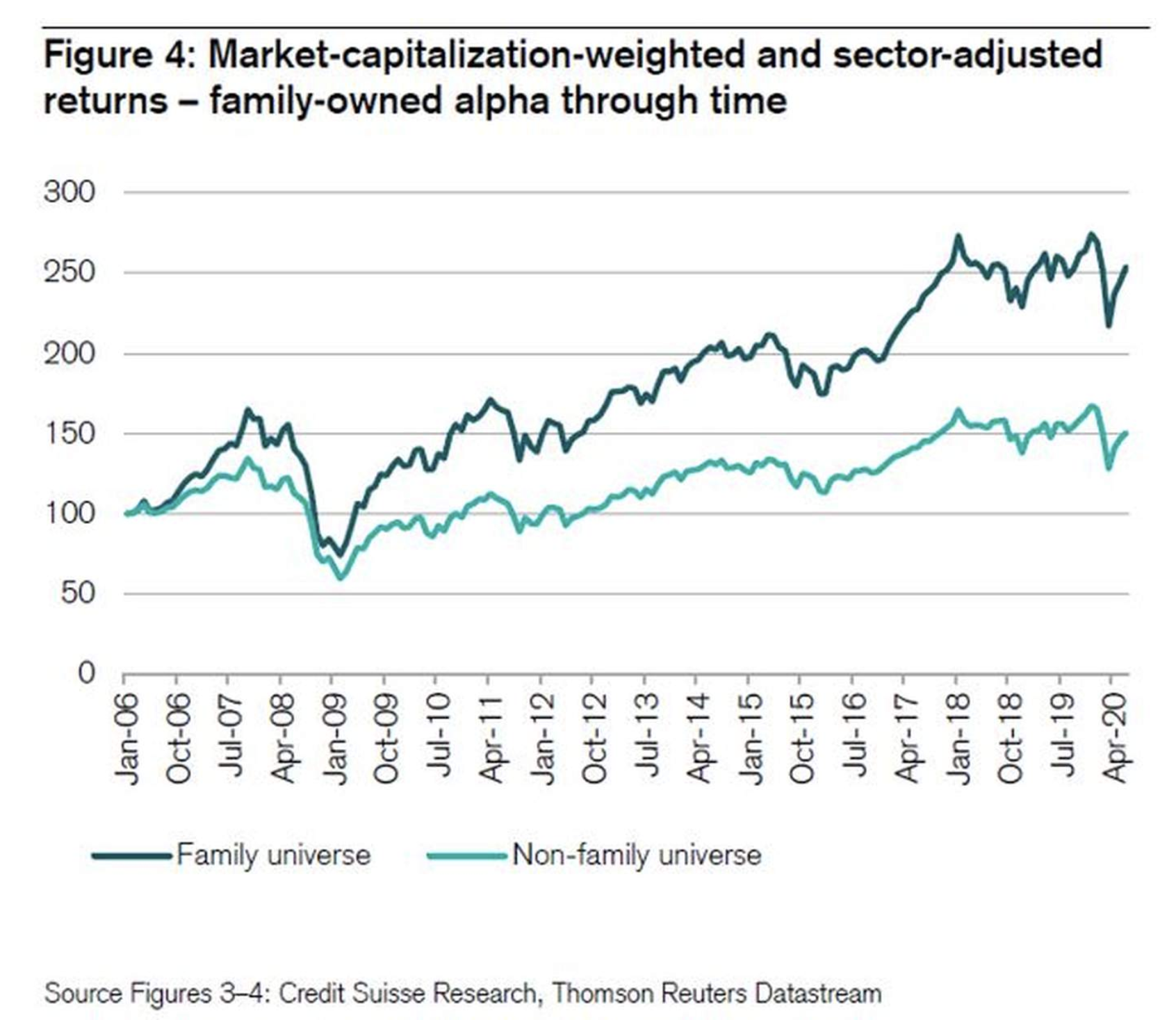

The Credit Suisse Research Institute have made similar findings. Using its proprietary ‘Family 1000’ database of more than 1000 publicly listed family or founder-owned companies, Credit Suisse has identified that since 2006, the overall universe of ‘Family-owned businesses’ have outperformed non-family-owned companies by an annual average of 370 basis points.

Research by Baillie Gifford concurs, “Our own research suggested that businesses where a family or founder owned more than 10 per cent outperformed by 3.4 per cent per annum over a fifteen-year period.”

Trust

Money managers effectively pass stewardship of their client’s capital to the management of the companies they invest in. And as it’s never possible to know everything going on inside a company, it’s paramount they trust management. A useful method to help ascertain management integrity is to study the course of a company’s history - reading every company announcement over the last five plus years until today - soon gives you an understanding of management’s achievements versus their goals. You’ll also get a sense of director behaviour through their buying and selling activity.

“When you choose to invest with us on behalf of your clients, you’re subcontracting their capital to us to look after. The reality of this process is we subcontract it to the management of companies. Therefore, seeing they think what we regard as sensible about things is a very important sign.” Terry Smith

“Our job is to pass custody of your investment over at the right price and to the right people.” Nick Sleep

“In effect, we subcontract our portfolio to the boards and managers of the companies in which we invest.” Andy Brown

If you don’t trust management, then don’t invest.

“If there is a serious question of the lack of a strong management sense of trusteeship for stockholders, the investor should never seriously consider participating in such an enterprise.” Phil Fisher

"We do not wish to join with managers who lack admirable qualities, no matter how attractive the prospects of their business." Warren Buffett

Incentives

In his 97 years, Charlie Munger has studied incentive-driven behaviour more than most. Yet, even he still feels he under-estimates it.

“I think I've been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I've underestimated it.” Charlie Munger

A company founder’s incentives are usually in stark contrast to those of a professional management team. A large ownership stake in the business means a founder’s wealth is far more influenced by longer term valuation improvements than a salary. In contrast, a CEO with little skin-in-the-game may be tempted to undertake accretive short term acquisitions or minimise capex & investments to achieve short term remuneration hurdles, even to the detriment of long term value creation.

"A CEO faced with 4 years at the helm with financial incentives is unlikely to act in the same way as an owner-manager with a multi-generational timescale." Marathon Asset Management

"All else being equal, favour companies in which management has a significant personal investment over companies run by people that benefit only from their salaries." Peter Lynch

"If the CEO owns $1 million worth of stock and gets paid $10 million per year, it’s pretty clear he’ll value his job more than the value of the stock. If he’s paid $1 million per year and owns $50 million in stock, we think that’s predictive of his making better long-term decisions for the company... Where the founder owns 20-30% of the business... they’ll work with Wall Street because they don’t completely control the company, but at the same time they can take a longer-term perspective. CEOs with tons of options rather than actual shares can be prone to adopt Wall Street’s short-term focus, which can cause value to be eroded more quickly than you’d think as one bad decision piles on top of another." Adam Weiss

“Many corporate CEOs have very low levels of genuine ownership in the firms they manage and are incentivised primarily on short-term earnings-per-share targets or share price movements. These sorts of incentive schemes do not engender long-term thinking.” Baillie Gifford

"A guy who rises to the top of a big corporation and owns none of it is much more interested in control than he is in economics. It is just the nature of humanity. A guy who owns his business is used to control. He never has to fight for control. What he has to fight for is economics. But a bunch of entrepreneurs find it much easier to collaborate and create economic value. They have something beyond control—they have economics.” John Malone

Principal-Agency Problem

The incentive misalignment is often referred to as the principal/agency problem; what’s in the best interest of the CEO may be detrimental to the shareholders. The presence of a founder can resolve this dilemma.

“As ownership increases agency costs fall. And like any cost, a sustained fall increases profitability and the value of firm. This effect is born out in our experience and numerous academic studies, dating as far back as the late 1980’s. This relationship between inside ownership and outcomes is not only positive but potentially meaningful. For example, Christoph Kaserer and Benjamin Moldenhauer correlated a 1 per cent increase in inside ownership with ~10 basis points per annum increase in share price performance.” Baillie Gifford

“Insider ownership has always seemed to us as the most direct way to deal with the principal-agent problem, which arises with the separation of corporate management from ownership. Our portfolios have tended to be skewed towards companies where successful entrepreneurs run their companies and retain sizeable shareholdings.” Marathon Asset Management

“The issue of alignment of interests is one of the great challenges of modern-day capitalism. Strong governance structures, well-devised remuneration schemes and large management shareholdings can help, but one of the best ways to overcome this challenge is simply to invest alongside the founders of a business or their descendants. When founders move on, substantial equity ownership by their descendants can still have significant beneficial effects." Baillie Gifford

Passion versus Pay

The most profitable businesses tend to be those focused on delivering a customer outcome, not the most profit-orientated. Founders often bring a passion to the business absent from that of professional managers. They are building a legacy, which requires long term thinking. Buffett himself is a good example; Berkshire pays him a salary of $100,000 a year; he resides in the same house he bought in 1958. Berkshire is his canvas. In the insightful book, Obliquity, John Kay observed, “Many of the businesspeople who talk obsessively about profit are ultimately less successful in creating profit than those who profess love for their business.”

“The best entrepreneurs we know don’t particularly care about the terms of their compensation packages, and some, such as Jeff Bezos and Warren Buffett have substantially and permanently waived their salaries, bonuses, or option packages. We would surmise that the founders of the firms Nomad has invested in are not particularly motivated by the incremental dollar of personal wealth… These people derive meaning from the challenge, identity, creativity, ethos (this list is not exhaustive) of their work, and not from the incentive packages their compensation committees have devised for them. The point is that financial incentives may be necessary, but they may also not be sufficient in themselves to bring out the best in people.” Nick Sleep

“One thing that Sam Walton and Mrs. B had in common is they had a passion for the business. It isn’t all about the money, at all. It was about winning. Passion counts enormously; you have to really be doing it because you love the results, rather than the money. When we buy businesses, we are looking for people that will not lose an ounce of passion for the business even after their business is sold.” Warren Buffett

“I always look to invest in a manager who has made the company his or her life’s work.” Robert Vinall

“A majority of our managers are financially independent, so that they don’t go to work because they are worried about putting kids through school or putting food on the table. So they have to have some reason to go to work aside from that.” Warren Buffett

“What matters most: passion or competence that was inborn. Berkshire is full of people who have a peculiar passion for their business. I would argue passion is more important than brain power.” Charlie Munger

“We’ve had terrific luck with the entrepreneurs who basically love their businesses the way I love Berkshire.” Warren Buffett

“I’ve spent a lot of time thinking about factors that influence the long-term success of a business, and I think firms (public or private) that are run by the founders often have a huge intangible quality to them - one that is crucial to the firm’s ultimate success. This intangible quality is that the founder is often motivated by much more than money. And that is a driving force that can be incredibly powerful, and incredibly valuable for the owners of those firms.” John Huber

Tone from the Top & Culture

This aspect is really quite simple, yet despite its simplicity, its often underestimated or even overlooked altogether. And it is vastly important to the success of any organisation. Higher management set the tone for any organisation. What this means is that when you think of a company’s culture, in its simplest form it is actually derived from the values and behaviour(s) of either the founder/owner or the combined personality of the management team.

And those behaviours of passion and commitment and love for the business are always going to be far more evident in a company that is run by a Founder, than that run by a professional manager or team.

“A company’s behaviour is an analog of its leadership’s behaviour, much as a marionette’s behaviour is an analog of the puppeteer’s hand motions.” Rajenda Sisodia

“Costco’s founder, Jim Sinegal owned a lot of shares but never made more than $300k a year. How different is that from other company's where the CEO is making $20, $30, $40m or gets fired and gets a $200m golden parachute? That doesn't usually bode well for the long term cultural success of the firm." Paul Black

“We’ve bought business after business because we admire the founders and what they’ve done with their lives. In almost all cases, they’ve stayed on, and our expectations have not been disappointed.” Charlie Munger

Lower Capital Requirements

Investors often give little consideration to the capital required to grow a business. One of the attractions of businesses owned by founders, or in an industry where a founder-led business thrives after decades, is the ability for a company to self-fund growth without calling upon external capital.

“We are the Groucho Marx of investment. Groucho Marx once said he would never join a club that would have him as a member. We would never invest in a company that needs our money. All the companies we invest in are quoted but the companies are not quoted on the stock market because they need our money. Why are they quoted? They are typically quoted because they were once family-owned, and when family’s become dispersed a realization has to happen. When we are looking at a sector and we are thinking of investing in it, we look for a big private company in that sector, that’s been around for many decades, if not longer and has never had to float. Which means we know in that sector companies can grow and prosper and create value without ever ringing up the shareholders and asking for more money. We can’t buy those companies but they give us comfort we are fishing in the right area.” Terry Smith

"We usually tend to be in bed with managements who don't really need the capital markets." Marty Whitman

Long Term Focus / Jam Tomorrow

All the way back in 1958, Phil Fisher understood the benefits of investing in businesses taking a long-term view.

“The investor wanting maximum results should favour companies with a truly long-range outlook concerning profits.” Phil Fisher

‘The Hunt for Europe’s Ten-Baggers’, Baillie Gifford 2019.

Often business decisions that promise long-term value, come at the cost of short-term performance. It might be investing in an overseas expansion which is dilutive to near term earnings, keeping margins low to deter competitors, increasing advertising spend to maximise long-term customer value or increasing R&D spending which has potential long-term benefits.

“Almost all good businesses engage in ‘pain today, gain tomorrow’ activities.” Charlie Munger

Professional CEO’s are often reluctant to disappoint Wall Street expectations over concerns of long-term job stability, short-term earnings implications and concern for short term stock price performance.

“If you owned a business all by yourself, you wouldn’t care at all about maximising reported numbers.” Tom Russo

“Our favourite and most frequent acquisitions are the businesses that we buy from founders. When a founder invests the better part of a lifetime building a business, a long-term orientation tends to permeate all aspects of the enterprise: employee selection and development, establishing and building symbiotic customer relationships, and evolving sophisticated product suites.” Mark Leonard

“At best, family control can be an elegant solution to the agency problem. Families are better able to withstand short-term profit fluctuations and to invest for the long term benefit of themselves and outside shareholders.” Marathon Asset Management

“Often family controlled companies have the ability to look out beyond quarters and that's valuable.” Thomas Russo

“Our experience suggests founder-led companies show greater propensity to focus on long-term value creation, even when it comes at the expense of short-term pain.” Baillie Gifford

“Family owners typically want their firms to last for generations, so they can make long-term investments without worrying about shareholders looking for short term-profits.” Vicki Tenhaken

A founder is less likely to be seduced by the demands of Wall Street.

“I admire Amazon founder, Jeff Bezos. He has revolutionized the retail industry and has two great qualities: He is patient and persistent, and he doesn’t care to please Wall Street’s quarterly expectations. This last quality is often overlooked but it is seldom found and represents, in my opinion, a true competitive advantage.” Francois Rochon

Summary

Warren Buffett has long espoused the more attractive opportunities in the equities market than the private market. Notwithstanding, he has continued to seek out founder-led businesses for acquisition. In fact, if he had his way, he’d own more.

“In the stock market, you get a chance to buy businesses at foolish prices, and that is why we end up with a lot of money in marketable securities. If we absolutely had our choice, we would own three times the number of businesses we own outright.” Warren Buffett

Many of the world’s best investors have applied the benefits of his approach to public equities investing.

“An owner-operator culture is the central idea expressed in our portfolio. Boiled down to our essential raison d'être, that’s it. We invest with talented people who have skin the game. In other words, we invest in businesses where management and/or the board own a significant amount of stock.” Chris Mayer

“Founders, at least the very best of them, are unstoppable, irrepressible forces of nature.” Mike Moritz

“I follow the philosophy, have your money where the owners are.” Mario Gabelli

“We look for managers who are owners.” Chuck Akre

"I invest almost exclusively in companies with active and engaged owners. Very occasionally, you find managers who think and act like owners even if no owner is present but this is the exception rather than the rule. If a restaurant has an absentee owner, over time the service quality will slip and the waiters will have their hand in the till. With large companies, it is no different.” Robert Vinall

"We love owner-operators.” Mason Hawkins

“Ideally, we want a founder. We want a founder or a founder-like leader that’s running the business, and running it like an owner.” Christopher Begg

"We want to invest with management teams 'that think and act like owners.’" David Herro

“If we recognise that portfolio performance is usually driven by a relatively small number of long-term winners, and that these winners most often are run by passionate managers, often founders or a second-generation with a deep-rooted interest in the success of their offspring, we must then redouble our efforts to find more of this type of company.” David Poppe

"I want to invest with people who have at-risk skin in the game, ideally founder capital. I like knowing that I and the person calling the shots are in parity in terms of risk." Frank Martin

“I try to stuff our portfolio with management teams that ‘get it’. Founders run 45% of our companies; the average tenure of management is fifteen years.” Ryan Krafft

One of my favourite quotes from Charlie Munger is ‘Fish where the fish are.’ The starting point is finding the right pond. And ultimately, this is profound advice. It’s clear that a great starting place in your search for great investments might be the pond of companies run by Founders.

Sources:

‘The Hunt For Europe’s Ten Baggers’, Baillie Gifford. 2019

‘Owner Operators’, Horizon Kinetics, 2014.

‘What You Can Learn from Family Business,’ Kachaner, Stalk, Bloch. Harvard Business Review. 2012.

‘Family-owned businesses show resilience through pandemic,’ Credit Suisse Research. 2020.

‘Founder-Led Companies Outperform the Rest — Here’s Why,’ Chris Zook, Harvard Business Review, 2016.

‘Business In The Blood - Companies controlled by Founding Families remain surprisingly important and look set to stay so.’ The Economist, 2014.

Follow us on Twitter : @mastersinvest

TERMS OF USE: DISCLAIMER