Buffett considers the best businesses to buy are the ones with pricing power. His experience with Berkshire Hathaway's textile business and then See's Candies provided him with a significant contrast in the value of pricing power. In a lecture to students at Notre Dame Facility in 1991, Buffett explained the differences between the two businesses...

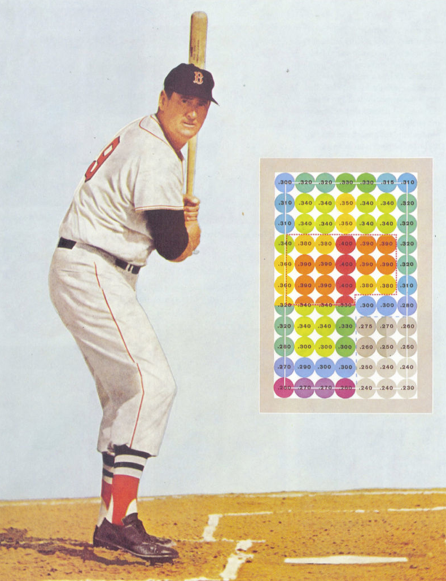

"Our textile business - That's a business that took me 22 years to figure out it wasn't very good. Well, in the textile business, we made over half of the men's suit linings in the United States. You wore a men's suit, chances were that it had a Hathaway lining. And we made them during World War II, when customers couldn't get their linings from other people. Sears Roebuck voted us "Supplier of the Year." They were wild about us. The thing was, they wouldn't give us another half a cent a yard because nobody had ever gone into a men's clothing store and asked for a pin striped suit with a Hathaway lining. You just don't see that. As a practical matter, if some guy's going to offer them a lining for 79 cents, [it makes no difference] who's going to take them fishing, and supplied them during World War II, and was personal friends with the Chairman of Sears. Because we charged 79½ cents a yard, it was "no dice."

See's Candies, on the other hand, made something that people had an emotional attraction to, and a physical attraction you might say. We're almost to Valentine's Day, so can you imagine going to your wife or sweetheart, handing her a box of candy and saying "Honey, I took the low bid." Essentially, every year for 19 years I've raised the price of candy on December 26. And 19 years goes by and everyone keeps buying candy. Every ten years I tried to raise the price of linings a fraction of a cent, and they'd throw the linings back at me. Our linings were just as good as our candies. It was much harder to run the linings factory than it was to run the candy company. The problem is, just because a business is lousy doesn't mean it isn't difficult."

See's Candies was a phenomenal investment for Berkshire. See's cost Berkshire $25m in 1972, and Berkshire invested an additional $32m between 1972 and 2007. The volume of chocolate See's sold grew at just a 2% annual rate between 1972 and 2007, however See's pre-tax earnings grew from less than $5m in 1972 to $82m in 2007, and over the period from 1972 to 2007 they totalled $1.35b. By today, that number is close to $2b.

“When we bought See’s Candy, we didn’t know the power of a good brand. Over time, we just discovered that we could raise prices 10% a year and no one cared. Learning that changed Berkshire. It was really important.” Charlie Munger

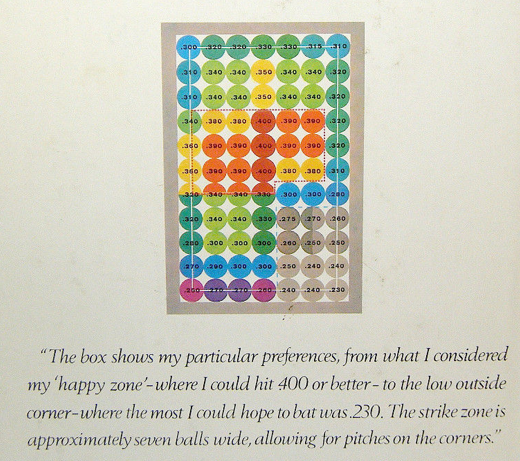

Buffett expanded on the thought process to determine pricing power...

"One of the interesting things to do is walk through a supermarket sometime and think about who's got pricing power, and who's got a franchise, and who doesn't. If you go buy Oreo cookies, and I'm going to take home Oreo cookies or something that looks like Oreo cookies for the kids, or your spouse, or whomever, you'll buy the Oreo cookies. If the other is three cents a package cheaper, you'll still buy the Oreo cookies. You'll buy Jello instead of some other. You'll buy Kool Aid instead of Wyler's powdered soft drink. But, if you go to buy milk, it doesn't make any difference whether its Borden's, or Sealtest, or whatever. And you will not pay a premium to buy one milk over another. You will not pay a premium to buy one of frozen peas over another, probably. It's the difference between having a wonderful business and not a wonderful business. The milk business is not a good business."

In an interview in 2011 Buffett said “The single most important decision in evaluating a business is pricing power.. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

Buffett expanded on product differentiation in his 1982 letter ..

"We need to look at some major factors that affect levels of corporate profitability generally. Businesses in industries with both substantial over-capacity and a “commodity” product (undifferentiated in any customer-important way by factors such as performance, appearance, service support, etc.) are prime candidates for profit troubles. If .. costs and prices are determined by full-bore competition, there is more than ample capacity, and the buyer cares little about whose product or distribution services he uses, industry economics are almost certain to be unexciting. They may well be disastrous. Hence the constant struggle of every vendor to establish and emphasize special qualities of product or service. This works with candy bars (customers buy by brand name, not by asking for a “two-ounce candy bar”) but doesn’t work with sugar (how often do you hear, “I’ll have a cup of coffee with cream and C & H sugar, please”). In many industries, differentiation simply can’t be made meaningful. A few producers in such industries may consistently do well if they have a cost advantage that is both wide and sustainable. By definition such exceptions are few, and, in many industries, are non-existent."

It's important to think about how differentiated a company's products are or at least how differentiated they are perceived to be. Why do people buy the product? Is it an essential item? Are there substitutes? Is the price regulated? Is competition increasing or decreasing? Is it a small part of a larger purchase? Are there risks of obsolescence? Are the buyers consolidated or fragmented? What are the barriers to entry? Whether it's milk, bread or some other item, you need to consider what the buyer's psychological motivations are, their habits and their considerations around price?

"Early in the process.. [we're] making sure we understand how business is really done in the space. How do customers make purchase decisions? What’s the differentiation between companies’ products? Who, if anyone, has pricing power? What are the key secular trends? What’s going on at competitors? To really understand all this you have to talk to people in the industry.” Ricky Sandler

".. among other factors it is about pricing power. You have something that is so attractive to the consumer that they pay a premium to walk into your store and do something." Ted Weschler

“We want to own businesses with pricing power vis-à-vis their customers and suppliers – those that sell unique, highly valued products or services to customers who have little desire to switch to a competitor.” Brian Vollmer

“Buy businesses with pricing flexibility. For several years our investment philosophy has been based on the assumption that inflation over the next ten years will be the major enemy of capital. We assume that inflation may equal or exceed 7%. If this proves to be wrong, we will be delighted as the lower rate will lead to a much healthier stock market. If our assumption is borne out, the pricing flexibility of companies with dominant market positions will provide an important hedge against inflation.” Bill Ruane

“Nothing makes the job of a portfolio manager easier & happier than owning a basket of companies with untapped pricing power at discounted prices. If he is patient, he needs no other virtue.” Li Lu

In his book "Common Stocks and Common Sense," Ed Wachenheim discusses the bakery industry …

"I knew that the bakery business is a miserable business, among the worst. Most shoppers do not have a strong preference for one brand of bread over another. White bread pretty much is white bread. Whole wheat bread pretty much is whole wheat bread. This relative lack of brand preference gives stores bargaining power over bakeries. A store can threaten a bakery that, if it cannot purchase bread at a certain price, it will seek another supplier. Thus, stores can play one bakery off against another, and they do. Warren Buffett likes businesses that are protected by moats. There are no moats surrounding the bakery business. There are not even any fences or "beware of dog" signs. Therefore, the prices received by the bakeries often are driven to levels so low that it is difficult for the bakeries to earn a decent profit, if any profit at all. This is a key reason why the bread business is a miserable business."

Think about it… milk and bread tend to be commodity products, like Berkshire Hathaway's linings. When you have a commodity product you need to be the low cost producer as commodity products tend to get priced by the marginal producer's cost of production. They also tend to be susceptible to over-capacity. Conversely, a differentiated, essential or unique product's price isn't based on the cost to produce in the absence of competition.

"The ability to raise prices – the ability to differentiate yourself in a real way, and a real way means you can charge a different price – that makes a great business." Warren Buffett

There are of course exceptions. I know of a milk company with pricing power. The company's milk contains different proteins produced from a certain breed of cow and people pay more than twice the price of standard milk. People will pay more for organic milk. The question to ask is, how sustainable is the premium? and how easy is it for other producers to replicate?

More recently Buffett expanded on his decision to buy Apple. Buffett saw a product with pricing power and a product intimately integrated into people's lives ....

“It’s amazing where Apple’s ended up with consumers. I can very easily determine the competitive position of Apple now and who’s trying to chase them and how easy it is to chase them. We happen to be well situated in terms of having these massive Home Furnishing stores. I can learn very easily how consumers react to different things there, probably easier than I can try and pick out what is really happening at Amazon at any given time. If you come in to buy a TV set at the Furniture Mart, price is extremely important. Obviously picture is, but they are all good pictures. You can have Samsung and all these different ones. If you put on a sale and you drop the price of Samsung ten percent you can fill that department with people who come out for it. You can’t move people by price in the smart phone market remotely like you can move them in appliances and all kinds of things. People want the product they don’t want the cheapest product. The loyalty is huge. That doesn’t mean somebody can’t come with a product that just jumps the field in some way. And then once you have the product the degree to which it sort of controls your life, it’s a very very very valuable product to the people that build their life around it. That’s true of 8 year olds and its true of 80 years olds.”

“So far you’ve had smart phones and big differences in price categories and if you had an Apple before you can have a much cheaper smart phone selling right next to it and they don’t look at it. If you have a cheaper TV [in the store] with pictures looking at you and you say what’s the difference, you buy the cheaper TV. Most items are price sensitive. That’s not to say an Apple has no price sensitivity, it’s very limited. Someone could come along and leapfrog the technology, and add benefits that would be the more competitive threat than price competition. It would be benefit competition.”

Notwithstanding the above, it’s untapped pricing pricing power that’s most valuable. Companies that abuse pricing power ordinarily end up attracting competition or regulatory backlash [eg. Valeant].

“We like to find businesses with pricing power. But to say that something has pricing power and to leave it there is really an incomplete line of thinking because nobody has unlimited pricing power.” David Abrams

“If you establish too wide a differential between Coke and a private label product, you will change consumption patterns somewhat. Not huge, but enough so that you don’t want to do it.” Warren Buffett

“Growth in profits from increasing prices can simply build an umbrella beneath which competitors can flourish. We are more interested in companies which have physical growth in the merchandise or service sold than simple pricing power, although that’s nice too.” Terry Smith

“It’s tempting for great businesses to leverage their strong market position through high price increases to the benefit of near-term earnings. We often hear terms such as ‘pricing power’ or ‘high switching costs’ as justification for asking customers to pay more for the same product or service. Increasing prices at a rate well above inflation is common in businesses with short-term–minded management who define success based on this year’s profit number. In squeezing customers through pricing, great businesses often compromise their future. As the value of what they deliver relative to the price they charge becomes a little less attractive, customers are more likely to seek out alternatives and the door for competitors opens a little wider. Price increases also diminish a customer’s appetite to take additional products or services from a supplier, or to recommend a supplier to a friend. Revenue per customer today may increase, but the lifetime value of each customer relationship moves in the opposite direction. Aggressive pricing increases the likelihood of fade. Businesses that successfully fight the fade don’t just preserve the value they deliver relative to the cost they charge over time; they improve it. Taking this approach, they keep their customers for longer, sell more products and services to them, progressively win more customers and keep competition at bay.” Stephen Arnold

Do the businesses you own have pricing power?