Who doesn’t love a story? Those tales of woe and drama, intrigue and suspense; and the better the storyteller the more we’re usually hooked.

Stories sell. We often believe them without thinking or questioning. And they can have an unjustified weight on our perceptions. Consequently, stories often impact markets and our investment decisions when they shouldn’t.

I’m sure you’ve seen a situation where an analyst or journalist writes a short story about a stock or sector? Then the market takes it as a given and the stock or sector plunges as a result. And I’m sure you can think of plenty of investment stories you’ve heard over the years. Just think about some of the more recent ones .. ‘bitcoin’s finite supply means it will be worth more’, ‘negative bond yields imply a global recession’, ‘the longest equity recovery in recent history portends a market crash’, or ‘value investing is dead’.

Why do we believe such stories? Why do we get hooked into these narratives that are neither factually correct or accurate? The answer is, we are wired that way; mankind actually hasn’t evolved much from the days we spent hunting and gathering. One of the key skills that allowed us to progress from these primitive beginnings and reach the top of the food chain was collaboration. And collaboration involved stories. Yuval Noah Harari made the point in his must-read book Sapiens.

"We are the only mammals that can cooperate with numerous strangers because only we can invent fictional stories, spread them around, and convince millions of others to believe in them." Yuval Noah Harari

In an essay titled ‘What Makes Us Human’, Lisa Mada notes “Humans around the world, from the very young to the very old, have been communicating and transmitting their ideas through stories for thousands of years, and storytelling remains integral to being human and to human culture.”

Stories are everywhere. In a recent article in the FT, Jon Authers, provided a few examples of ‘stories’ in today’s financial markets.

“What’s the story? US unemployment numbers are out, jobs are up, and wages are not growing as fast as they were. Does this mean we are back in “Goldilocks”, or should the narrative be “Making America Great Again”? And as for world markets, can we go back to the story that was looking so good until a surprisingly strong wage growth number brought it to a halt? That story was “Melt-Up”, after an extraordinary rally in stock markets.” Jon Authers

Mr Authers refers to the narrative fallacy, the tendency for humans to turn random or disparate data into stories.

“We think in stories. When applying the word “narrative” we often bump against the “narrative fallacy” — the human tendency to try to turn random or disparate data into a satisfying story. But that is how we make sense of the world. Any journalist will admit that to explain a complex story you must turn it into a narrative. Anyone selling you an investment similarly does so by telling a story.” Jon Authers

And our story instinct makes us vulnerable to believing narratives that just aren’t true. Joe Wiggins, of Behavioural Investment notes, “There are myriad behavioural pitfalls that blight value investing”, an obvious one is ‘Stories’. He provides us with an example in the context of value investing.

“We have an overwhelming desire to construct, and believe, coherent, simple narratives. Walter Fisher (1978) first posited the narrative paradigm theory, which argued for the pre-eminence of storytelling in human communication – compelling tales outweigh robust argumentation. Growth stocks often benefit from beguiling narratives, which we inextricably link to positive share price performance, whereas value stocks suffer from the reverse –‘cheap for a reason’ is the common slight aimed at undervalued stocks. As investors strive for consistency, it is hard to reconcile the typically negative narrative that accompanies a depressed value stock with the potential for strong future performance.” Joe Wiggins

Investing stories can be dangerous. It’s little wonder the world’s most successful investors are mindful of this.

"Most stock-picking stories, advice and recommendations are completely worthless." Ed Thorp

"Stories are more powerful than statistics because the most believable thing in the world is whatever takes the least amount of effort to contextualize your own life experiences." Morgan Housel

“Of all the dangers that investors face, perhaps none is more seductive than the siren song of stories. Stories essentially govern the way we think. We will abandon evidence in favour of a good story.” James Montier

“Humans are irrational. We’re not especially good at stock picking. We have a tendency to get caught by narratives and stories.” Raife Giovinazzo

“Stories sell stocks: the wonderful new product that will revolutionise everything, the monopoly that controls a product and sets prices, the politically connected and protected firm that gorges at the public trough, the fabulous mineral discovery, and so forth.” Ed Thorp

Stories appeal to our emotional side and they often blind us to the underlying facts. Stories are quick and easy. It’s human nature to respond to emotion before reason. That’s how we’ve evolved.

"Our brain is wired to perceive before it thinks - to use emotions before reason.” Peter Bevelin

"Information presented in vivid and concrete detail often has unwarranted impact, and people tend to disregard abstract or statistical information that may have greater evidential value. Statistical data, in particular, lacks the rich and concrete detail to evoke images, and they are often overlooked, ignored or minimised." Richards Hueur

Stories are often formed from a single or limited number of observations transformed into a generalisation. Just the other day, the front page of a national financial newspaper I was reading carried the story about a man who had lost his job, whose wife had just had a baby, and could no longer afford his mortgage repayments. He sold his house and received less than he’d expected, which was also less than the amount an estate agent told him the house would sell for 3 months prior. The narrative was: people are being forced out of their homes as they can’t afford them, and house prices are falling. Therefore mortgage banks are in trouble. SELL BANKS. The market reacted accordingly despite a sample size of just one.

Relying on only a few anecdotes can lead investors to the wrong conclusions. The famous theoretical physicist, Richard Feynman, observed “The first principle is that you must not fool yourself and you are the easiest person to fool.”

Studied by many of the world’s greatest investors, Feynman understood the danger of relying on small sample sizes.

"You can't prove anything by one occurrence, or two occurrences, and so on. Everything has to be checked out very carefully. Otherwise you become one of these people who believe all kinds of crazy stuff and don't understand the world they're in. Nobody understands the world they're in, but some people are better off at it than others." Richard Feynman

"Many people believe things from anecdotes in which there is only one case instead of a large number of cases." Richard Feynman

Because stories often lack statistical rigour, they provide a false representation of reality. They can also suffer from wishful thinking, poor analysis, inappropriate analogies, or incorrect observations.

“The narratives investors use to explain the market or economy sometimes lack the statistical rigor required for a proper description. And as we have learned, if the description is faulty the explanation is likely wrong.” Robert Hagstrom

Overcoming the pull of stories requires keeping an open mind, collecting all the facts and testing investment ideas. Before acting on stories and narratives it’s important to test their validity. This can be done by collecting more information.

“One also needs to learn to fight certain human biases such as buying into stories. The thing that gets fundamental discretionary traders involved in trade is stories, because we can grasp onto them. But in general, it’s good to step away from the stories and take it back to the numbers.” Jim Leitner

“My point about narratives is that if you’re so caught up in the story and in finding evidence that supports the story, you might not adequately process data points that could raise important red flags,” Jake Rosser

When false narratives and stories are prevalent, stocks trade at the wrong prices; the stock price reflects the narrative, not the facts.

“Because of a financial-community appraisal that is at variance with the facts, a stock may sell for a considerable period for much more or much less than it is intrinsically worth.” Phil Fisher

It’s when a share price that’s been supported by a false narrative is subjected to reality, that investors who acted on that false information suffer.

“Investment fads and misinterpretations of facts may run for several months or several years. In the long run, however, realities not only terminate them, but frequently, cause the affected stocks to go to far in the opposite direction. The ability to see through some majority opinions to find what facts are really there is a trait that can bring rich rewards in the field of common stocks.” Phil Fisher

Such distortions in perception, or not seeing the world as it really is, can lead to serious investment mistakes. In fact, Charlie Munger considers seeing the world the way it really is, as the most important thing of all.

“I would argue rationality, which is seeing the world the way it is, instead of the way you hope it is, I’d say that’s the most important [thing]. If you don’t see the world the way it is, it’s like judging something through a distorted lens, you think the world is one way and it’s different. And of course, that leads to terrible mistakes. You want to think correctly.” Charlie Munger

“We should see the world the way it is, which is the same as seeking truth from facts.” Li Lu

So, before you jump into an investment or make a change to an existing investment, you need to ask yourself the following questions - “Do I have all the facts?” “Am I relying on an unsubstantiated story,” “Have I asked all the right questions?” and “What assumptions am I making?”

The Investment Masters don’t act without ensuring they have all the facts. They let the facts do the talking and don’t get caught up in stories and narratives.

“If you don’t know the facts don’t play.” Jim Rogers

“We’re not looking for opinions. We’re looking for facts.” Warren Buffett

“Opinions are a dime a dozen and nearly everyone will share theirs with you. Many will state them as if they are facts. Don’t mistake opinions for facts.” Ray Dalio

"Be obsessive in making sure your facts are right and that you haven't missed or misunderstood something." Barton Biggs

“I’m quite capable of selling a stock when it goes down. I am quite capable of buying a stock when it goes down. It all depends on the underlying facts.” Warren Buffett

“Most people do not look thoughtfully at the facts and draw their conclusions by objectively weighing the evidence… When you’re approaching a decision, ask yourself: Can you point to clear facts (i.e facts believable people wouldn’t dispute) leading to your view? If not, chances are you’re not being evidence based.” Ray Dalio

“When done well, investing involves learning how to process information in order to determine when the odds are in your favor; the goal is to make educated bets based on facts and not stories.” Todd Combs

“Both my failure in whiskey and my success in copper emphasized one thing – the importance of getting the facts of a situation free from tips, inside dope, or wishful thinking. In the search for facts I learned that one had to be as unimpassioned as a surgeon. And if one had the facts right, one could stand with confidence against the will or whims of those who were supposed to know best.” Bernard Baruch

“You have to come to your own conclusions, and you have to do it based on facts that are available. If you don’t have enough facts to reach a conclusion, you forget it. You go on to the next one. You have to also have the willingness to walk away from things that other people think are very simple.” Warren Buffett

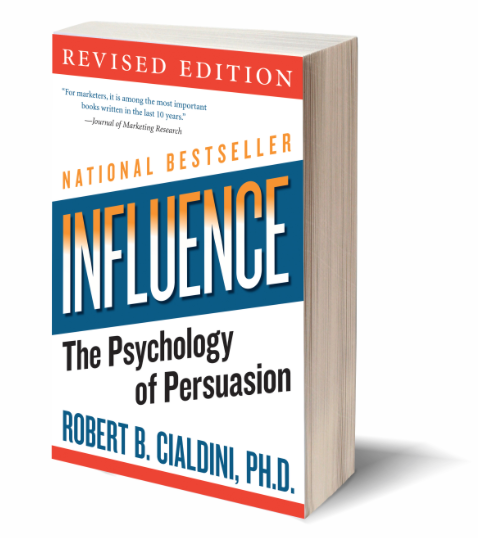

“We must focus on facts – as Dragnet fans will recall, “Just the facts,” Stories usually have an emotional content, hence they appeal to the X-system – the quick and dirty way of thinking. If you want to use the more logical system of thought (the C-system), then you must focus on the facts. Generally, facts are emotionally cold, and thus will pass from the X-system to the C-system.” James Montier

“First you’ve got to get all the facts, and then you’ve got to face the facts. Not pipe dreams.” Paul Cabot

“Make your theories fit your facts, not your facts your theories.” Dickson G Watts

“Never act upon wishful thinking. Act without checking the facts, and chances are that you will be swept away along with the mob.” Jim Rogers

“In the 1950s, an early detective series on TV was Dragnet, starring the fictional Joe Friday. In the opening sequence to every show he would say: “My name is Friday. I’m a cop.” His other famous one-liner, usually delivered while trying to extract evidence from a hapless babbling witness, was: “Just the facts.” We would all do well to remember Joe’s witness interview technique when it comes to investing.” Terry Smith

Summary

The moral of this story is: be mindful of stories and get the facts. And only the facts. Just because one homeowner can’t pay his mortgage doesn’t mean house prices are going to crash and banks are going to be in trouble. Just because one person heard that so and so stock was going to tank doesn’t mean that it will.

Your task is to sift through the stories out there and find the kernels of truth, the facts that will determine if the story is correct. And while you’re doing it, don’t let other people’s emotional reactions or beliefs influence you to a different way of thinking. Don’t let urban myth dictate your investment activities. And whatever you do, look for evidence where stories are based on a sample size of one. Trust me when I say, they’re not hard to find, they’re just very hard to ignore.

Further Suggested Reading:

'Sapiens - A Brief History of Humankind’ - Yuval Noah Harari

‘Narrative Economics’ - Robert J. Shiller January 2017

Keep learning on Twitter: @mastersinvest

TERMS OF USE: DISCLAIMER

![Les Schwab [Source: The Bulletin]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1535458473739-6XGNLHQB5SIKXGO47BH1/Screen+Shot+2018-08-28+at+10.13.59+PM.png)

![Wal-Mart vs Dow Jones Industrial Average - 1972-2018 [source: Bloomberg]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1531209471165-ZCOQS12YGZVSKMPG7B9X/wmt.JPG)