“Entrepreneurs are disproportionately valuable precisely because they are not confined to doing only those things that makes sense to a committee. Interestingly, the likes of Steve Jobs, James Dyson, Elon Musk and Peter Thiel often seem certifiably bonkers.”

“When you demand logic, you pay a hidden price: you destroy magic.”

“The human mind does not run on logic any more than a horse runs on petrol.”

“Logic is what makes a successful engineer or mathematician, but psycho-logic is what made us a successful breed of monkey, that has survived and flourished over time.”

“We have faster trains with uncomfortable seats departing from stark, modernist stations, whereas our unconscious may well prefer the opposite; slower trains with comfortable seats departing from ornate structures.”

Emotions Rule

“Think about it. There are some phrases that just wouldn’t appear in the English language:

‘I chose not to be angry.’

‘He plans to fall in love at 4.30pm tomorrow.’

‘She decided that she was no longer to feel uneasy in his presence.’

‘From that moment on, she determined no longer to be afraid of heights.’

‘He decided to like spiders and snakes.’”

Data

“More data leads to better decisions. Except when it doesn’t.”

“The need to rely on data can also blind you to important facts that lie outside your model.”

“Strangely, as we have gained access to more information, data, processing power and better communications, we may also be losing the ability to see things in more than one way, the more data we have, the less room there is for things that can’t easily be used in computation.”

“Bad maths can lead to collective insanity, and it is far easier to be massively wrong mathematically than most people realise - a single dud data point or false assumption can lead to results that are wrong by many orders of magnitude.”

“Just a few wrong assumptions in statistics, when compounded, can lead to an intelligent man being wrong by a factor of about 100,000,000 - tarot cards are rarely this dangerous.”

“A single rogue outlier can lead to an extraordinary distortion of reality - just as when Bill Gates can walk into a football stadium and raise the average level of wealth of everyone in it by $1m.”

“We should at times be wary of paying too much attention to numerical metrics. When buying a house, numbers (such as number of rooms, floor space or journey time to work) are easy to compare, and tend to monopolise our attention. Architectural quality does not have a numerical score, and tends to sink lower in our priorities as a result, but there is no reason to assume that something is more important just because it is numerically expressible.”

“Our brains did not evolve to make perfect decisions using mathematical precision - there wasn’t much call for this kind of thing on the African savannah. Instead we have developed the ability to arrive at pretty good, non-catastrophic decisions based on limited non-numerical information, some of which may be deceptive.”

“The risk with the growing use of cheap computational power is that it encourages us to take simple, mathematically expressible part of a complicated question, solve it to a high degree of mathematical precision, and assume we have solved the whole problem.”

“We fetishise precise numerical answers because they make us look scientific - and we crave the illusion of certainty. But the real genius of humanity lies in being vaguely right - the reason that we do not follow the assumptions of economists about what is rational behaviour is not because we are stupid. It may be because part of our brain has evolved to ignore the map, or to replace the initial question with another one - not so much to find a right answer as to avoid a disastrously wrong one.”

“To use the analogy of the needle in the haystack, more data does increase the number of needles, but it also increases the volume of hay, as well as the frequency of false needles — things we will believe are significant when really they aren’t. The risk of spurious correlations, ephemeral correlations, confounding variables, or confirmation bias can lead to more dumb decisions than insightful ones, with the data giving us a confidence in these decisions that is simply not warranted.”

“In reality, all valuable information starts with very little data - the lookout on the Titanic only had one data point .. ‘Iceberg ahead,’ but they were more important than any huge survey on iceberg frequency.”

“The data might suggest people won’t pay £49 for a jar of coffee and that’s true, mostly. However people will pay 30p for a single Nespresso capsule which amounts to a similar cost - without understanding human perception it is unable to distinguish between the two. Big data makes the assumption that reality maps neatly on to behaviour but it doesn’t. Context changes everything.”

“We should also remember that all big data comes from the same place: the past. Yet a single change in the context can change human behaviour significantly. For instance, all the behavioural data in 1993 would have predicted a great future for the fax machine.”

“It is possible to construct a plausible reason for any course of action, by cherry-picking the data you choose to include in your model and ignoring inconvenient facts. The more data you have, the easier it is to find support for some spurious, self-serving narrative. The profusion of data will not settle arguments: it will make them worse.”

Innovation

“Metrics, and especially averages, encourage you to focus on the middle of a market, but innovation happens at the extremes.”

“If you look at the history of inventions and discoveries, sequential deductive reasoning has contributed to relatively few of them.”

“A good guess which stands up to observation is still science. So is a lucky accident.”

“Business and politics have become far more boring and sensible than they need to be.”

“Most valuable discoveries don’t make sense at first; if they did, somebody would have discovered them already.”

“In coming up with anything genuinely new, unconscious instinct, luck and simple random experimentation play a far greater part in the problem-solving process than we ever admit.”

“We constantly rewrite the past to form a narrative which cuts out the non-critical points - and which replaces luck and random experimentation with conscious intent. In reality almost everything is more evolutionary than we care to admit.”

“It is surprisingly common for significant innovations to emerge from the removal of features rather than the addition. Google is, to put it bluntly, Yahoo without all the extraneous crap cluttering up the search page. Similarly, Twitter’s entire raison d’etre came from the limitation on the number of characters it allowed. McDonalds deleted 99% of items from traditional American diner repertoire; Starbucks placed little emphasis on food for the first decade of its existence.”

“In the early stages of any significant innovation, there may be an awkward stage where the new product is no better that what it is seeking to replace. For instance, early cars were in most respects worse than horses. Early aircraft were insanely dangerous. Early washing machines were unreliable. The appeal of these products was based on their status as much as their utility.”

More Logic

“To solve logic-proof problems requires intelligent, logical people to admit the possibility they might be wrong about something, but these people’s minds are often most resistant to change - perhaps because their status is deeply entwined with their capacity for reason.. Highly educated people don’t merely use logic; it is part of their identity. When I told one economist that you can often increase the sales of a product by increasing its price, the reaction was one not of curiosity, but of anger.”

“It is perfectly possible to be both rational and wrong. Logical ideas often fail because logic demands universally applicable laws but humans, unlike atoms, are not consistent enough in their behaviour for such laws to hold very broadly.”

“Imagine you are a company whose product is not selling well. Which of the following proposals would be easier to make in a board meeting called to resolve the problem? a) ‘We should reduce the price’ or b) ‘We should feature more ducks in our advertising.’ The first of course - and yet the second could, in fact, be much more profitable.”

“The fatal issue is that logic always gets you to exactly the same place as your competitors. Our mantra is, ‘Test counterintuitive things, because no-one else ever does.'"

“Stubborn problems are probably stubborn, because they are logic proof.”

“All progress involves guesswork, but it helps to start with a wide range of guesses.”

“If a problem is solved using a discipline other than that practised by those who believe themselves the rightful guardians of the solution, you’ll face an uphill struggle no matter how much evidence you can amass… Surgeons felt challenged by keyhole surgery and other less invasive procedures that can be carried out with the support of radiographers, because they used skills different from those that they had spent a lifetime perfecting.”

“Human behaviour is an enigma. Learn to crack the code.”

“Real life is not a conventional science - the tools which work so well when designing a Boeing 787, say, will not work so well when designing a customer experience or a tax programme. People are not nearly as pliable or predictable as carbon fibre or metal alloys, and we should not pretend that they are.”

“Hillary thinks like an economist, while Donald is a game theorist, and is able to achieve with one tweet what would take Clinton four years of congressional infighting. That’s alchemy; you may hate it, but it works.”

“The single worst thing that can happen in a criminal investigation is for everyone involved to become fixated on the same theory, because one false assumption shared by everyone can undermine the entire investigation. There’s a name for this - it’s called ‘privileging the hypothesis.’

“If science did not allow for such lucky accidents, its record would be much poorer - imagine if we forbade the use of penicillin, because its discovery was not predicted in advance. Yet policy and business decisions are overwhelmingly based on a ‘reason first, discovery later’ methodology, which seems wasteful in the extreme. Evolution, too, is a haphazard process that discovers what can survive in the world where some things are predictable but others aren’t. It works because each gene reaps the rewards and costs from its lucky or unlucky mistakes, but it doesn’t give a damn about reasons.”

“Conventional logic is a straightforward mental process that is equally available to all and will therefore get you to the same place as everyone else.”

Models

“The models of human behaviour devised and promoted by economists and other conventionally rational people are wholly inadequate at predicting human behaviour.”

“Notice that ordinary people are never allowed to pronounce on complex problems. When do you ever hear an immigration officer interviewed about immigration, or a street cop interviewed about crime? These people patently know far more about these issues than economists or sociologists, and yet we instead seek wisdom from people with models and theories rather than actual experience.”

“If this book provides you with nothing else, I hope it gives you permission to suggest slightly silly things from time to time. To fail a little more often. To think unlike an economist.”

“The 2008 financial crisis arose after people placed unquestioning faith in mathematically neat models of an artificially simple reality.”

“In any complex system, an overemphasis on the importance of some metrics will lead to weaknesses developing in other over-looked ones. It’s surely better to find satisfactory solutions for a realistic world, than perfect solutions for an unrealistic one.”

New Ideas

“After all, no big business idea makes sense at first. I mean, just imagine proposing the following ideas to a group of skeptical investors .. ‘What people want is a really cool vacuum cleaner’ (Dyson), ‘And best of all the drink has a taste which consumers say they hate.’ (Red Bull), ‘.. and just watch as perfectly sane people pay $5 for a drink they can make at home for a few pence’ (Starbucks).”

Reasoning

“The evolutionary psychologist Robert Kurzban, explains that we do not have full access to the reasons behind our decision-making because, in evolutionary terms, we are better off not knowing, we have evolved to deceive ourselves, in order that we are better at deceiving others.”

“If you want to change people’s behaviour, listening to their rational explanations for their behaviour may be misleading, because it isn’t the real why.”

“We consciously believe our actions are guided by reason, but this does not mean that they are - it may simply be evolutionary advantageous for us to believe this.”

“One astonishing possible explanation for the function of reason only emerged about ten years ago: the argumentative hypothesis suggests reason arose in the human brain not to inform our actions and beliefs, but to explain them and defend them to others. In other words, it was an adaption necessitated by our being a highly social species. We may use reason to detect lying in others, to resolve disputes, to attempt to influence other people or to explain our actions in retrospect, but it seems not to play the decisive role in individual decision-making. In this model, reason is not as Descartes thought, the brain’s science and research and development function - it is the brains legal and PR department.”

“The fact that we can deploy reason to explain our actions post-hoc does not mean that it was reason that decided on that action in the first place, or indeed that the use of reason can help obtain it.”

Customers

“Just as we infer a great deal about an air carrier from their on-board catering, while neglecting to care about the $150m aircraft or make of the engines, we are just as likely to be unhappy with a hospital because the reception area is neglected, the magazines are out of date and the nurse didn’t spare us much time. The truth is that ancillary details have a far greater effect on our emotional response, and hence our behaviour, than measured outcomes.”

“For a business to be truly customer-focused it needs to ignore what people say. Instead it needs to concentrate of what people feel.”

Short Term Optimisation

“A company pursuing only profit but not considering the impact of its profit seeking upon customer satisfaction, trust or long-term resilience, could do very well in the short term, but its long term future may be perilous. There is a parallel in the behaviour of bees, which do not make the most of the system they have evolved to collect nectar and pollen. Although they have an efficient way of communicating about the direction of reliable food sources, the waggle dance, a significant proportion of the hive seems to ignore it altogether and journeys off at random. In the short term, the hive would be better off all bees slavishly followed the waggle dance, and for a time this random behaviour baffled scientists, who wondered why 20 million years of bee evolution had not enforced a greater level of behavioural compliance. However, what they discovered was fascinating: without these rogue bees, the hive would get stuck in what complexity theorists call ‘a local maximum'; they would be so efficient at collecting food from known sources that, once these existing sources of food dried up, they wouldn’t know where to go next and the hive would starve to death. So the rogues bees are, in a sense, the hive’s research and development function, and their efficiency pays off handsomely when they discover a fresh source of food. It is precisely because they do not concentrate exclusively on short-term efficiency that bees have survived so many million years. If you optimise something in one direction, you may be creating a weakness somewhere else.”

Silly Questions

“The reason we do not ask basic questions is because, once our brain provides a logical answer, we stop looking for better ones: with a little alchemy, better answers can be found.”

“To reach intelligent answers, you often need to ask really dumb questions.”

“Perhaps advertising agencies are largely valuable simply because they create a culture in which it is acceptable to ask daft questions and make foolish suggestions.”

How You Ask Questions

“One of the great contributions to the profit of high-end restaurants is the fact that bottled water comes in two types, enabling a waiter to ask ‘still or sparkling?’, making it rather difficult to say ‘just tap.’”

Change

“An inability to change perspective is equivalent to a loss of intelligence.”

Efficiency Doesn’t Always Pay

“I rang a company’s call centre the other day, and the experience was exemplary: helpful, knowledgeable and charming. The firm was a client of ours, so I asked them what they did to make their telephone operators so good. The response was unexpected: ‘to be perfectly honest, we probably overpay them.’.. The staff weren’t regarded as a ‘cost’ - they were a significant reason for the company’s success. However, modern capitalism dictates that it will only be a matter of time before some beady-eyed consultants pitch up at a board meeting with a PowerPoint presentation entitled ‘Rightsizing Customer Service Costs Through Offshoring and Resource Management.’ or something similar. Soon nobody will phone to place orders because they won’t be able to understand a word they are saying, but that won’t matter when the company presents its quarterly earnings to analysts and one chart contains the bullet point: ‘Labour cost reduction through call centre relocation/downsizing.”

“Today the principal activity of any publicly held company is rarely the creation of products to satisfy a market need. Management attention is instead largely directed towards the invention of plausible sounding efficiency narratives to satisfy financial analysts, many of whom know nothing about the businesses they claim to analyse, beyond what they can read on a spreadsheet.”

Psychology

“In psychology, one plus one can equal three.”

“We don’t value things we value their meaning. What they bare is determined by the laws of physics, but what they mean is determined by the laws of psychology. Companies which look for opportunities to make magic, like Apple or Disney, routinely feature in lists of the most valuable and profitable brands in the world; you might think economists would have notice this by now.”

“Nearly all really successful businesses, as much as they pretend to be popular for rational reasons, owe most of their success to have stumbled on a psychological magic trick, sometimes unwittingly. Google, Dyson, Uber, Red Bull, Diet Coke, McDonalds, Just Eat, Apple, Starbucks and Amazon have all deliberately or accidentally happened on a form of mental alchemy.”

“According to research from the University of Illinois, descriptive menu labels raised sales by 27% in restaurants, compared to food items without descriptors.”

“So much for economic orthodoxy - in fact, it is not uncommon for premium priced products to have a high market share, as any of those financial analysts might have realised had they reached into their pockets to find an I-phone or the key to an Audi.”

“If there is a mystery at the heart of this book, it is why psychology has been so peculiarly uninfluential in business and in policy making when, whether done well or badly, it makes a spectacular difference.”

“If a customer has a problem and a brand resolves it in a satisfactory manner, the customer becomes a more loyal customer than if the fault had not occurred in the first place.”

“Much of the paraphernalia and practice of the military - flags, drums, uniforms, square-bashing, regalia, mascots and so forth - might be effectively bravery placebos, environmental cues designed to foster bravery and solidarity.”

“People want cheap, abundant and nice tasting drinks, surely? And yet the success of Red Bull proves they don’t.”

Hiring

“I have never seen evidence that academic success accurately predicts workplace success.”

“It is now common practice in British firms to interview people with an upper second-class degree or above, a criterion that is applied with no evidence but simply because it is logical.”

“An unconventional rule for spotting talent that nobody else uses may be far better than a ‘better’ rule which is in common use, because it will allow you to find talent that is undervalued by everyone else.”

Diversity

“As I always advise young people, ‘Find one or two things your boss is rubbish at and be quite good at them.’ Complementary talent is far more valuable than conformist talent.”

Summary

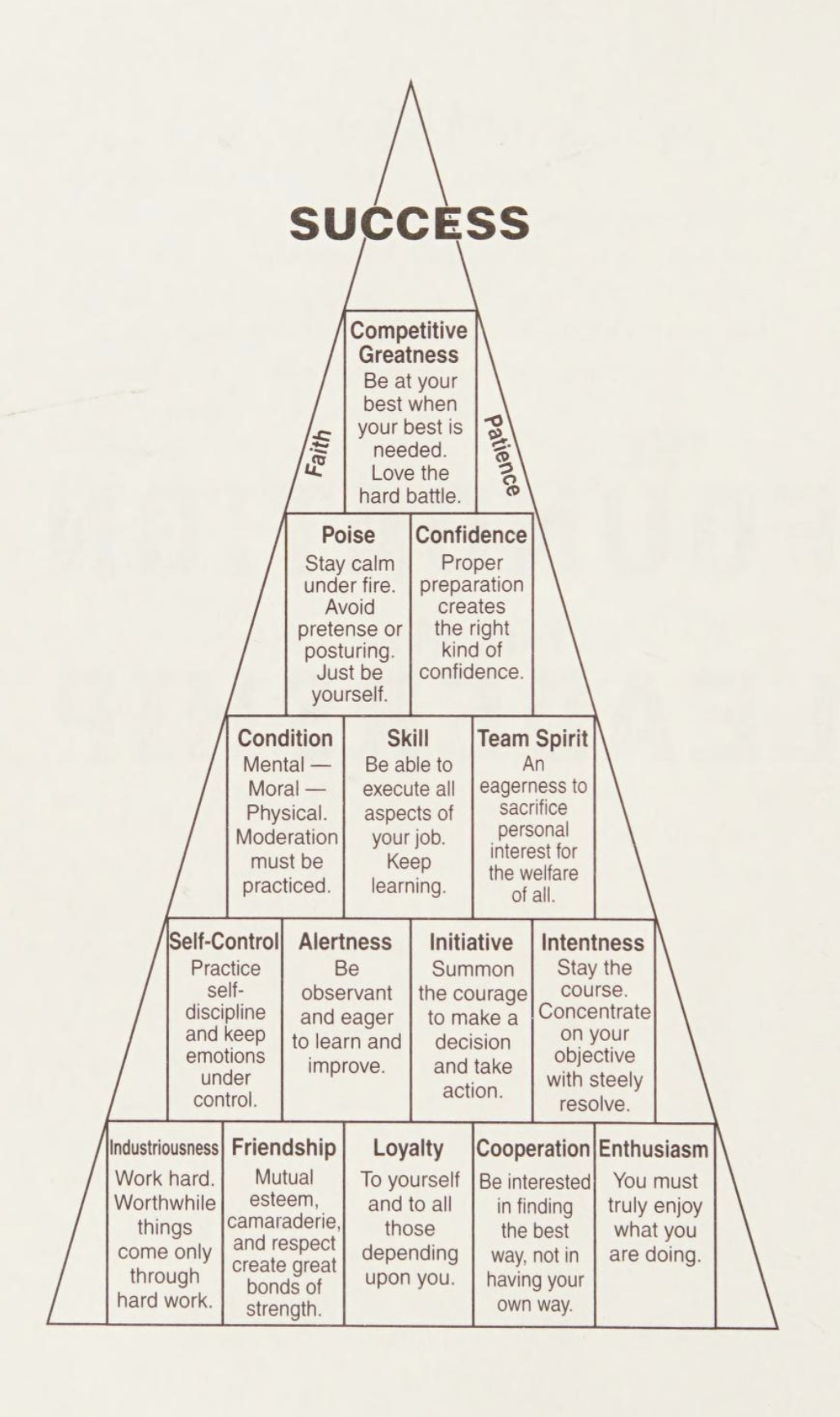

Every investor needs an edge and seeing things that others don’t can be one of those. Building a latticework of mental models provides more tools. As Charlie Munger warns, ‘to a man with a hammer, every problem looks like a nail.’ One of my favourite mental models is Sutherland’s observation about the bees and the waggle dance. There’s a real analogy here for investors. If you keep doing the same things, buying the same types of investments, you might risk missing the changing world. In our portfolio we’ve started to experiment with very small positions in businesses we’d likely have overlooked a few years ago. We make an effort to read and listen to investors in adjacent disciplines like venture capital and private equity. We keep pushing into broader intellectual fields to identify lessons and mental models we can incorporate in our own investing. And we listen to investors we disagree with who test our long held assumptions about how we define successful investing. We’re hoping, like the bees and the waggle dance, it will help us survive and flourish over the long term.

Sources:

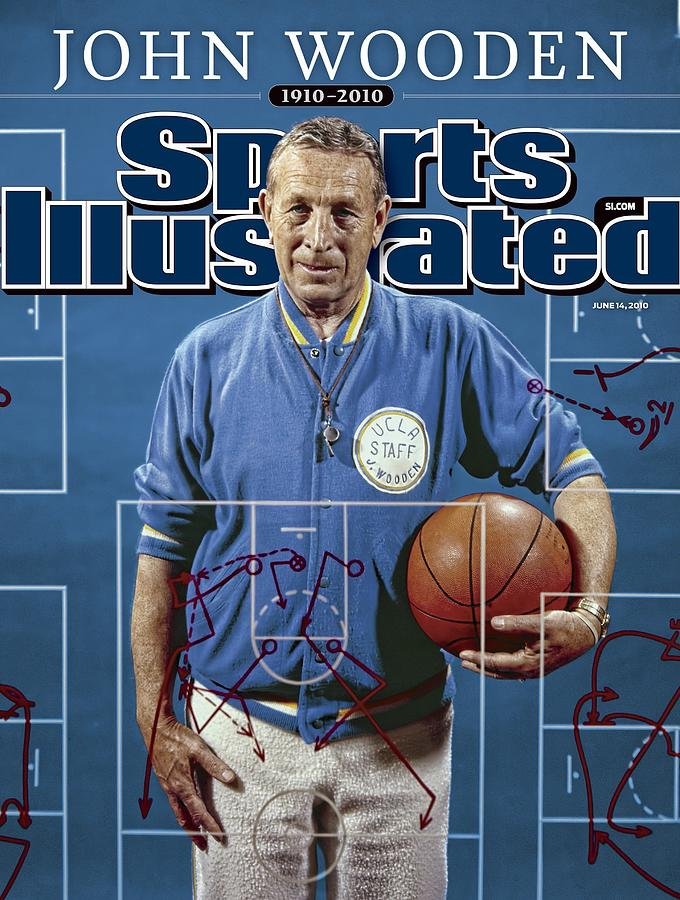

‘Alchemy’ by Rory Sutherland. 2019. Harper Collins

Podcasts:

‘My Conversation with Rory Sutherland’, Farnham Street.

‘Rory Sutherland: The Alchemist's Mix of Behavioral Science’, The Behaviourist.

Follow us on Twitter: @mastersinvest

TERMS OF USE: DISCLAIMER