One dollar invested in John Malone’s TCI in 1973 had grown to $3,950 by 2024. That’s an annualized return of 17.4%, compared to just 11.1% for the S&P500 ($234). Those numbers don’t happen by accident. They are the product of genius, discipline, and a relentless pursuit of advantage.

Malone’s new biography Born to Be Wired is a masterclass in corporate transactions, navigating industry dislocations, and thinking long-term. From the outset, Malone understood that scale was the lifeblood of cable. Larger networks spread fixed costs, lowered unit prices, and built bargaining power. His entire career reflected a deep appreciation of scale economics shared, decades before investors turned it into a catchphrase.

But Malone also knew that scale meant little without the right people. He backed visionaries like Rupert Murdoch, Barry Diller, and Ted Turner - entrepreneurs who could harness technology and storytelling to capture markets. He placed rational analysis above emotion and trusted leaders to act in their own enlightened self-interest.

Malone’s long-term success came from thinking ahead. Traits that bordered on the autistic made him relentless in seeking order where others saw chaos. He built intricate deal structures, embraced new technologies early, and anticipated inflection points long before they were obvious.

For investors, Born to be Wired is more than corporate history. It’s a guide to the future: global scale, technological edges, incentives that align with long-term value, and leaders willing to adapt when the ground shifts. Malone’s career reminds us that capitalism is unforgiving, but for those wired to embrace scale, back people, and resist short-term temptation, the rewards can be extraordinary.

Below, I’ve gathered some of my favourite quotes from the book and other sources.

Personality & Drive

“I regarded myself as mismatched to the world to some degree, handicapped by an absence of social skills or the drive to socialize, and envious of the people who felt at ease in crowds and parties. Even the people I think I am close to sometimes see me as cold and aloof. I have come to realize later in life that, like other members of my family, I am a high-functioning autistic.”

“I am an introvert, and I am quiet—for the most part—at meetings. Public speaking for me can be a mild form of punishment.”

“I can appear to be distant and unapproachable at times. But my autism, wherever it is on the spectrum, has gifted me with the ability to hyper-focus on intricate challenges and pursue a goal with dogged determination. From a young age, I saw patterns, connections, and solutions others overlooked and this attention to detail helped me identify opportunities early and gave me a competitive edge. With a virtually photographic memory at the time, I could recall verbatim entire sections of books.”

“I learned to forgive others easily, but forgiving myself was always a silent negotiation with the ghost of my father's expectations. I missed him then as I miss him now. The unfulfilled need for his approval, maybe more than anything, is a major element of what drives me, and over a lifetime, with male mentors, bosses, and friends, I've tried to prove my worth.”

“Brilliant ideas never came to me like a bolt of lightning. Creative genius for me was the constant assemblage of prior exposures and putting those things together for a solution.”

Palchinsky Principal

“Now fifty years ago, I made a promise to myself that I never have broken: If we get out of this alive, I will never bet the whole farm... on anything. No deal is ever worth doing that..”

“Monty Shapiro, my first business mentor, when I was in my twenties, who told me, ‘Son, always ask, 'What if not?' What if things do not go as planned?’ He taught me to assess the worst that could happen and ensure that we could live to fight another day, advice that I hear in my head thinking over every big deal.”

Beyond Numbers

“The bankers saw us as just numbers on a balance sheet—and they would never understand what drove us. Bootstrapping the business over the past two years had forged a strong bond between us all at TCI. This was our life's work, something built on grit, optimism, and a trust that ran deeper than any balance sheet could reflect.”

“Everything looks good in a PowerPoint presentation— the real world is always harder.”

Competitive Advantage

“Unlike some industries where it is kill or be killed…. each cable system was a natural monopoly awarded by the local government, which allowed us to spend more time lobbying jointly on regulatory issues and solving thorny technological issues. Most of all it led to a collegial, almost familial industry, where friendships grew.”

“Yielding to a better, smaller competitor taught me that when you lack a special expertise, it is better to own a small piece of a thriving enterprise rather than to own 100 percent of a struggling one you don't know how to run.”

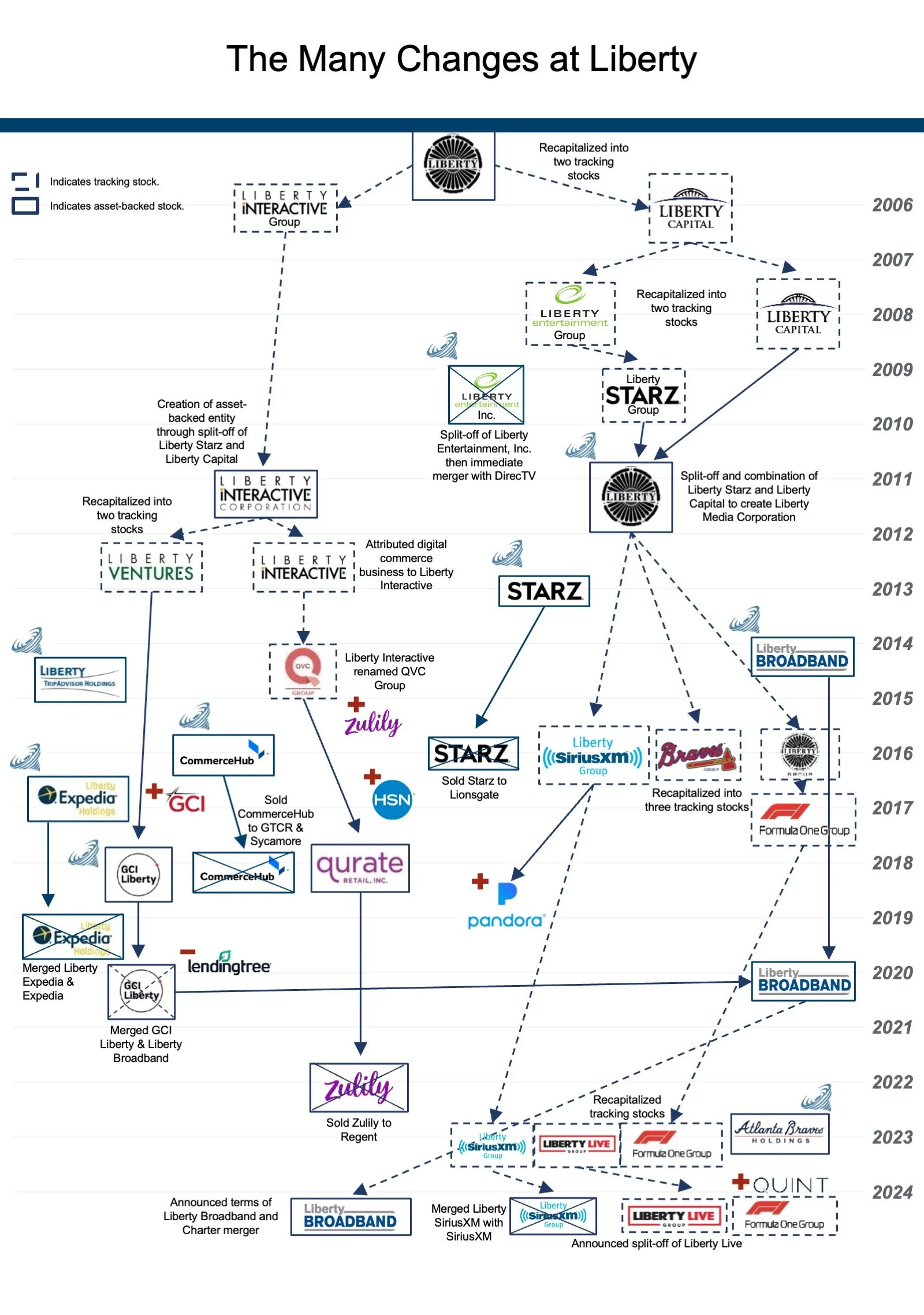

Source: Liberty Media Annual Report 2024.

Tailwinds

“Demand for cable service was compounding, spreading from its rural roots as an antenna service and into some of the largest urban centers, from New York City on down as a source of new and unique programming. From 1976 to 1987, revenue industry-wide expanded more than twelvefold, from $900 million to almost $12 billion. America liked the taste of cable TV.”

“With the post-World War Il economy roaring, Americans craved entertainment and connection. Facing a flood of applications for broadcast stations and technical challenges to map them, the FCC imposed a ‘freeze’ on new TV licenses from 1948 to 1952—leaving millions of Americans in a television void. Into that vacuum stepped plucky pioneers who devised a bold solution: hoist towering antennas atop the highest peaks to capture faint transmissions from distant stations. From there, they strung wire, pole by pole, down into the shadowed towns below.”

Scale-Economics

“We raised money from everywhere —banks, insurance companies, publishers, Wall Street, anyone with capital—to fuel TCI's growth, because I knew the advantage would go to the biggest company. Scale economics drove every decision.”

“By 1982, TCI had built itself into the nation's largest cable company, but the biggest deals were yet to come. More scale equals more savings, which gave us more buying power to buy more systems and build more scale, which equaled more savings - a virtuous growth cycle.”

Long Term

“I’m always a long term guy.”

“Throughout my business career, I have done everything I can to be in control of the companies in which I invest. Control is a necessity rather than a luxury—it is the primary reason we have succeeded. At Liberty Media, our controlling stakes in our various properties let us avoid having to spend all of our time looking over our shoulders, making short-term decisions for antsy Wall Street analysts looking for quarterly gains.”

“Often, I get asked about the ‘endgame’ for the Liberty Media structure. I don't know what that is, but I will let you know when we get there. Liberty is in a constant state of evolution as a business. Nothing is forever at Liberty, but there is one element that remains constant: a focus on growing long-term shareholder value.”

“A big part of any chairman's role is making sure you have hired a CEO who is focused on long-term wealth creation for shareholders - and a themselves. Self-interest is a driving force in capitalism. You must avoid micromanaging - and trust them.”

“We had the advantage of even though we were a public company, we were controlled. Bob Magness, as the principle shareholder, the controlling shareholder, wasn’t particularly interested in near term earnings and was willing to really pursue a long-term strategy, which certainly I was, and so we were able to do things that most public companies can’t do.”

“If you’re going to ask about quarterly earnings, you’re at the wrong meeting. What we care about is value. We want to create value for our shareholders. And I think the best way to create value is to have a very long view, so that’s what we do.”

Source: Liberty Media Annual Report 2023.

Decentralize / Autonomy

“You always try and get back to that theory of decentralized, delegated authority and responsibility. So that shaped a lot of my concepts about the right way to run things.”

“TCI was decentralized to the point that decisions were delegated to six different regions, each with their own accounting, engineering, and maintenance teams. Layered on the owned systems, we were operating systems through more than fifty partnerships, most of which were with the original operators we trusted to keep running more systems. If you buy a property and find a manager motivated by ownership in the company, keep them in power and trust them.”

“Our theory of making money was similar to Berkshire Hathaway— a portfolio of companies run by a lively mix of driven and dedicated entrepreneurs.”

“We don’t believe in staff. Staff are people who second-guess people.”

Business is People

“Wall Street bankers debate which metric is best for divining the intrinsic value of a company. Is it revenue growth or the bottom line? Forward-looking earnings estimates or shareholder equity? What about any one of the alphabet soup of acronyms they so love to spout —EBITDA, ROE, ROI, ARPU, CAGR, EPS, P/E, P&L? But none of these is right. We focused hard on one measure: cash flow, or specifically, EBITDA (earnings before interest, taxes, depreciation, and amortization). It gives a clearer picture of operating performance and a firm's ability to borrow or invest. Some people say I all but invented the term. I can't swear to it, though it is true that I helped make it a whole new form of currency on Wall Street. But it turns out that cash flow is the wrong answer, too, in placing a value on a company, or any deal for that matter. The most valuable assets in any business are people and relationships.”

The Right People

“The right people at the right time can change everything.”

“I may have neglected to appreciate this at the time, when we were down in the fray. Now that I am a bit older and slowing down, just a little, I have realized that, all along, the most important element was who was involved, not what. The people whom I befriended, learned from, and fought against — rather than the deals or the payoff— gave me the most satisfaction. And the right people produced the highest upside— giving my journey meaning and enriching my knowledge of the world.”

“For all the knowledge I have accumulated, there are things I will never know how to do. I have learned that no matter how brilliant you are, there will be other people who are better than you are at executing your ideas. And if you are smart, you will politely step out of the way and leave them to it.”

Skin in the Game

“A guy who rises to the top of a big corporation and owns none of it is much more interested in control than he is in economics. It is just the nature of humanity. A guy who owns his business is used to control. He never has to fight for control. What he has to fight for is economics. But a bunch of entrepreneurs find it much easier to collaborate and create economic value. They have something beyond control—they have economics.”

“Guys will understand a cable system a hell of a lot better if they have skin in the game.”

Share the Profits

“TCI made millionaires of many middle managers, and even a few secretaries, and the payoff built loyalty among employees. In the first 16 years of the company, not one key executive had left for another job. TCI’s outside share-holders benefited as well.”

Mistakes / Embrace Technology

“When you run a technology company you have to take your shots, and sometimes that means losing hundreds of millions of dollars. I call it tuition. You either adapt to new technology, disruptive or not, or die with ‘this is the way we've always done it.’”

“Business is like chess. You can feel remorse over your own bad move, but it is wasted energy to get angry at your opponent for making a good one.”

“Sometimes you have to experience a setback or a surprise to change your way of thinking. I look back and wish I had done some things differently, but I know the mistakes I made are an important part of what I learned, and they helped shape my thinking and make me a better person.”

“I have made many mistakes in business and life, and selling TCI to AT&T might have been the biggest whopper of them all. Losing more than half my wealth at the time was jarring, but also it was galling… My harshest personal critique is that I failed to look hard enough a what we were getting in return for selling TCI to AT&T. We were raptly focused on the handsome premium that AT&T was willing to pay. We were too optimistic. Other TCI shareholders could sell their stock and take the premium, but we were stuck.

Capital Allocation

Source: Liberty Media Corporation 2024.

“While many of my peers in the media and entertainment business were empire builders, I always advocated for smart capital allocation and good timing—like exiting Japan and Australia at high multiples and reinvesting $5 billion into Europe, where the cable market was fragmented and ripe for consolidation.”

“For the most part, Liberty has opted to own stakes of companies, rather than take full control, and then to spin those stakes out at the right time to create more public companies with their own separate stocks, creating sill more value for shareholders. Among the companies Liberty has spun out are Discovery Communications, Starz, DirecTV. QVC, Liberty Broadband, Expedia, and Sirius XM.”

“We (had) been in business 20 years as a public company, we have never paid a cash dividend to our shareholders. We have invested every dollar that we've been able to scrape together through equity sales or borrowing back in the cable business. Our cumulative retained earnings in that time has been zero. We have plowed everything back into growth and renewing our technology. Cable companies are cash alligators, capital alligators.”

Acquisitions

“Chemistry and culture are key ingredients in any merger, and this becomes apparent very early on.”

“You can choke on a deal if you rush through the numbers or get too emotional about a prize. You must learn the other company's business as fast as humanly possible before you commit money, even after assurances from the seller. A lesson I've come to embrace: there is no such thing as too much due diligence before a merger.”

“All of the due diligence in the world, however, will fail to rescue you if you are dealing with a deceitful person.”

“Most of the money I’ve made in my life is when other people don’t like what’s going on.”

“In more recent years, Formula One had failed to live up to its potential, and it looked more like a fixer-upper. I like fixer-uppers, in both cars and companies: they are a lot cheaper than buying something shiny and new. Plus, you could buy the whole shebang for maybe $4 billion or so, less than the cost of just one NFL team.”

Trust

“Trust is the foundation of all business, and it is difficult to earn and easy to lose.”

Innovate / Continuous Improvement

“Adapt or die’ isn't just a catchy phrase— it's the brutal truth. The companies that evolve prosper; the ones stuck in the past get left there. Cable’s ability to pivot, from TV into broadband and telephone and wireless connectivity demonstrates precisely how industries not only survive disruption but surf it for new opportunities. Adaptability is a pillar of the industry’s enduring success.”

“I remain energized by the relentless reinvention of this industry. The companies that stay sharp, anticipate change, and adapt will survive— because media, at its core, is a living organism. It evolves or it dies. And that instinct to adapt, to thrive in chaos—that's what drew me to this business in the first place.”

Declining Businesses

“Why buy this once-beautiful but now fading star in the sky? (DirectTV) Even a declining business offers good intrinsic value if you can acquire it on the cheap on tax-advantaged terms. Plus, people always overestimate how soon the Next Big Thing will arrive and take hold. And we also underestimate how long the old incumbent technology will hold on. You can earn a nice return by investing in assets that fall somewhere in that gap, and DirecTV was one of them.”

Read & Learn

“I loved to read.”

“All my career, I have tried to nurture a curiosity to learn.”

“My wife says I overthink and extrapolate for everything, from menu choices to movie night. I was a loner in my teen years, and I could bury myself in books while isolating myself from the high school social scene.”

“My parents never had big money, but what they left with me was more valuable: a love of learning and proof that education could change a life. For them, success wasn't measured in dollars— it was measured in curiosity, effort, and growth. That's the inheritance I carry forward in my philanthropy, trying to give others the same chances.”

Listening

“Listening. A severely underrated talent in business. It should be a class unto itself in business schools. Most people in a conversation are waiting for their turn to speak. Everyone wants to be heard, but few people in business engage in listening to understand. I have learned an awful lot about business over the last sixty-plus years by asking dumb questions and then keeping my mouth shut, more than I ever learned by saying something.”

“The thorniest case I worked on (while employed at McKinsey) was a reorganization of General Electric. Connecting with people, understanding their biggest concerns, and mapping their universe proved far more valuable than reading GE annual reports. You have to go in and talk to people to understand why something's not working. And again, you listen.”

“To understand the sport's core issues and challenges, (F1’s new CEO - Chase Carey) embarked on a listening tour, meeting with team owners, marketers, even the drivers, identifying pain points that hampered growth. Afterward, he observed quite bluntly to the press: Formula One ‘doesn't tell any stories. The goal in this is to make the fans connect to the live experience as much as possible, and the tools you have to do that, we're not using at all.’ Chase changed not only the tools, but the entire culture, toward long-term growth instead of short-term gains.”

Win-Win

“Even with my somewhat lesser people skills, I got pretty good at the people end of dealmaking... I learned not only that you have to put yourself in the other person's shoes to figure out what they want, you also have to always leave something on the table for the other person in the deal.”

Don’t Dilute

“We believed our stock was undervalued, and I avoided using cheap currency to buy assets — a mistake many start-ups make by giving up too much equity early, instead of waiting to raise capital when their value is higher.”

Disruption

“A traditional cable network, to take hold, had to sell itself to a cable operator that held a choke point over the network's ability to reach viewers. Netflix, by contrast, circumvented the cable operator as the retailer of video content and sold directly to the consumer -and then delivered the product over the cable systems' high way without paying them for the transit.”

“Reed Hastings and Netflix paved the way for the streaming revolution that now is all but shattering the traditional TV business I've been a part of all my adult life. Netflix sparked an era of mergers, collaborations, and bidding wars that continues today. Brilliantly, Reed beat the cable giants at their own game, using the content they sold him and the platform they had built. The cable industry funded its own demise, and cable networks added to their troubles by selling their movies and TV series to Netflix, helping it lure away more viewers. Netflix gained traction with network series reruns like The Office and Friends; only later did to come up with its own original hits.”

“Netflix was streaming so many off-network shows to U.S. homes that it was the single largest consumer of internet bandwidth in North America, hogging 33 percent of all traffic in peak nighttime hours. Just a year earlier the portion was at 20 percent, far surpassing Amazon Prime Video, Hulu, and HBO GO. Here's the really hard part to swallow—Netflix's business was using the wires that cable operators strung and spent hundreds of billions of dollars to upgrade, then slurping up the lion's share of usable bandwidth—and paying almost nothing for it.”

“By June 2025, Netflix, Disney, and other streamers collectively reached a historic milestone, surpassing the viewership of cable and broadcast TV combined for the first time, with a record 44.8 percent total of U.S. TV usage, according to Nielsen. For the industry, letting itself get so disrupted by Netflix was an astonishing misstep, and this owes in part to the fact that the cable giants consistently underestimated Reed Hastings and his company at every turn. In business, as in life, you can be blinded by the confidence that comes from ‘That's the way it's always worked.’”

“Reed Hastings had used the cable industry's wires, and their shows, to build a new rival right under their noses. And now with his own programming, he was getting stronger by the viewing minute. Federal regulators played a key role in letting Netflix run rampant over the cable industry, which they seemed to regard with suspicion and disdain. And cable incumbents were outgunned badly, in terms of their lobbying power vs. Big Tech.”

“Facebook, Apple, Amazon, Netflix, and Google are so massive in scale, reach, influence, customer data, and profitability, and so far out ahead of any other company with any shot at challenging them, that only smart and specific government regulation has any chance of keeping them honest.”

“For the most part, regulators and politicians are nowhere to be seen. Compare the free rein that Big Tech gets from government today with the onerous laws slapped on the cable-TV industry: the Cable Communications Policy Act of 1984, the Cable Television Consumer Protection and Competition Act of 1992, the Telecommunications Act of 1996, and net neutrality rules in 2015.”

“Pay-TV subscriptions (traditional cable, telco, or satellite TV-excluding virtual MVPDs) have taken a steep dive - down to just 35 percent of U.S. households from their towering 87 percent reach in 2010. By the end of 2024, only 46 million subscribers remained, a staggering 54 percent drop from the peak of 99 million. That's 53 million homes gone, and assuming, $30 a month in lost revenue, over $19 billion a year in lost revenue. Mean-while, the infrastructure costs haven't budged.”

“One of the biggest flaws in the cable-TV package was the skyrocketing price of live sports— the NFL, the NBA, and MLB. Programmers such as Disney bundled ESPN, historically the most expensive network by orders of magnitude, into their wholesale package. For years, cable passed these rising costs on to customers for its basic package, but subscribers bolted when cheaper, no-contract streaming services appeared. The once-mighty ESPN, boasting 100 million cable subscribers at its peak, counts only 66 million now, and that's falling.”

“ESPN announced plans for a stand-alone streaming service set to launch in 2025. This move will accelerate the decline of traditional cable TV and also signals a fundamental shift —premium live sports will increasingly bypass cable, catering directly to younger, streaming-savvy audiences. And when struggling local broadcasters, which now trade at historic lows, lose sports, there will be even less to draw in viewers.”

“If you think sports rights are pricey now, just wait—the next bidding war will be more brutal as Big Tech muscles in. Live sports remain TV's last bastion of appointment viewing, making up ninety-six of the top one hundred broadcasts in 2023. Tech giants see them as a golden ticket.”

“In the future, successful content companies must have global scale, but there will be no more ‘mass media.’ The world of content is splintering beyond recognition now. Quality, story, and characters still matter more than anything else, but there is unlimited capacity, and the choices for consumers are overwhelming. Technology will continue to shape the viewer experience. Cable operators were disrupted by streaming, but content creators will face similar disruption from AI. What once united millions now plays out on personal screens, each one feeding from vast Al-driven databases designed to serve up exactly what an individual wants to see.”

Obliquity

“Wealth is never what drove me, though I have been incredibly successful, beyond anything I ever could have expected. What really drove me was a desire to bring order to chaos. I want to take the bulk of the wealth I have been lucky enough to accumulate and do good things with it. In the commotion and confusion of life, I find myself constantly searching for order.”

Happiness

“When it comes to emotions, I am more of a stoic like my father. Happiness seems to me a relative measure, because it must be juxtaposed to expectation. If you walk through life expecting everything to be wonderful and trouble-free, you will never be what most people consider happy.”

Career Advice

“A simple lesson for any person graduating college, starting a new job or beginning a relationship: you will go incredibly far in life if you simply do what you say you will do.”

Summary

John Malone’s career is a reminder that enduring success in business isn’t built on quarterly numbers or flashy headlines — it rests on scale, discipline, the right people, and the willingness to think decades ahead. Prudence, coupled with fanatic intensity, allowed him to thrive in industries defined by disruption.

His story is far bigger than corporate transactions. It’s about people: rescuing Ted Turner from the clutches of Kirk Kerkorian, extending a lifeline to Mel Karmazin that saved SiriusXM — turning Liberty’s initial $12,500 equity stake into $5 billion and securing control of the company — backing Robert and Sheila Johnson to launch BET, the first Black-owned television network, showing up on Rupert Murdoch’s doorstep after secretly amassing a 17% voting stake in News Corp, and restructuring TCI so his influence grew from 20% to 40%. It’s about listening more than talking, betting on technology while others clung to the past, and trusting that the right people could create value beyond what any spreadsheet could predict.

Born to Be Wired captures the lessons of one of capitalism’s most original thinkers. Malone himself put it best: “The companies that stay sharp, anticipate change, and adapt will survive — because media, at its core, is a living organism. It evolves or it dies.” The same applies to investing. Those who adapt, learn, and think long-term will endure.

Sources:

Malone, John C., and Keach Hagey. Born to Be Wired: The Untold Story of John Malone, Cable Cowboy and Master Dealmaker. [Publisher], 2024.

Smith, Mark Robichaux. Cable Cowboy: John Malone and the Rise of the Modern Cable Business. John Wiley & Sons, 2002.

“John Malone Interview.” Hauser Oral History Project, Sydneo Institute, October 22, 2001.

Follow us on Twitter : @mastersinvest

* Visit the Blog Archive *

TERMS OF USE: DISCLAIMER