Every so often you stumble across a book so old, so unassuming, that it shouldn’t have any relevance to modern investing… and yet it reads as if it were written yesterday.

That was my experience with R.W. McNeel’s 1927 gem, Beating the Market. Nearly a century old, it feels startlingly contemporary.

You might reasonably ask: How could a hundred-year-old investing book offer anything useful today? Markets have evolved, technology has transformed how we trade, and the world looks nothing like it did in 1927.

The answer lies in one of the greatest truths ever spoken about markets - Jesse Livermore’s immortal line:

“Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes.”

McNeel understood that. His observations about behaviour, temperament, and value are as fresh—and as useful—as anything written today.

And here’s where it gets even more interesting.

Although it was published three years before Warren Buffett was born, the lessons in this little volume closely mirror his own philosophy: buy below intrinsic value, bet on America, stay unemotional, seek value, avoid new issues, ignore brokers, be patient, resist the crowd, and focus on businesses with quality management — to name just a few.

You’ll find the similarities striking.

Below, I’ve placed McNeel’s words side-by-side with Buffett’s — not to suggest influence, but to illustrate how enduring principles survive generations.

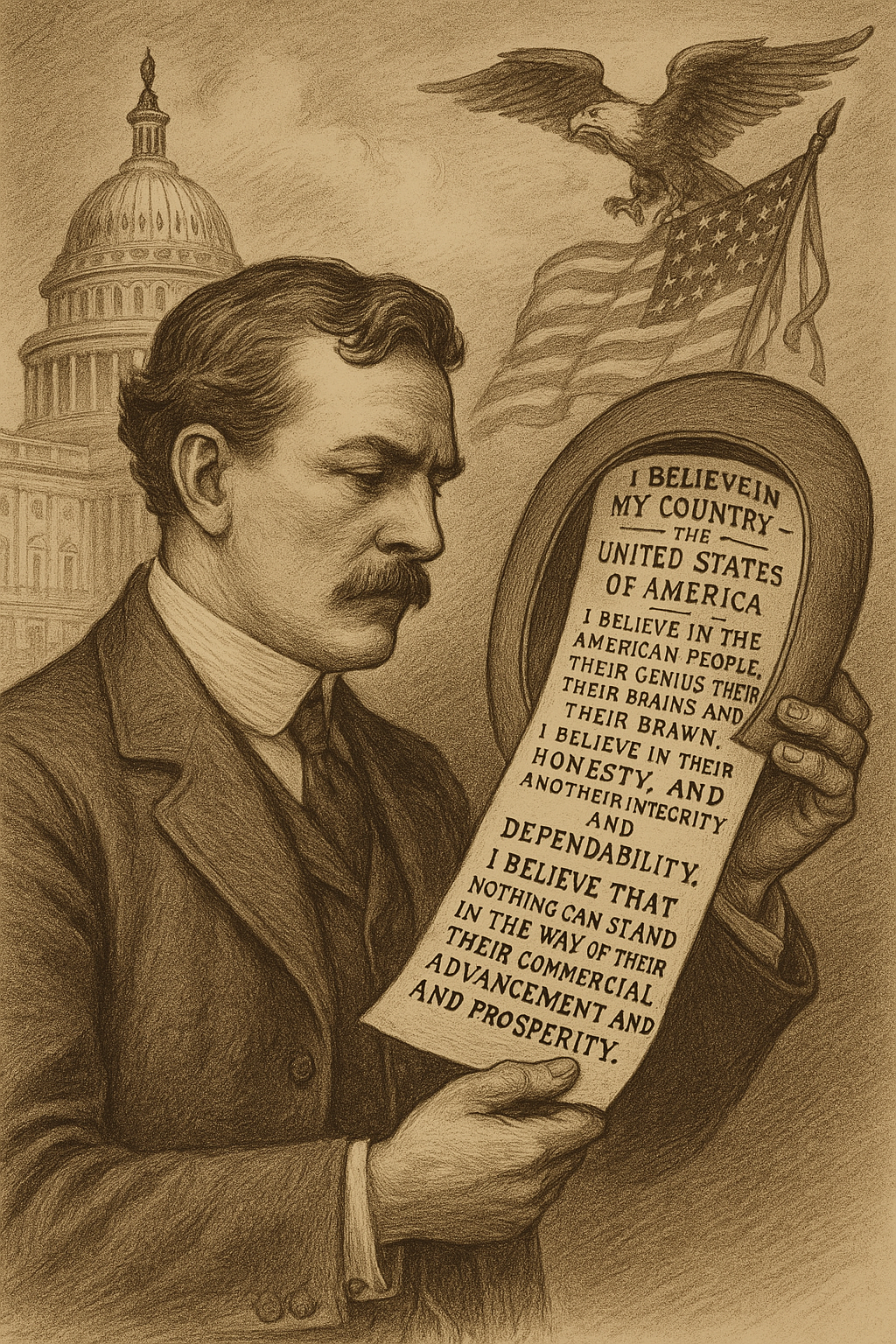

Bet on America

“One of the first principles of speculative success, the fundamental necessity, if one would be in the frame of mind to buy stocks when they are low - namely, faith in the United States of America, faith in her government, her institutions, and her people.” R.W.McNeel

“Before one starts in to speculate, therefore, he should paste this old creed in his hat: ‘I believe in my country - The United States of America. I believe in the American people, their genius, their brains, and their brawn. I believe in their honesty, and their integrity and dependability. I believe that nothing can stand in the way of their commercial advancement and prosperity.’” R.W. McNeel

‘Bet on America’

“American business, really, has never let investors down as a group, but investors have done themselves in quite frequently.” Warren Buffett

“Charlie and I have always considered a ‘bet’ on ever-rising U.S prosperity to be very close to a sure thing. Indeed, who has ever benefitted during the past 237 years by betting against America? If you compare our country’s present condition to that existing in 1776, you have to rub your eyes in wonder. And the dynamism embedded in our market economy will continue to work it’s magic. America’s best days lie ahead.” Warren Buffett

“America has been a terrific country for investors. All they have needed to do is sit quietly, listening to no one.” Warren Buffett

“In general, the batting average of doomsayers in the U.S. is terrible. Our country has consistently made fools of those who were skeptical about either our economic potential or our resiliency. Many pessimistic seers simply underestimated the dynamism that has allowed us to overcome problems that once seemed ominous. We still have a truly remarkable country and economy.” Warren Buffett

The Power of Retained Earnings

“The real value of securities representing well-managed American industries is increasing all the time. Earnings are constantly being put back into the properties to build them up, and the asset value is steadily being augmented. Stocks usually go well above their real value in bull markets, and they go below their real value in bear markets. But with the real value steadily rising, the tendency is for the extreme low price of any stock in one bear market to be higher than the low level in the bear market preceding.” R.W. McNeel

“[The stock market’s underlying] value gains from year to year. Companies retain earnings. If you own a business and you plow back a good portion of your earnings into building the business you are going to have something more valuable, on average, year after year. Sometimes the market reflects it and sometimes it is crashing for some other reason, but the stock market builds in underlying value from year to year.” Warren Buffett

Emotions and Temperament

“Speculative success depends as much on the character of the speculator as on knowledge of how to win.” R.W. McNeel

“The majority of people who enter the stock-market arena to make money are beaten before they start, because they have a wrong mental attitude towards the speculative game.” R.W. McNeel

“If one is emotional, if he lacks the power of independent thought and the power of will to act on his own knowledge, he should keep out of the stock market. If one is so temperamental that he is carried away by the enthusiasm or depression of the moment, failing to act when he should and acting when he should not, he should keep his money in the savings bank. Otherwise, some one will get it away from him.” R.W. McNeel

“It is a problem of self-mastery and self- discipline as much as one in finance.“ R.W. McNeel

“Rationality is essential when others are making decisions based on short-term greed or fear. That is when the money is made.” Warren Buffett

"It’s an easy game, if you can control your emotions." Warren Buffett

"Beyond a certain basic level, though, of skill .. your emotional make-up’s more important than some super high degree of skill." Warren Buffett

“The proper temperament is far more important in investing than points of intellect. If you’ve got a reasonable intellect and the right temperament you’d get very rich, and if you’ve got the wrong temperament for it, you’ll get done in at some point.” Warren Buffett

Human Nature

“If one will but analyze the fundamental causes of speculative failure, he will discover that the chief blame lies not in the character of the stock market, not in the fact that the ‘game’ is loaded against the average speculator, but in weaknesses inherent in human nature. It is not the stock market which beats speculators. It is their own unreasoning instincts and inborn tendencies which they cannot master, and which given free rein lead on to ruin.” R.W. McNeel

“A great Frenchman once said, ‘There is but one person in a, hundred, nay in a thousand, who thinks.’ If that be true, and it sometimes seems as though it were, it is not surprising that few can curb their instinctive actions in the market and act in accordance with reason.” R.W. McNeel

“Human nature has not changed. People will always behave in a manic-depressive way over time. They will offer great values to you.” Warren Buffett

“Humans will continue to make the same mistakes that they have made in the past.” Warren Buffett

“The better you understand human nature and are able to distinguish between different types of individuals, the better the investor you are going to be.” Warren Buffett

Discount To Intrinsic Value

“Men who make a success of speculation, lay in their lines of stocks when prices are low and the risks are small…. They know from investigation before they buy that at the prices they pay for stocks they are buying into the properties which the stock certificates represent at fifty cents on the dollar of the value of the assets of those corporations.” R.W. McNeel

“On the one side are those who know that stocks ought to be bought when they are low and below the line of real values, and have the courage to buy them at such times. They know, too, that stocks ought to be sold, however attractive they may appear, when they are high and above the line of real values, and have the courage to sell them. On the other side are those who play the game but who do not know, or have not the courage to follow, the principles which lead to speculative success - the sucker public.” R.W. McNeel

“The mere desire to make money should never be the mainspring of speculative action. Knowledge or belief based on intelligent analysis that a speculative opportunity presents itself is the only safe basis for making purchases of stocks. It is in forgetting that principle that so many speculators err. They do not ask when they are preparing to buy stocks, ‘Is the stock cheap, and is it selling below its real value?’ but ‘Is that stock going up?’ The only sound reason for buying any stock is that it can be had cheap. Granted that, and also that it represents ownership in one of our great essential American industries, a speculative profit is practically assured, if one have patience.” R.W. McNeel

“The only reason to lay out money is because you expect to get something in return that is worth at least as much, and hopefully more, than you pay." Warren Buffett

“My game is simply to buy something worth a dollar for 50 cents.” Warren Buffett

“If you buy businesses for less than they’re worth, you’re going to make money.” Warren Buffett

Company Earnings & Value

“Hold firm the principles underlying all successful speculation, that earning power makes values, and values make prices in the long run, and, having in mind the value based on earning power of any particular stock.“ R.W. McNeel

“Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.“ Warren Buffett

“Over time, of course, market price and intrinsic value will arrive at about the same destination. But in the short run the two often diverge in a major way.” Warren Buffett

Good Management

“Good management is at the foundation of all corporate success. If there is one thing on which the investor or speculator should insist above all others, it is on knowing the character of the men behind the enterprise.” R.W. McNeel

“The veteran banker of Boston, the late Henry L. Higginson, asked one day by an investor what stocks he ought to buy with some idle funds replied, ‘Buy character.’ He meant that if one bought into any industry backed by men of experience and of high character and intelligence, one would at least be subject only to the usual risks of business, and chances of success would be excellent. On the other hand, no one could have faith in securities of any corporation operated by men of doubtful character.“ R.W. McNeel

“In management you look for ability, trust & character.” Warren Buffett

“We depend on management.” Warren Buffett

“We do not wish to join with managers who lack admirable qualities, no matter how attractive the prospects of their business. We've never succeeded in making a good deal with a bad person.” Warren Buffett

Independent Thinking

“One of the frequent causes of failure in speculation is the inability of the average speculator to think independently, when people around him are telling him in most definite terms what they are thinking.” R.W. McNeel

“The best way to think about investments is to be in a room with no one else and just think. And if that doesn‘t work, nothing else is going to work.” Warren Buffett

"Independent thinking, emotional stability, and a keen understanding of both human and institutional behaviour are vital to long-term investment success." Warren Buffett

Fear

“One chief reason many fail to buy stocks when they are low is because of fear. Periodically prices of stocks representing ownership in the great productive industries of the United States and her great railroad systems fall so far that ownership in them is selling for 25 to 50 cents on the dollar of the value of the bricks and mortar and working capital which the stocks represent. But the majority of people will not buy them then because they are afraid. If they would analyze the cause of their fear they would discover it to be due to doubt as to the very stability of American institutions, for nothing less fearsome would justify certificates of ownership in the great industries of the nation selling at such ridiculous prices.” R.W. McNeel

“Fear is the oldest human instinct, from the standpoint of biology. It is universal and the most deep-rooted of all. It is the outgrowth of the instinct of self-preservation, through whose effective workings life has been able to survive through the ages. Every man has this instinct developed to an uncomfortable extent. Because of its ancient origin and its great strength, man is at all times exposed to the absolute breaking down of his courage under certain conditions and frequently without cause.” R.W. McNeel

“Fear is the foe of the faddist, but the friend of the fundamentalist.” Warren Buffett

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffett

“During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy.” Warren Buffett

“If you have a temperament that when others are fearful you’re going to get scared yourself, you know, you are not going to make a lot of money in securities over time, in all probability.” Warren Buffett

Patience

“Patience - an indispensable quality. If one were asked to name the quality which as much as any other is essential to success in speculation, the answer would be ‘patience.’” R.W. McNeel

“The biggest thing about making money is time. You don’t have to be particularly smart you just have to be patient.” Warren Buffett

“The stock market is designed to transfer money from the active to the patient.” Warren Buffett

Take a Loss

“One great weakness of the average speculator is his inability to swallow small losses. He can never forget what he paid for a stock. He sees it go below his selling price, and, regardless of the position of the general market in the cycle, declines to sell, always hoping for a rally which will let him out whole.” R.W. McNeel

“I’m quite capable of selling a stock when it goes down. I am quite capable of buying a stock when it goes down. It all depends on the underlying facts.” Warren Buffett

“Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.” Warren Buffett

“The stock doesn't know you own it. The stock just sits there; it doesn't care what you paid or the fact that you own it.” Warren Buffett

Buy at Market

“The point is just this - if a stock is cheap at 30, it is cheap at 32. So there is no common sense in running the chance of missing what one believes to be an opportunity to make 100 per cent on a speculative venture, by sparring for an extra point or two on the buying side. Buy ‘at the market.’” R.W McNeel

“There’s a lot of mistakes that I’ve repeated, I can tell you that. The biggest one, probably — or the biggest category over time — is being reluctant to pay up a little for a business I knew was really outstanding, or to continue to buy it at higher prices when I knew it was outstanding. So the cost of that has been many, many billions. And I’ll probably keep making that mistake.” Warren Buffett

Stock Prices

“There is no such thing as ‘can't’ in respect to the stock market. Any stock can do anything.” R.W. McNeel

“In stock markets, it’s an auction market. Crazy things can happen.” Warren Buffett

“It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. ‘Efficient’ markets exist only in textbooks. In truth, marketable stocks and bonds are baffling, their behavior usually understandable only in retrospect.” Warren Buffett

Opinions

“It is a curious fact of finance that any one on the ‘street’ is always willing to express an opinion on the market, and on any particular stock, however little he may know of either.” R.W. McNeel

“We’re not looking for opinions. We’re looking for facts.” Warren Buffett

“You really shouldn’t ask other people their opinion about stocks. Let’s say I give an opinion on the XYZ company. I could change my opinion a week from now and [you won’t know]. You ought to have your own reasons for buying a stock. If you don’t your going to get shaken out by some event, the stock markets goes down a lot or you read some negative comments. You should make you own judgements in stocks.” Warren Buffett

Get Rich Quickly / Hard Work

“Where the public in general does err is in thinking the market is a ‘get rich quick scheme.’ It is not a game which pays something for nothing, or much for little. It is a game which repays liberally careful study of the underlying conditions which cause stock-market fluctuations. But the reward is apt to be more or less commensurate with the effort put forth to master it. It is a game to be beaten, not by disregarding the fundamental law of existence, but by remembering the old law that in order to reap the rewards of this world one must give something of himself, of his time and efforts and abilities, in order to acquire them.” R.W. McNeel

“People would rather be promised a (presumably) winning lottery ticket next week than an opportunity to get rich slowly.” Warren Buffett

“Read 500 pages every week ... That's how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.” Warren Buffett

“Intensity is the price of excellence.” Warren Buffett

The Crowd

“There is comfort in a crowd, in doing what others are doing, even when the support or refuge is purely illusory. It is calculated by war authorities that in an average company of men, 20 per cent possess a certain amount of initiative, 60 per cent will follow the crowd, and 20 per cent are cowards at heart. In speculation it is doubtful if 20 per cent possess the powers of independent thought and action.” R.W. McNeel

“When any one buys a stock merely because he thinks or some one tells him it is going up, regardless of its real value, he is following a speculative plan which is absolutely certain to lead on to ruin. He may make a profit once, twice, or half a dozen times by that method, but sometime he is absolutely certain to be badly hurt.” R.W. McNeel

“Men tend to flock together. Allied to this is the instinct of sympathy and imitation. Men have an inborn tendency to do what they see some one else doing; to run or stop or cheer when others act in that fashion. It is the same instinct which causes sheep to run or stop, or dogs to bark when other sheep run or stop or when other dogs bark, without having any special reason for doing so. By unconscious imitation or sympathy, men catch the feeling of others and act in accordance with it.“ R.W. McNeel

"An ability to detach yourself from the crowd — I don’t know to what extent that’s innate or to what extent that’s learned — but that’s a quality you need." Warren Buffett

“Once a bull market gets under way, and once you reach the point where everybody has made money no matter what system he or she followed, a crowd is attracted into the game that is responding not to interest rates and profits but simply to the fact that it seems a mistake to be out of stocks. In effect, these people superimpose an I-can't-miss-the-party factor on top of the fundamental factors that drive the market. Like Pavlov's dog, these ‘investors’ learn that when the bell rings - in this case, the one that opens the New York Stock Exchange at 9:30 a.m. - they get fed. Through this daily reinforcement, they become convinced that there is a God and that he wants them to get rich.” Warren Buffett

Sleep at Night Test

“‘What shall I do?’ said a trader to a great successful operator. ‘I am loaded with stocks, and the market keeps going down. I can't sleep nights.’ And the operator replied, ‘You sell your stocks down to the sleeping-point.’” R.W. McNeel

“The financial calculus that Charlie and I employ would never permit our trading a good night’s sleep for a shot at a few extra percentage points of return.” Warren Buffett

Checking Stock Quotes

“If one would be successful in speculation, he should keep away from the stock-ticker. It is a fascinating little machine, and any one holding stocks and constantly watching the ticker will have plenty of thrills. But the practice is a deadly one.” R.W. McNeel

‘Checking Stock Quotes’

“The average trader who hangs around the ticker eventually comes to look no farther ahead than the day-to-day fluctuations. His ideas are shaped wholly by the hourly movement of prices, and not by study of fundamental conditions of business on which his market operations should be based.” R.W. McNeel

"You know, I think people’s investment would be more intelligent, you know, if stocks were quoted about once a year." Warren Buffett

“Focusing on the price of a stock is dynamite, because it really means that you think that the stock market knows more than you do. Now if the stock market may know more than you do, but then you shouldn’t be in stocks. The stock market is there to serve you and not to instruct you.” Warren Buffett

“In investing, just as in baseball, to put runs on the scoreboard one must watch the playing field, not the scoreboard.” Warren Buffett

Maintain Focus

“All financial history shows that the old adage ‘Cobbler, stick to your last’ holds good of high and low alike. When one finds an able man sticking to his last, he is usually a safe man to follow. But where he is wandering far afield and engaging in industries in which he has had no training and no past successes, his name should not be considered any guarantee of safety of an investment or speculation in the stock of the concern in which he is interested.” R.W. McNeel

“Loss of focus is what worries Charlie and me when we contemplate investing in businesses that in general look outstanding.” Warren Buffett

“At dinner, Bill Gates Sr. posed the question to the table: ‘What factor did people feel was the most important in getting to where they’d gotten in life? And I said, ‘Focus,’ and Bill [Gates] said the same thing.” Warren Buffett

Charts

“In speculation, no mechanical device will ever take the place of judgment - not even the chart.” R.W. McNeel

“The chart of the price action doesn’t mean a thing to us, although it may catch our eye, just in terms of businesses that have done very well over time. But price action has nothing to do with any decision we make. Price itself is all-important, but whether a stock has gone up or down, or what the volume is, or any of that sort of thing, that is — as far as we’re concerned, you know, those are chicken tracks, and we pay no attention to them.” Warren Buffett

New Issues

“New flotations - Let someone else have them. In every period of rising stock prices, many new corporate flotations are brought to the attention of speculators by banking houses and so-called banking houses. Under the spell of the enthusiasm engendered by rising corporate profits and rising stock-market prices, these issues are floated, and innumerable speculators buy them hoping for quick profits.

Banking houses are manufacturers of securities. They manufacture not necessarily what people ought to have, but what they will buy. That is sound finance, too, where the manufacture of a security is for the purpose of raising money for the legitimate expansion of sound industries. But the majority of stock flotations in boom times in the stock market are largely for the purpose merely of realizing a promoter’s profit for the sponsors of the new issue.” R.W. McNeel

“When there is a boom in automobile securities on the Stock Exchange, one may expect several new motor stock flotations, not because there is a public need for a new motor concern, but because the public mind has been inflamed by stories of great profits made by those who bought the motor stocks months previously, and the public is in a frame of mind to buy a new motor stock. It is the state of the public mind and the desire for a rake-off on a new issue, rather than the necessity for a new motor concern, which dictate the stock flotations.” R.W. McNeel

“The public usually ‘falls’ for these new flotations. It is argued by false analogy that because an established motor stock is good and the price is advancing, the new stock must be good. In addition, they swallow the customary selling argument that purchase of the stock at the very inception of that concern gives them an opportunity to get in ‘on the ground floor.’

Prospective buyers of the stock are practically always shown figures representing the tremendous profits made by the original subscribers to stocks of the big successful concerns in the industry, the theory being that they will be duplicated by purchasers of the stock of the concern being floated.

In reality, the public ought to argue that the stock of the new flotations is probably much dearer than stocks of the successful concerns already listed on the Stock Exchange, for the price of the new stock includes a big promoter’s profit. Moreover, the older companies are established in their fields and their business is assured as far as any business can be, whereas the future of the new concern instead of being assured is a pure gamble.

That line of reasoning applies to nearly all new flotations of stock. In copper booms, new copper stocks are printed. In zinc booms, new zinc mines are discovered or old ones are polished up. In steel booms, privately owned steel concerns are bought from their owners, recapitalized, and their stocks sold to an enthusiastic public.

Sometimes speculative profits on these things materialize, but it is a good rule to let the new propositions alone. Standard listed stocks which have stood the battledore and shuttlecock of the marketplace for years can usually be had intrinsically cheaper than the new things being floated, and they usually enjoy a more stable market in times of unsettlement. In addition, it is unsound speculation to buy stocks in a boom period in any case, and the new flotations usually make their appearance only in the latter stages of a great bull market.” R.W. McNeel

“I will guarantee you that if you have thousands of opportunities among stocks all over the world and most of them are not being promoted or being sold with special commissions in them or something else, and then some other security is coming to market that day, when the seller picks the time to bring it, as opposed to just this auction market operating otherwise, you know, it just doesn’t make any sense to spend five seconds thinking about new issues, so we don’t think about them.” Warren Buffett

“An intelligent investor in common stocks will do better in the secondary market than he will doing buying new issues. The reason has to do with the way prices are set in each instance.” Warren Buffett

“It’s almost a mathematical impossibility to imagine that, out of the thousands of things for sale on a given day, the most attractively priced is the one being sold by a knowledgeable seller (company insiders) to a less-knowledgeable buyer (investors).” Warren Buffett

“I don’t think buying new offerings during hot periods in the market is anything the average person should think about at all.” Warren Buffett

Brokers

“When it comes to taking a broker’s advice in stock market operations, it is a different proposition. They should probably all be shunned, or at least their advice should be considered very carefully before one acts on it.

There are various reasons for that statement. The majority of brokers are not deep thinkers nor deep students of financial affairs. The very nature of their business makes them shallow. Moreover, while the interests of the broker are supposed to be the same as those of his client, because, theoretically, the more money the client makes the more commissions the broker will receive, in reality their interests are quite different.

It is in the interests of the client to trade very infrequently. The only safe rule of speculative success is to buy when prices are low and wait patiently until they are high. That does not involve many brokerage commissions. The broker, however, can only thrive through having his customers trading in and out of the market every day or every few days. That involves trying to catch the small fluctuations in prices, and not the long swings.

No one knows or can guess consistently what the market will do from day to day, for the small swings are not brought about by any fluctuations in fundamental conditions. They are largely the result of psychological phenomena. They merely reflect the vagaries of the speculative mind. The broker’s guess as to what these may be is no better than that of the street-sweeper, and perhaps not so good, for the street-sweeper would have no preconceived ideas of the fluctuations, while the broker would probably feel it his duty to be bullish most of the time. The majority claim to be optimistic most of the time, though it is obviously impossible to be right on the bull side much more than half the time.

But the average broker figures that for his own best interests he must be bullish for several reasons. First, no one likes a pessimist, while every one likes an optimist for the good cheer he engenders even if he is wrong. A pessimist would drive customers away.

Second, the public seldom sells short, so nearly all the business a broker gets must originate on the buying side. The selling side afterwards will take care of itself. That is, if a man goes into a brokerage house with an idea of doing something in the market and the broker is pessimistic, the chances are the customer will go out without doing anything. He may give his orders to some other broker.” R.W. McNeel

“One fact of financial life should never be forgotten. Wall Street – to use the term in its figurative sense – would like its customers to make money, but what truly causes its denizens’ juices to flow is feverish activity. At such times, whatever foolishness can be marketed will be vigorously marketed – not by everyone but always by someone.” Warren Buffett

“Anytime I see some article that says, you know, these analysts say this or that about some business, it just — it doesn’t mean anything to us. You cannot get rich with a weather vane.” Warren Buffett

"I never talk to brokers or analysts... You have to think for yourself... Wall Street is the only place people ride to in a Rolls-Royce to get advice from people who take the subway." Warren Buffett

Broker Sales

“A popular ex-football player, a golf champion or tennis star is a much more desirable customers’ man or perhaps a more desirable partner in a brokerage house, in the eyes of the broker, than a little known financial genius. He can generally pick up the lingo of the ‘street’ quickly, and conceal his financial ignorance by indulging only in glittering generalities, while his presence there attracts his friends and admirers.” R.W. McNeel

"There’s been far, far, far more money made by people in Wall Street through salesmanship abilities than through investment abilities." Warren Buffett

Broker Incentives

“The salary the customers’ man (the broker) receives and his bonus at the end of the year depend not on the amount of money his clients make, but on the number of times he gets them in and out of the market—that is, on the amount of commissions he brings in.” R.W. McNeel

“[The broker’s] getting paid based on how many pills he sells. He gets paid more for some pills than others. You wouldn’t go to a doctor whose pay was totally contingent on how many pills you took.” Warren Buffett

Broker Reports

“Brokers’ letters, issued daily or weekly, are intended to fill the same purpose, namely, of getting speculators to trade frequently. They are usually bullish. When they are not so they are generally non-committal. The letters are calculated to inspire confidence whether justified or not, and create action among clients. It is just another method of pursuing the elusive commission of $15 on each hundred shares of stock traded in.” R.W. McNeel

“We never look at any analyst reports. If I read one it was because the funny papers weren’t available. I don’t understand why people do it.” Warren Buffett

"You can’t read Wall Street reports and get anything out of them. You have to do it yourself and get your arms around it. I don’t think we’ve ever gotten an idea, you know, in 40 years from a Wall Street report. But we’ve gotten a lot of ideas from annual reports." Warren Buffett

Summary

While Buffett ultimately built a far broader and more sophisticated investing framework than McNeel could ever have imagined, the foundations McNeel laid in 1927 remain remarkably solid. Strip away the technology, the speed, the data, and the noise, and you find the same timeless principles: discipline, patience, rationality, independent thought, and a focus on value anchored in real businesses run by real people.

That is why this nearly century-old book still feels so alive. Markets evolve, but human nature does not. The behaviours that drove booms and busts in McNeel’s era are the same forces we wrestle with today — fear, greed, impatience, imitation, overconfidence, and the lure of the crowd.

Or, as Buffett put it most succinctly:

“Humans behave the way humans behave, and they’re going to continue to behave that way in the next 50 years.”

McNeel understood that in 1927. And for the thoughtful investor, the lesson is clear: if you master yourself, you can master the market — regardless of the century you’re living in.

Source:

McNeel, William W. Beating the Stock Market: A Book of Practical Investment Advice. New York: The Magazine of Wall Street, 1927.

Follow us on Twitter : @mastersinvest

* Visit the Blog Archive *

TERMS OF USE: DISCLAIMER