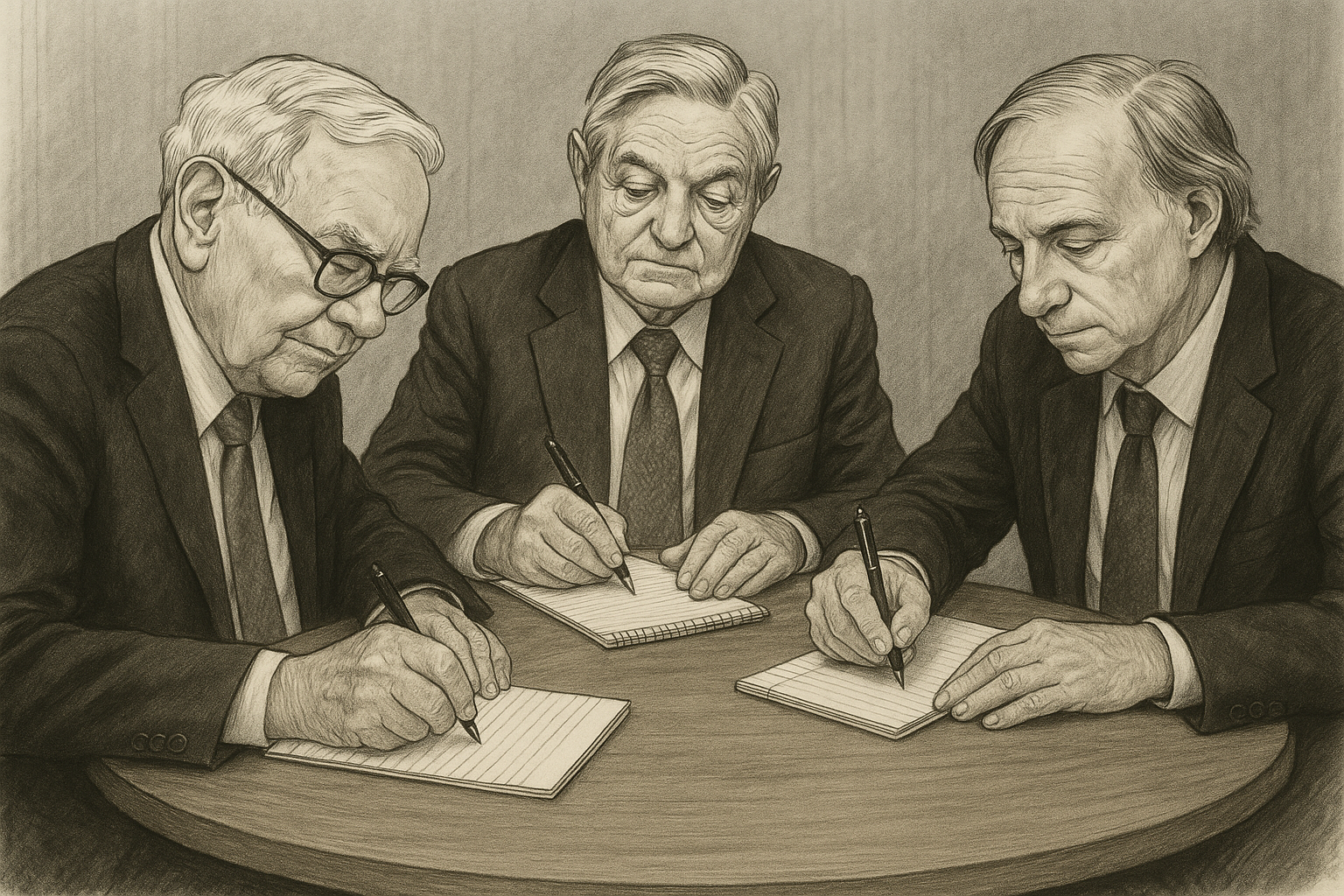

Many of the Investment Masters recognise the benefits of writing to improve thinking and identify potential pitfalls and/or psychological biases that may have crept into the investment decision making process.

“I find this very useful when I write my annual report. I learn while I think when I write it out. Some of the things I think I think, I find don’t make any sense when I start trying to write them down and explain them to people. You ought to be able to explain why you’re taking the job you’re taking, why you’re making the investment you’re making, or whatever it may be. And if it can’t stand applying pencil to paper, you’d better think it through some more.” Warren Buffett

“Beginning around 1980, I developed a discipline that whenever I put on a trade, I would write down the reasons on a pad. When I liquidated the trade, I would look at what actually happened and compare it with my reasoning and expectations when I put on the trade.” Ray Dalio

“I always write down when I make a purchase. I usually update those notes once a quarter on what the intrinsic value is. Why we bought? What are the drivers? I update those thoughts every three to six months. Those are useful because I can go back to the notes and say, ‘hey there was a method to the madness.’” Mohnish Pabrai

“Good writing clarifies your own thinking and that of your fellow shareholders.” Seth Klarman

“We’re keen to always have the portfolio managers put pencil to paper and work through their investment ideas in a structured way, above a pre-designed investment threshold.” Peter Schoenfeld

“‘Why do we bother with this? When nobody reads it?’… It’s not for the readers, It’s for us. We write it for ourselves. Putting ideas on paper forces you to think through things.” Shelby Davis

“We publish these fifteen-page quarterly letters because it forces us to write down and communicate in a very clear fashion what we think and why we think it. There are a lot of crumpled up pieces of paper that end up next to the garbage can when we do that. Yet, a lot of times they are a reminder that there are a couple of questions that we still have about an investment that we really should be addressing. It also helps because by synthesizing it, you sometimes realize just how good the investment that you have is.” Larry Robbins

“I used to always recommend to my students that they take a yellow pad like this and if they’re buying a hundred shares of General Motors at 30 and General Motors has whatever it has out, 600 million shares or a little less, that they say, ‘I’m going to buy the General Motors company for $18 billion, and here’s why’. And if they can’t give a good essay on that subject, they’ve got no business buying 100 shares or ten shares or one share at $30 per share because they are not subjecting it to business tests.” Warren Buffett

“I was greatly helped by the discipline of having to write down my thoughts.” George Soros

“I think being a good writer is a really great tool to being a good investor. It's important to be able to articulate how you're thinking about things. It's important to be able to simplify your ideas down to a few key principles. Writings are a really great way to do that.” Mike Trigg

“Writing has always been a crucial part of my investment process and I believe it’s been a big contributor to our results over time. For me, I’ve found it to be the most effective way to work through challenging investment problems I’m working on.” John Huber

While writing down a thesis helps thinking, it's important to recognise the act of writing will increase a person's commitment to an idea, particularly if it is made public. Experiments show that people are more loyal to choices they make when they are written down.

"We are most consistent when we have made a public, effortful or voluntary commitment. The more public a decision is, the less likely we will change it. Written commitments are strong since they require more effort than verbal commitments and can also be made public." Peter Bevelin

"Yet another reason that written commitments are so effective is that they require more work than verbal ones. And the evidence is clear that the more effort that goes into a commitment, the greater is its ability to influence the attitudes of the person who made it." Robert Cialdini

One way to help overcome this is to consider a wide range of potential outcomes, not just the outcome your investment thesis is predicated on. By writing these down, it will make it harder to ignore facts that contradict you’re original hypothesis.

“It is incredibly important to list all possible hypotheses, not just the most probable ones but also the most absurd and outrageous ones. This is the only way to retain an open mind about all possible scenarios, not just the more probable ones. Once a hypothesis is foreclosed, it is incredibly difficult to put it back on the table. The corollary in investing would be to articulate competing hypotheses, for example that a Company does not have a moat or has a deteriorating moat. It is incredibly important to write things down. The human brain has a tendency to ignore or downplay hypotheses we disagree with and information that does not fit with our beliefs. The best antidote to this tendency is to physically write down competing hypotheses and all the facts. It is also important to write down the type of information, which, were it come to light in the research process, would invalidate a theory. This protects us from bending the theory to fit the facts rather than simply dismissing the theory.” Robert Vinall

It's paramount to remain open minded, to continually re-test the thesis and be prepared to exit a position if the original thesis is no longer valid.

"Charlie and I believe that when you find information that contradicts your existing beliefs, you've got a special obligation to look at it - and quickly." Warren Buffett

“It is incredibly important to seek out disconfirming as well confirming information. Having formed hypotheses, the natural inclination is to seek out confirming information. Given that there is so much information out there, this is not likely to be all that difficult to find. This makes it even more critical to seek out disconfirming information too.” Robert Vinall

"We try not to have many investing ‘rules,’ but there is one that has served us well: If we decide we were wrong about something, in terms of why we did it, we exit, period. We never invent new reasons to continue with a position when the original reasons are no longer available." David Einhorn

"You can't avoid wrong decisions. But if you recognise them promptly and do something about them, you can frequently turn the lemon into lemonade." Charlie Munger

It is a delicate balance between maintaining confidence in an idea and having the humility to recognise you may be wrong.

"We know that we are fallible and must therefore consider the possibility that for every investment we make we may be wrong." Seth Klarman

Its time to start writing …