Many of the Investment Masters had the opportunity to work under great investors. Larry Robbins worked with Leon Cooperman, Warren Buffett and Walter Schloss with Benjamin Graham, Stanley Druckenmiller with George Soros, Lee Ainslie & Steve Mandel with Julian Robertson to name just a few.

When starting your professional life it's important you choose the right career and the right people to work with - where you can learn. It shouldn't be about the money. To be successful you're going to have to love what you do, and that's a lot easier if you enjoy who you're working with.

"If you're early on in your career and they give you a choice between a great mentor or higher pay, take the mentor every time. It’s not even close. And don't even think about leaving that mentor until your learning curve peaks." Stanley Druckenmiller

“Don’t worry about making the most money this week or next month. When I went and offered to work for Ben Graham, I said I’d work for nothing and I meant it. Just the idea of being turned on, look for the job that is going to turn you on.” Warren Buffett

“In terms of starting something right out of business school… I wouldn’t worry very much about how much money you make. I’d worry much less about compensation than I would about what you can learn.” Bill Ackman

“It is important to find a decent, successful person to mentor you. If you work with the right people and do what you like to do, then you’ve got it made.” Bruce Berkowitz

"For young people just getting started, I say apprentice yourself to somebody who's good and knowledgeable, and you'll learn the ropes much more rapidly." Ed Thorp

“In terms of career, take the job you would take if you weren’t getting paid. As Buffett says, go work for someone you like, admire, and trust. Those are the jobs you want. Don’t take the job with the most prestigious firm or offering the most money. Those are both very stupid things.” Mohnish Pabrai

“I think the most important thing [for young people] is to get themselves into a organization, it could be public markets, private markets, it doesn't really matter, where they are mentored by people who teach them really good fundamentals.” Steve Mandel

“When you're young, only take a job that provides you with a steep learning curve and strong training. First jobs are foundational. Don't take a job just because it seems prestigious.” Steven Schwarzman

“I always say to young people that are trying to get jobs, the first job is your hardest job because once you get your first job, you get into the mix, you get to know people, other opportunities will open up to you. That’s the first thing. Then if you have choices, the most important thing is sizing up the very people you’ll be working with, the half a dozen, dozen people you’ll be working with. Those are the people who are going to influence you. That is the key thing. It’s not the prestige of the firm, it’s not whether your parents or your mother-in-law knows, has heard of the place that you work. It’s the people that you’re going to be working with. There are a lot of great people.” David Abrams

“Avoid working directly under somebody you don’t admire and don’t want to be like.”

Charlie Munger

“If you can’t see yourself working with someone for life, don’t work with them for a day.” Naval Ravikant

“.. one of the things about good mentors is you can learn on someone else's nickel. It's something you don't realize when you’re younger. But it struck me at a very early age to try to go find people that were the best in their particular businesses” John Phelan

“I had the benefit of working at three different places before I started Lone Pine. I learned a ton and had really good mentors at each of those three places.” Steve Mandel

“Try and find a mentor. Try and find a mentor, somebody who knows how it works and is prepared to take the time and effort and share that with you.” Terry Smith

“Look for people who have your interests and want to move you along – not somebody who thinks that they’re going to chew you up in two or three years and find some more ambitious person. I was determined in my career to have great mentors and I’ve been super fortunate in my life to find them.” Scott Bessent

If you can't land the exact job you want, you can continue your investing journey by learning from the Investment Masters. If you take the time to go through the Investment Masters Class tutorials you'll notice many common threads between the Investment Masters.

Warren Buffett himself recognises the value of role-models:

“I’ve had half a dozen or so heroes in my life. I think it’s very important to have the right heroes. Now they call them role models or whatever, but you’re going to take your cues from somebody. So I say, choose your heroes carefully, and then figure out what it is about them you admire. Then figure out how to do the same thing. It’s not impossible.”

Many of the Investment Masters also find heroes outside of investing...

“I have a mentor wall that is the first thing you see in my small office. By identifying men who you really admire, you shortcut your learning curve tremendously.” Frank Martin

"It is important to have a mentor and/or great heroes. If you don't have the former, the latter is really important. Pick the right heroes in investing, and in life, and then learn as much as you can from them. Over my career, I have been lucky and grateful to have mentors, but heroes are available to everyone and the reservoir of their wisdom is infinite." Christopher Begg

One of the greatest investors of our age, Buffett’s partner, Charlie Munger, studied the great minds from history.:

"I am a biography nut myself, and I think when you’re trying to teach the great concepts that work, it helps to tie them into the lives and personal ties of the people who developed them. I think that you learn economics better if you make Adam Smith your friend. That sounds funny, making friends among the eminent dead, but if you go through life making friends with the eminent dead who had the right ideas, I think it will work better in life and work better in education. It’s way better than just giving the basic concepts." Charlie Munger

"I would say that you’re not restricted to living people when picking your mentors. Some of the very best people are dead." Charlie Munger

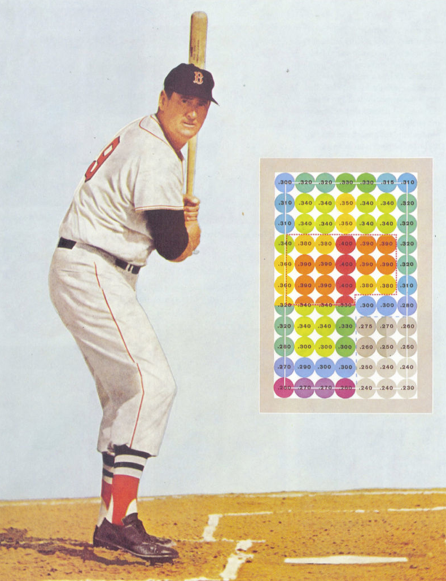

A great place to start is with the most successful investor of our time, Warren Buffett. Buffett shares his wisdom through his annual letters, Berkshire meetings and interviews. Many of the Investment Masters have studied him. Over the years I and many others have learnt a great deal from Buffett. I don't think there's much he and Charlie haven't worked out.

"I have read everything I could on Buffett. He is our business/investment role model." Frank Martin

“I think I have read almost everything Warren Buffett has written and I agree with more than 95% of his thinking.” Lee Ainslie

“You should read the Berkshire Hathaway ‘Letters to Shareholders’ which are on the Berkshire website so they are free. That will be a great start.” Mohnish Pabrai

"By far, the best investor of all time is Warren Buffett. I have read everything I could find (past and present) about him." Francois Rochon

"Going back and reading Berkshire Hathaway annual reports is worth the time." Arnold Van Den Berg

"Berkshire Hathaway annual reports - one has to not only read them, but re-read them." Charles de Vaulx

"In my opinion, Warren Buffett’s group of annual letters is the best teaching anyone could find in the history of business." Francois Rochon

"I started reading [Buffett’s shareholder letters etc.] and I’ve read over the years, just about everything, I think, Warren’s put out there." Ted Weschler

“I consider him [Buffett] a mentor, but while we see each other from time to time, I have learned mainly from watching what he does with Berkshire and reading his letters.” Wally Weitz

“Warren Buffett is one of my investing heroes... I admire Warren Buffett and would say if you are going to read about only one investor, pick him.” Bill Nygren

“Warren Buffett, he has been a wonderful role model even though I know him only a very tiny bit. He was a role model long before I ever met him. What I think he’s done wonderfully, in the tradition of Benjamin Graham, is he is a brilliant investor, and he’s a teacher. He teaches us through his writings, through his interviews, and through his behavour. I think some of the best things that any investor today can read are his early partnership letters. The world is totally different, but there’s wisdom in them for the ages.” Seth Klarman

"Over the years, I have been most significantly influenced by the writings of Warren Buffett." Chuck Akre

"Warren Buffett is a hero. Pick some good heroes and read everything you can about them." Thomas Gayner

“Warren Buffett [is] my hero.” Bruce Karsch

“I got into this business because someone tipped me off about Warren Buffett early on. So he’s certainly, he’s obviously a hero… A big part of my education as an investor came from reading everything Buffett’s written.” Bill Ackman

“I can’t say I walked with any individual investor who has mentored me, but obviously you learn a lot from reading Buffett. Anything Buffett has written is worth reading and re-reading.” Rajiv Jain

"Warren Buffett is in a league by himself, I would say, in terms of his business skills and so forth." David Rubenstein

"Warren Buffett influenced me tremendously. I'm an expert in his writings and his views." Leon Cooperman

"I started reading the now legendary Berkshire Hathaway annual chairman's letter in the 1980s.” Terry Smith

"Warren Buffett has been a major influence on my life because he's so brilliant and I've read a lot of what Buffett has said and memorized many of the things that he said." Ed Wachenheim

“Like millions of Warren Buffett and Charlie Munger admirers around the world, the teachings of these two teachers and Berkshire Hathaway’s amazing performance have shaped my investment career… I found all the books written about Buffett, including his annual letters to Berkshire shareholders and articles about him. I also learned that Charlie Munger was Buffett’s decades-long partner. I spent nearly two years studying them.” Li Lu

“About 20 years ago I began studying the lessons of the masters — both Benjamin Graham and his star student in the 1950s up at Columbia University, Warren Buffett — and through the study of the writings of and speeches by, and books that have been written by and about those two gentlemen, I was able to develop a certain investment philosophy.” David Polen

“Buffett's influence on me, Rockbridge, and your portfolios is personal. My paper file on Buffett goes back to 1986 when he was not well known and I was a total know-nothing as it related to the investment process. Since then, no one has been more influential in my business life, both directly and indirectly, for the legions of others he has influenced have also been important to me. If I have added value over 46 years in the investment business, the long line of people to thank forms behind Warren.” Peter Keefe

“I read an article in a newspaper and they talked about Warren Buffett and I had never heard of him. So pretty quickly, I wrote him a letter, so probably early ‘93, and I told him I was interested in investing, and I would like to read his Annual Letters, so that was before the internet. So he sent me a big package in the mail of all of the Annual Letters since I think 1977. And I read that, and had a vision of investing in the stock market change overnight.” Francois Rochon

"Like many other investors, Marathon never tires of quoting Warren Buffett." Marathon Asset Management

“Like so many others, Munger and Buffett have been the inspiration behind my general investment philosophy and the way I've structured my firm.” John Huber

"Another cornerstone of my re-education involved studying Buffett's investment strategy with even greater intensity. There's no better way to do this than to read Berkshire Hathaway's annual reports... This wasn't a matter of idol worship. It was about choosing a teacher who had already discovered the truths that I still needed to learn." Guy Spier

“When people ask me, ‘I’d love to be an investor, who should I read? what are the books?’ I say go and get all the Buffett letters and read them because he has re-defined the way to think about investing for the world, for much more than this generation. He is our Benjamin Franklin. People don’t realise that. He has said so many things that have changed the way people think. He is a brilliant writer, but he is a much more brilliant thinker.” Tom Steyer

“I owe more gratitude to the two gentlemen running Berkshire as mentors than to any others by a country mile.” Christopher Bloomstran

“The lessons [Benjamin Graham taught] are fresh and pertinent every single day of our lives as investors — as is the philosophy of Warren Buffett. And you can’t leave out Mr. Charles Munger. What they’ve done and said and laid out for us over the years is all we really need.” David Polen

“As a young(ish) man there is something slightly depressing about thinking things through for a while, arriving at a somewhat reasoned conclusion only to find that others have been there before, and years earlier. In some respects we are fifty years behind Buffett, but that’s ok so long as the average investor is at least fifty-one years behind!” Nick Sleep

“One of the things we learned [from studying Warren Buffett]: invest in great businesses; let them continue to compound so they pay you cash flow; and allocate that cash back [to] new investments. That's one of those insights [from] looking at what Buffett's done.” Scott Nuttall, KKR

Start learning from your mentors..