2025 Reading - Favorites

People often ask me what's on my reading list, and to be honest, there’s usually one or two books I’m keen to read, but most of them pop up along the journey. 2025 has been no different. Of the thirty-plus books I’ve read this year, I can only think of two that would’ve been on the list at the end of last year. In fact, many of them I hadn’t even come across before. They usually show up in idiosyncratic ways…

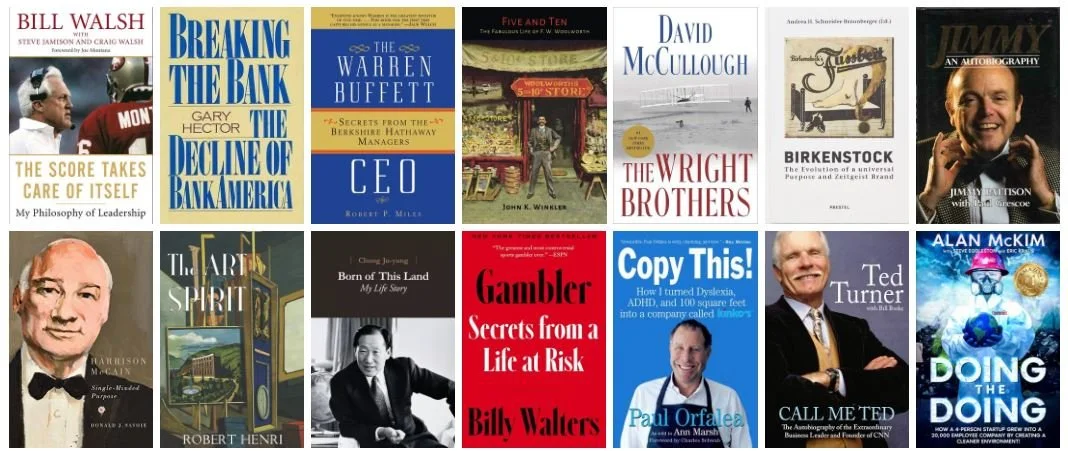

I came across Breaking the Bank after diving into the incredible story of Bank of America founder A.P. Giannini last year. I picked up The Wright Brothers after a tweet reminded me of their improbable success. I read Jimmy Pattison’s book after learning he was a hero of Harrison McCain (of McCain Foods). I got into F.W Woolworth after reading about one of Munger’s heroes—Simon Marks of Marks & Spencer—who said he had to change his entire model because he couldn’t compete with Woolworth. Chatting to Irv Blumpkin from Nebraska Furniture Mart—and having enjoyed memoirs from many of the CEOs of Berkshire’s acquisitions—drew me to The Warren Buffett CEO, where Irv, incidentally, is interviewed.

One book, one snippet from an investor, or one CEO insight is often all it takes.

I picked up The Score Takes Care of Itself because I’ve always loved great coaching books—Wooden by John Wooden is an all-time favorite—and both were co-authored by Steve Jamison. Walsh’s book didn’t disappoint; it’s now one of my all-time favorites. His reflections on preparation, culture, and setting high standards are masterful—but it’s his candid insights on handling pressure and the relentless expectation to win, which ultimately led to his early retirement, that I think will resonate most deeply with professional investors.

It was Bill Walsh’s book that unexpectedly led me to one of the more oblique—but most rewarding—reads of the year. The Art Spirit by Robert Henri came onto my radar through a video of Jack Dorsey sharing two of his favorite books. One was Walsh’s, which I had just finished. The other was The Art Spirit, which I remembered seeing on Blas Moros’ “Books Worth Re-Reading” list. I nearly skipped it—but I’m glad I didn’t.

While I’m a hopeless artist, I think—like most people—I’ve always felt I grasp the concept of art. But this book, written back in the 1920s, was a humbling eye-opener. Henri’s reflections on creativity, intention, and mastery revealed ideas I’d never before considered. His emphasis on continuous improvement, self-education, finding beauty in the everyday, and letting your work reflect your values reminded me that great founders and great artists aren’t so different. Both seek clarity of vision. Both obsess over quality. And both refuse to be boxed in by convention.

This year’s reading has been less about compiling information and more about synthesizing insight—learning to see across silos, and realising that whether it’s painting, flying, or selling steakburgers, the principles of excellence often rhyme.

I was never much of a reader in high school—in fact, I probably read only one book. I’m also a pretty slow reader. But I don’t read to finish; I read to learn. Much to the disgust of one of my colleagues, I underline pages and write notes in the margins. I often revisit those books and find the notes invaluable. Over time, I’ve built a 1,500-page repository of quotes, organized by topic—a handy reference for my investing. What’s fascinating is how often these quotes echo the same characteristics found in successful human endeavors across time. If the books are truly fabulous, their insights might make their way into a blog post (or draft - I still have plenty of those to finish!).

Ultimately, I’m trying to extract lessons. While we don’t spend hours building spreadsheet models, we do spend a lot of time identifying the mental models that define and drive our investing. Where most analysts get lost in the spreadsheets, I find the most important elements often sit outside them. The mental models are mostly qualitative—and it’s the qualitative features that drive the quantitative outcomes. In fact, many of our most successful investments have been anchored in a single mental model—or a powerful combination of them. I can think of numerous times when one well-applied idea, drawn from my readings, has saved us from investing in businesses that looked fine on a spreadsheet but were fundamentally flawed.

One theme that really stood out this year was how many founders I read about faced significant adversity—their success was anything but linear. It was resilience, paired with relentless hard work, that proved crucial. Many were underdogs.

2025 Reading continued…

Ted Turner (Call Me Ted) took over a struggling billboard company after his father’s suicide—having already lost a younger sister and grown up with alcoholism at home. Sheila Johnson (Walk Through Fire) was abandoned by her father and endured an abusive marriage before co-founding BET. Alan McKim (Doing the Doing) was forced out of home by an alcoholic father and built Clean Harbors from scratch. Billy Walters (The Gambler) overcame poverty, gambling addiction, and prison to become one of the greatest sports bettors of all time. Chung Ju-Yung (Born of This Land) escaped extreme poverty in Japanese-occupied Korea, endured the failure of two businesses, and ultimately founded Hyundai, building the backbone of modern-day Korea. Paul Orfalea (Copy This) grew up with dyslexia and built Kinko’s by trusting others to handle what he couldn’t. Even Charles Goodyear—was relentless in his pursuit of vulcanized rubber, enduring jail, poverty, and ridicule for a decade before succeeding.

Oftentimes, fanatics are forged in hardship.

The best lessons don’t come from the cleanest stories—they come from the mess, the comeback, and the long game. And the more I read, the more I believe: you can learn from everywhere. The job is to stay open, stay curious, and keep building the mental latticework—one page at a time.

Follow us on Twitter : @mastersinvest

* Visit the Blog Archive *

TERMS OF USE: DISCLAIMER